🐣 New to Crypto? Start Here!

🔸 1-min to know what #FUD is → https://youtube.com/shorts/i6s2QQ9XEDw?feature=share

📌 Bookmark this thread – your ultimate starter kit👇

#CryptoBeginner #Blockchain101 #LearnWeb3

JuCoin Official

2025-07-31 09:12

🐣 New to Crypto? Start Here!

Disclaimer:Contains third-party content. Not financial advice.

See Terms and Conditions.

📢New Listing @Schili_official

JuCoin will list the SCHILI/USDT trading pair on Aug. 1, 2025

🔷Deposit & Withdrawal: 9:00 (UTC) on July 31, 2025

🔷Trading: 15:00 (UTC) on Aug. 1, 2025

👉More: https://support.jucoin.blog/hc/en-001/articles/49339467955993?utm_camhttps://support.jucoin.blog/hc/en-001/articles/49371776526489?utm_campaign=listing_SCHILI&utm_source=twitter&utm_medium=post

#JuCoin #SCHILI

JuCoin Official

2025-07-31 09:10

📢New Listing @Schili_official

Disclaimer:Contains third-party content. Not financial advice.

See Terms and Conditions.

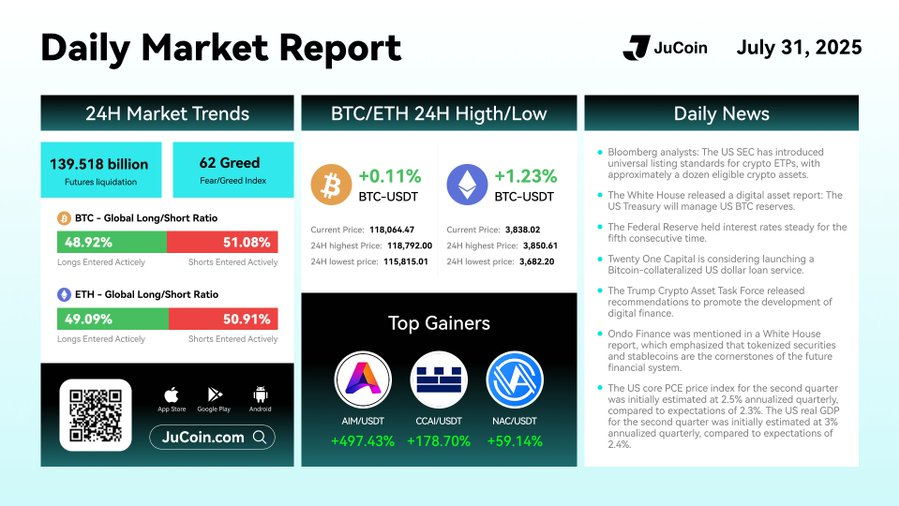

🚀 JuCoin Daily Market Report|July 31, 2025

📅 Stay updated with the latest crypto market trends!

Sign up👉 http://bit.ly/3BVxlZ2

Blog👉 https://blog.jucoin.com/btc-eth-us-treasury-btc-reserves-july31-2025/

#JuCoin #CryptoNews

JuCoin Official

2025-07-31 09:10

🚀 JuCoin Daily Market Report|July 31, 2025

Disclaimer:Contains third-party content. Not financial advice.

See Terms and Conditions.

Are There Specific Tools for Trading Credit Spreads?

Trading credit spreads requires a combination of analytical tools, market data, and trading platforms to effectively assess risk and identify profitable opportunities. These tools help traders interpret market signals, compare bond yields, and execute trades with confidence. Understanding the available resources is essential for both novice and experienced traders aiming to navigate the complexities of credit spread trading.

Key Market Indices and Benchmarks

One of the foundational tools in credit spreads trading is the use of indices that serve as benchmarks for assessing market performance. The Barclays Capital U.S. Corporate High Yield Index tracks the performance of high-yield bonds (junk bonds), while the Barclays Capital U.S. Credit Index measures investment-grade corporate bonds. These indices provide a broad view of how different segments are performing relative to each other, enabling traders to gauge whether credit spreads are widening or narrowing in response to economic conditions.

By comparing current bond yields against these benchmarks, traders can identify potential entry or exit points based on perceived over- or under-valued spreads. For example, an unusually wide spread might signal increased default risk or market stress, presenting a buying opportunity if fundamentals support it.

Bond Yield Curves as Analytical Tools

Yield curves are vital for visualizing how bond yields vary across different maturities within similar credit categories. They illustrate expectations about future interest rates and inflation trends—factors that influence credit spreads significantly.

A normal upward-sloping yield curve suggests healthy economic growth with manageable risk premiums; conversely, an inverted curve may indicate recession fears and wider spreads on risky assets like high-yield bonds. Traders analyze shifts in these curves over time to anticipate changes in credit risk sentiment before they fully materialize in spread movements.

Role of Credit Rating Agencies

Credit rating agencies such as Moody’s, S&P Global Ratings, and Fitch Ratings play a crucial role by providing independent assessments of issuer creditworthiness. Their ratings influence investor perceptions—and consequently—yield differences between various bonds.

When an agency downgrades a company's rating from investment grade to junk status—or vice versa—the associated bond's yield typically adjusts accordingly due to changing perceived risks. Traders monitor these ratings closely since sudden downgrades can cause rapid widening in credit spreads; thus making them key indicators when planning trades.

Financial News Platforms & Market Data Providers

Real-time information is indispensable when trading credit spreads because markets can shift quickly amid macroeconomic news or geopolitical events. Platforms like Bloomberg Terminal and Reuters Eikon offer comprehensive data feeds—including live bond prices, yield movements, news alerts—and analytical tools tailored specifically for fixed-income markets.

These platforms also provide access to historical data trends which help traders analyze patterns over time—crucial for developing effective strategies around spread movements during volatile periods or economic cycles.

Advanced Trading Software & Platforms

Modern trading software enhances decision-making by integrating multiple data sources into user-friendly interfaces that facilitate trade execution directly from analysis screens:

- Bloomberg Terminal: Offers extensive analytics on bond markets alongside customizable dashboards.

- Reuters Eikon: Provides real-time quotes combined with news updates relevant for fixed-income securities.

- Proprietary Trading Platforms: Many financial institutions develop their own systems optimized for specific strategies such as pair trades involving different segments within the debt market.

These platforms often include features like scenario analysis (stress testing), automated alerts based on preset criteria (e.g., spread thresholds), and order execution capabilities—all critical components when managing complex options around credit spread fluctuations efficiently.

Emerging Technologies Impacting Credit Spread Trading

Recent technological advancements have further empowered traders through machine learning algorithms capable of analyzing vast datasets faster than traditional methods—identifying subtle patterns indicating potential shifts in spread dynamics before they become apparent publicly.

Artificial intelligence-driven models now assist with predictive analytics regarding default probabilities or macroeconomic impacts influencing sector-specific risks—a significant advantage given how swiftly sentiment can change during periods of heightened volatility such as during global crises or regulatory shifts.

Summary: Essential Tools Every Trader Should Know

To succeed at trading credit spreads effectively:

- Use benchmark indices like Barclays High Yield Index & Investment Grade Index

- Analyze yield curves regularly

- Monitor updates from reputable rating agencies

- Leverage real-time financial news platforms

- Utilize advanced software solutions tailored for fixed-income analysis

- Keep abreast with emerging AI-driven analytics technologies

Combining these resources allows traders not only to interpret current market conditions but also anticipate future movements—an essential skill given how sensitive this segment is to macroeconomic factors ranging from central bank policies to geopolitical tensions.

Final Thoughts on Building Expertise in Credit Spread Trading Tools

Developing proficiency with these tools enhances your ability to make informed decisions rooted in sound analysis rather than speculation alone. As markets evolve—with increasing automation and sophisticated data modeling—the importance lies not just in having access but understanding how best leverage each resource within your overall strategy framework.

By integrating index benchmarks, yield curve insights, ratings assessments, real-time news feeds—and embracing innovative tech solutions—you position yourself better equipped against unpredictable swings inherent within fixed-income markets’ complex landscape.

Stay informed. Stay prepared. Trade smarter.

JCUSER-F1IIaxXA

2025-06-09 22:35

Are there specific tools for trading credit spreads?

Are There Specific Tools for Trading Credit Spreads?

Trading credit spreads requires a combination of analytical tools, market data, and trading platforms to effectively assess risk and identify profitable opportunities. These tools help traders interpret market signals, compare bond yields, and execute trades with confidence. Understanding the available resources is essential for both novice and experienced traders aiming to navigate the complexities of credit spread trading.

Key Market Indices and Benchmarks

One of the foundational tools in credit spreads trading is the use of indices that serve as benchmarks for assessing market performance. The Barclays Capital U.S. Corporate High Yield Index tracks the performance of high-yield bonds (junk bonds), while the Barclays Capital U.S. Credit Index measures investment-grade corporate bonds. These indices provide a broad view of how different segments are performing relative to each other, enabling traders to gauge whether credit spreads are widening or narrowing in response to economic conditions.

By comparing current bond yields against these benchmarks, traders can identify potential entry or exit points based on perceived over- or under-valued spreads. For example, an unusually wide spread might signal increased default risk or market stress, presenting a buying opportunity if fundamentals support it.

Bond Yield Curves as Analytical Tools

Yield curves are vital for visualizing how bond yields vary across different maturities within similar credit categories. They illustrate expectations about future interest rates and inflation trends—factors that influence credit spreads significantly.

A normal upward-sloping yield curve suggests healthy economic growth with manageable risk premiums; conversely, an inverted curve may indicate recession fears and wider spreads on risky assets like high-yield bonds. Traders analyze shifts in these curves over time to anticipate changes in credit risk sentiment before they fully materialize in spread movements.

Role of Credit Rating Agencies

Credit rating agencies such as Moody’s, S&P Global Ratings, and Fitch Ratings play a crucial role by providing independent assessments of issuer creditworthiness. Their ratings influence investor perceptions—and consequently—yield differences between various bonds.

When an agency downgrades a company's rating from investment grade to junk status—or vice versa—the associated bond's yield typically adjusts accordingly due to changing perceived risks. Traders monitor these ratings closely since sudden downgrades can cause rapid widening in credit spreads; thus making them key indicators when planning trades.

Financial News Platforms & Market Data Providers

Real-time information is indispensable when trading credit spreads because markets can shift quickly amid macroeconomic news or geopolitical events. Platforms like Bloomberg Terminal and Reuters Eikon offer comprehensive data feeds—including live bond prices, yield movements, news alerts—and analytical tools tailored specifically for fixed-income markets.

These platforms also provide access to historical data trends which help traders analyze patterns over time—crucial for developing effective strategies around spread movements during volatile periods or economic cycles.

Advanced Trading Software & Platforms

Modern trading software enhances decision-making by integrating multiple data sources into user-friendly interfaces that facilitate trade execution directly from analysis screens:

- Bloomberg Terminal: Offers extensive analytics on bond markets alongside customizable dashboards.

- Reuters Eikon: Provides real-time quotes combined with news updates relevant for fixed-income securities.

- Proprietary Trading Platforms: Many financial institutions develop their own systems optimized for specific strategies such as pair trades involving different segments within the debt market.

These platforms often include features like scenario analysis (stress testing), automated alerts based on preset criteria (e.g., spread thresholds), and order execution capabilities—all critical components when managing complex options around credit spread fluctuations efficiently.

Emerging Technologies Impacting Credit Spread Trading

Recent technological advancements have further empowered traders through machine learning algorithms capable of analyzing vast datasets faster than traditional methods—identifying subtle patterns indicating potential shifts in spread dynamics before they become apparent publicly.

Artificial intelligence-driven models now assist with predictive analytics regarding default probabilities or macroeconomic impacts influencing sector-specific risks—a significant advantage given how swiftly sentiment can change during periods of heightened volatility such as during global crises or regulatory shifts.

Summary: Essential Tools Every Trader Should Know

To succeed at trading credit spreads effectively:

- Use benchmark indices like Barclays High Yield Index & Investment Grade Index

- Analyze yield curves regularly

- Monitor updates from reputable rating agencies

- Leverage real-time financial news platforms

- Utilize advanced software solutions tailored for fixed-income analysis

- Keep abreast with emerging AI-driven analytics technologies

Combining these resources allows traders not only to interpret current market conditions but also anticipate future movements—an essential skill given how sensitive this segment is to macroeconomic factors ranging from central bank policies to geopolitical tensions.

Final Thoughts on Building Expertise in Credit Spread Trading Tools

Developing proficiency with these tools enhances your ability to make informed decisions rooted in sound analysis rather than speculation alone. As markets evolve—with increasing automation and sophisticated data modeling—the importance lies not just in having access but understanding how best leverage each resource within your overall strategy framework.

By integrating index benchmarks, yield curve insights, ratings assessments, real-time news feeds—and embracing innovative tech solutions—you position yourself better equipped against unpredictable swings inherent within fixed-income markets’ complex landscape.

Stay informed. Stay prepared. Trade smarter.

Disclaimer:Contains third-party content. Not financial advice.

See Terms and Conditions.

How to Earn CYBER Tokens: A Complete Guide

Understanding how to earn CYBER tokens is essential for users interested in participating actively within the CyberConnect ecosystem. As a decentralized social platform leveraging blockchain technology, CyberConnect offers multiple avenues for users to earn and utilize CYBER tokens. This guide provides a clear overview of the steps involved, ensuring you can maximize your engagement and potential rewards.

What Are CYBER Tokens and Why Are They Valuable?

CYBER tokens are the native cryptocurrency of the CyberConnect platform, serving as a fundamental component of its decentralized social network. These tokens facilitate various activities such as paying transaction fees, staking for governance participation, and unlocking exclusive features. Their value is driven by their utility within the ecosystem and broader market dynamics influenced by DeFi trends.

Holding CYBER tokens not only grants access to special features but also empowers users to participate in decision-making processes through governance voting. This dual role enhances user engagement while aligning incentives across the community.

How Can You Earn CYBER Tokens Through Staking?

Staking is one of the most straightforward methods to earn additional CYBER tokens. It involves locking up a certain amount of your existing tokens in designated smart contracts on the platform for a specified period—ranging from days to months. In return, stakers receive rewards proportional to their staked amount.

To get started with staking:

- Acquire CYBER Tokens: First, purchase or transfer existing CYBER tokens into your compatible wallet.

- Choose a Staking Pool: Navigate through available staking pools on official platforms or partner sites that support CyberConnect.

- Lock Your Tokens: Follow instructions provided by these pools or platforms to lock your tokens securely.

- Earn Rewards: Over time, you'll accrue rewards based on your stake size and duration; these can often be compounded or reinvested.

Staking not only generates passive income but also contributes toward network security and decentralization efforts.

Participating in Governance for Additional Rewards

Another way to earn CYBER involves active participation in governance decisions within CyberConnect. Token holders typically have voting rights that influence proposals related to platform upgrades, feature development, or policy changes.

Engaging in governance usually requires:

- Holding Sufficient Tokens: Ensure you possess enough CYBER tokens required for voting eligibility.

- Reviewing Proposals: Stay informed about ongoing discussions or proposals posted on official channels.

- Casting Votes: Use your holdings during voting periods via supported interfaces—often integrated into wallets or dedicated dashboards.

Active voters may sometimes receive incentives such as bonus tokens or recognition within the community—adding an extra layer of earning potential beyond mere token appreciation.

Creating Content and Engaging with Community Activities

CyberConnect emphasizes community-driven content creation as part of its social ecosystem. Users who produce high-quality posts, comments, videos, or other forms of content may be rewarded with CYBER tokens either directly from platform incentives or through engagement metrics like likes and shares.

To leverage this:

- Develop engaging content aligned with community interests.

- Participate regularly by commenting on others’ posts.

- Share valuable insights that foster discussion.

- Keep an eye out for specific campaigns offering token rewards for particular activities (e.g., contests).

This approach not only helps grow your presence but can also lead directly—or indirectly—to earning more cybertokens over time due to increased activity levels recognized by reward mechanisms.

Utilizing Referral Programs

Referral programs are common across blockchain projects aiming at expanding their user base organically. By inviting friends or colleagues into CyberConnect using unique referral links:

- You can earn small amounts of CYBER when new users sign up using your link.

- Some programs offer tiered rewards based on referral activity levels.

Ensure you understand each program’s terms before participating; effective referrals require genuine engagement rather than spammy tactics which could violate policies leading to penalties.

Tips To Maximize Your Earnings

While engaging with these methods individually is beneficial, combining them strategically will optimize earnings:

- Regularly stake available funds during high-reward periods

- Stay updated about governance proposals requiring votes

- Consistently create quality content that resonates with communities

- Promote platform growth via referrals responsibly

Additionally,

Stay Informed: Follow official channels like blogs, social media accounts (Twitter/Discord), and newsletters related to CyberConnect for updates about new earning opportunities or changes in protocols affecting reward structures.

Security First: Always use secure wallets supported by reputable providers when handling cryptocurrencies; avoid sharing private keys under any circumstances.

Final Thoughts

Earning CYBER tokens involves active participation across multiple facets—staking assets securely online; engaging thoughtfully in governance decisions; contributing valuable content; leveraging referral programs—all aligned towards fostering growth within this decentralized social ecosystem. By understanding each pathway thoroughly—and staying vigilant regarding security practices—you position yourself well both as an active contributor and potential beneficiary within this innovative blockchain-based community space.

Additional Resources:

- Official CyberConnect Documentation – [Link]

- Community Forums & Social Media – [Links]

- Guides on Cryptocurrency Security Best Practices – [Links]

By following these steps diligently while keeping abreast of industry developments—including regulatory shifts—you can effectively navigate earning opportunities around CYBER coins today—and prepare yourself better amid future innovations emerging from DeFi ecosystems worldwide

Lo

2025-06-09 21:45

What steps do I need to take to earn CYBER tokens?

How to Earn CYBER Tokens: A Complete Guide

Understanding how to earn CYBER tokens is essential for users interested in participating actively within the CyberConnect ecosystem. As a decentralized social platform leveraging blockchain technology, CyberConnect offers multiple avenues for users to earn and utilize CYBER tokens. This guide provides a clear overview of the steps involved, ensuring you can maximize your engagement and potential rewards.

What Are CYBER Tokens and Why Are They Valuable?

CYBER tokens are the native cryptocurrency of the CyberConnect platform, serving as a fundamental component of its decentralized social network. These tokens facilitate various activities such as paying transaction fees, staking for governance participation, and unlocking exclusive features. Their value is driven by their utility within the ecosystem and broader market dynamics influenced by DeFi trends.

Holding CYBER tokens not only grants access to special features but also empowers users to participate in decision-making processes through governance voting. This dual role enhances user engagement while aligning incentives across the community.

How Can You Earn CYBER Tokens Through Staking?

Staking is one of the most straightforward methods to earn additional CYBER tokens. It involves locking up a certain amount of your existing tokens in designated smart contracts on the platform for a specified period—ranging from days to months. In return, stakers receive rewards proportional to their staked amount.

To get started with staking:

- Acquire CYBER Tokens: First, purchase or transfer existing CYBER tokens into your compatible wallet.

- Choose a Staking Pool: Navigate through available staking pools on official platforms or partner sites that support CyberConnect.

- Lock Your Tokens: Follow instructions provided by these pools or platforms to lock your tokens securely.

- Earn Rewards: Over time, you'll accrue rewards based on your stake size and duration; these can often be compounded or reinvested.

Staking not only generates passive income but also contributes toward network security and decentralization efforts.

Participating in Governance for Additional Rewards

Another way to earn CYBER involves active participation in governance decisions within CyberConnect. Token holders typically have voting rights that influence proposals related to platform upgrades, feature development, or policy changes.

Engaging in governance usually requires:

- Holding Sufficient Tokens: Ensure you possess enough CYBER tokens required for voting eligibility.

- Reviewing Proposals: Stay informed about ongoing discussions or proposals posted on official channels.

- Casting Votes: Use your holdings during voting periods via supported interfaces—often integrated into wallets or dedicated dashboards.

Active voters may sometimes receive incentives such as bonus tokens or recognition within the community—adding an extra layer of earning potential beyond mere token appreciation.

Creating Content and Engaging with Community Activities

CyberConnect emphasizes community-driven content creation as part of its social ecosystem. Users who produce high-quality posts, comments, videos, or other forms of content may be rewarded with CYBER tokens either directly from platform incentives or through engagement metrics like likes and shares.

To leverage this:

- Develop engaging content aligned with community interests.

- Participate regularly by commenting on others’ posts.

- Share valuable insights that foster discussion.

- Keep an eye out for specific campaigns offering token rewards for particular activities (e.g., contests).

This approach not only helps grow your presence but can also lead directly—or indirectly—to earning more cybertokens over time due to increased activity levels recognized by reward mechanisms.

Utilizing Referral Programs

Referral programs are common across blockchain projects aiming at expanding their user base organically. By inviting friends or colleagues into CyberConnect using unique referral links:

- You can earn small amounts of CYBER when new users sign up using your link.

- Some programs offer tiered rewards based on referral activity levels.

Ensure you understand each program’s terms before participating; effective referrals require genuine engagement rather than spammy tactics which could violate policies leading to penalties.

Tips To Maximize Your Earnings

While engaging with these methods individually is beneficial, combining them strategically will optimize earnings:

- Regularly stake available funds during high-reward periods

- Stay updated about governance proposals requiring votes

- Consistently create quality content that resonates with communities

- Promote platform growth via referrals responsibly

Additionally,

Stay Informed: Follow official channels like blogs, social media accounts (Twitter/Discord), and newsletters related to CyberConnect for updates about new earning opportunities or changes in protocols affecting reward structures.

Security First: Always use secure wallets supported by reputable providers when handling cryptocurrencies; avoid sharing private keys under any circumstances.

Final Thoughts

Earning CYBER tokens involves active participation across multiple facets—staking assets securely online; engaging thoughtfully in governance decisions; contributing valuable content; leveraging referral programs—all aligned towards fostering growth within this decentralized social ecosystem. By understanding each pathway thoroughly—and staying vigilant regarding security practices—you position yourself well both as an active contributor and potential beneficiary within this innovative blockchain-based community space.

Additional Resources:

- Official CyberConnect Documentation – [Link]

- Community Forums & Social Media – [Links]

- Guides on Cryptocurrency Security Best Practices – [Links]

By following these steps diligently while keeping abreast of industry developments—including regulatory shifts—you can effectively navigate earning opportunities around CYBER coins today—and prepare yourself better amid future innovations emerging from DeFi ecosystems worldwide

Disclaimer:Contains third-party content. Not financial advice.

See Terms and Conditions.

Understanding the CARV Token and Its Ecosystem

The CARV token is a digital asset associated with the CARV ecosystem, which aims to provide innovative solutions within the blockchain space. While specific details about its core functions may vary, tokens like CARV are typically used to facilitate transactions, governance, or access within their respective platforms. The ecosystem could encompass decentralized finance (DeFi) applications, non-fungible tokens (NFTs), or other blockchain-based services designed to enhance user engagement and utility.

Investors and enthusiasts interested in cryptocurrencies should understand that the value of such tokens often depends on factors like ecosystem development, community support, partnerships, and overall market conditions. As with many emerging projects in crypto markets, staying informed about recent updates and strategic moves by project developers is crucial for making educated investment decisions.

How to Participate in Sharing 5819 CARV Tokens

The article emphasizes an opportunity for readers to share a total of 5819 CARV tokens as part of a promotional campaign or community engagement initiative. Typically, such sharing programs involve steps like:

- Registering on official platforms or participating in specific campaigns.

- Completing certain tasks such as social media sharing or inviting friends.

- Following guidelines provided by the project team to ensure eligibility.

Participation methods can vary depending on ongoing promotions but generally aim to increase awareness and adoption of the token while rewarding active community members. It’s essential for participants to verify official sources before engaging in any sharing activities to avoid scams.

Key Uses and Benefits of Holding CARV Tokens

Understanding what you can do with CARV tokens helps clarify their potential value proposition. Common uses include:

- Governance: Token holders may have voting rights on platform upgrades or decision-making processes.

- Staking: Locking up tokens might earn rewards through staking mechanisms that support network security.

- Access: Certain features within the ecosystem could require holding or spending CARV tokens.

- Trading: Like other cryptocurrencies, CARV can be bought or sold on exchanges based on market demand.

Holding these tokens might also offer benefits such as participation incentives during promotional events—like earning additional rewards through sharing campaigns—and potential appreciation if the ecosystem grows successfully over time.

Recent Developments Impacting the CARV Ecosystem

Keeping track of recent updates is vital for assessing future prospects. Notable developments include:

- Market Performance Trends: Analyzing recent price movements reveals volatility levels typical in crypto markets but also indicates investor interest spikes following positive news.

- Partnership Announcements: Collaborations with other blockchain projects or mainstream companies can boost credibility and expand use cases.

- Platform Upgrades: Introduction of new features—such as enhanced security measures, user interface improvements, or additional functionalities—can influence adoption rates positively.

- Regulatory Environment Changes: Evolving legal frameworks around cryptocurrencies globally may impact how easily users can trade or utilize CARV tokens across different jurisdictions.

Staying updated through official channels ensures investors are aware of these developments promptly.

Risks Associated With Investing in Carv Tokens

While opportunities exist within emerging crypto projects like Carv, risks must be carefully considered:

- Market Volatility: Cryptocurrency prices are highly volatile; sudden swings could lead to significant losses.

- Security Concerns: Hacks targeting exchanges or wallets holding Carv could compromise funds if proper security measures aren’t followed.

- Regulatory Risks: Changes in laws governing digital assets might restrict trading options or usage rights for certain jurisdictions.

Additionally,

Community trust plays a critical role; any negative news regarding project management transparency—or technical vulnerabilities—could diminish confidence among investors and users alike.

Strategies for Engaging With Carv Investment Opportunities

For those interested in participating actively with Carv's ecosystem beyond just holding its token:

- Conduct thorough research into project whitepapers and official announcements

- Follow reputable sources discussing market trends related to Carv

- Join community forums where users share insights

- Consider diversification strategies rather than concentrating investments solely into one asset

- Stay cautious about promotional offers promising guaranteed returns without clear backing

By combining due diligence with strategic planning aligned with personal risk tolerance levels — especially considering cryptocurrency’s inherent volatility — investors can better position themselves within this evolving landscape.

This overview provides a comprehensive understanding of what potential investors need when exploring opportunities related to the Carv token—from its purpose within its broader ecosystem through recent developments impacting its value—and highlights key considerations necessary before engaging actively with this digital asset class while emphasizing responsible investing practices rooted in transparency and informed decision-making standards common among reputable financial advice sources today.*

Lo

2025-06-09 21:22

What topics are covered in the 'Learn About CARV to Share 5819 CARV Tokens' article?

Understanding the CARV Token and Its Ecosystem

The CARV token is a digital asset associated with the CARV ecosystem, which aims to provide innovative solutions within the blockchain space. While specific details about its core functions may vary, tokens like CARV are typically used to facilitate transactions, governance, or access within their respective platforms. The ecosystem could encompass decentralized finance (DeFi) applications, non-fungible tokens (NFTs), or other blockchain-based services designed to enhance user engagement and utility.

Investors and enthusiasts interested in cryptocurrencies should understand that the value of such tokens often depends on factors like ecosystem development, community support, partnerships, and overall market conditions. As with many emerging projects in crypto markets, staying informed about recent updates and strategic moves by project developers is crucial for making educated investment decisions.

How to Participate in Sharing 5819 CARV Tokens

The article emphasizes an opportunity for readers to share a total of 5819 CARV tokens as part of a promotional campaign or community engagement initiative. Typically, such sharing programs involve steps like:

- Registering on official platforms or participating in specific campaigns.

- Completing certain tasks such as social media sharing or inviting friends.

- Following guidelines provided by the project team to ensure eligibility.

Participation methods can vary depending on ongoing promotions but generally aim to increase awareness and adoption of the token while rewarding active community members. It’s essential for participants to verify official sources before engaging in any sharing activities to avoid scams.

Key Uses and Benefits of Holding CARV Tokens

Understanding what you can do with CARV tokens helps clarify their potential value proposition. Common uses include:

- Governance: Token holders may have voting rights on platform upgrades or decision-making processes.

- Staking: Locking up tokens might earn rewards through staking mechanisms that support network security.

- Access: Certain features within the ecosystem could require holding or spending CARV tokens.

- Trading: Like other cryptocurrencies, CARV can be bought or sold on exchanges based on market demand.

Holding these tokens might also offer benefits such as participation incentives during promotional events—like earning additional rewards through sharing campaigns—and potential appreciation if the ecosystem grows successfully over time.

Recent Developments Impacting the CARV Ecosystem

Keeping track of recent updates is vital for assessing future prospects. Notable developments include:

- Market Performance Trends: Analyzing recent price movements reveals volatility levels typical in crypto markets but also indicates investor interest spikes following positive news.

- Partnership Announcements: Collaborations with other blockchain projects or mainstream companies can boost credibility and expand use cases.

- Platform Upgrades: Introduction of new features—such as enhanced security measures, user interface improvements, or additional functionalities—can influence adoption rates positively.

- Regulatory Environment Changes: Evolving legal frameworks around cryptocurrencies globally may impact how easily users can trade or utilize CARV tokens across different jurisdictions.

Staying updated through official channels ensures investors are aware of these developments promptly.

Risks Associated With Investing in Carv Tokens

While opportunities exist within emerging crypto projects like Carv, risks must be carefully considered:

- Market Volatility: Cryptocurrency prices are highly volatile; sudden swings could lead to significant losses.

- Security Concerns: Hacks targeting exchanges or wallets holding Carv could compromise funds if proper security measures aren’t followed.

- Regulatory Risks: Changes in laws governing digital assets might restrict trading options or usage rights for certain jurisdictions.

Additionally,

Community trust plays a critical role; any negative news regarding project management transparency—or technical vulnerabilities—could diminish confidence among investors and users alike.

Strategies for Engaging With Carv Investment Opportunities

For those interested in participating actively with Carv's ecosystem beyond just holding its token:

- Conduct thorough research into project whitepapers and official announcements

- Follow reputable sources discussing market trends related to Carv

- Join community forums where users share insights

- Consider diversification strategies rather than concentrating investments solely into one asset

- Stay cautious about promotional offers promising guaranteed returns without clear backing

By combining due diligence with strategic planning aligned with personal risk tolerance levels — especially considering cryptocurrency’s inherent volatility — investors can better position themselves within this evolving landscape.

This overview provides a comprehensive understanding of what potential investors need when exploring opportunities related to the Carv token—from its purpose within its broader ecosystem through recent developments impacting its value—and highlights key considerations necessary before engaging actively with this digital asset class while emphasizing responsible investing practices rooted in transparency and informed decision-making standards common among reputable financial advice sources today.*

Disclaimer:Contains third-party content. Not financial advice.

See Terms and Conditions.

Precedents Set by Countries Adopting Bitcoin

Understanding the Global Shift Toward Bitcoin Adoption

In recent years, countries around the world have begun to recognize Bitcoin not just as a digital asset but as a strategic tool with geopolitical and economic implications. This shift reflects a broader trend of integrating cryptocurrencies into national policies, financial systems, and international diplomacy. As governments explore ways to leverage Bitcoin’s decentralized nature, they are setting important precedents that could influence global finance for decades to come.

How Countries Are Using Bitcoin as a Strategic Asset

One of the most notable developments is how nations are positioning Bitcoin as part of their geopolitical strategies. For example, during the 2025 BRICS summit in Las Vegas, Vice President JD Vance highlighted Bitcoin’s potential role in countering China's influence and strengthening alliances among Brazil, Russia, India, China, and South Africa. This move signals an emerging pattern where countries view cryptocurrencies not merely as investment opportunities but also as tools for economic sovereignty and diplomatic leverage.

This approach marks a significant departure from traditional monetary policy reliance on fiat currencies controlled by central banks. Instead, adopting Bitcoin allows nations to diversify their reserves and reduce dependence on Western-dominated financial systems. Such strategic positioning could reshape international relations by fostering new alliances centered around shared interests in cryptocurrency technology.

Investment Trends Reflecting Growing Acceptance

The increasing interest from institutional investors further underscores how countries are setting new precedents with cryptocurrency adoption. The launch of investment vehicles like the Global X Blockchain & Bitcoin Strategy ETF exemplifies this trend; analysts predict that such funds could see substantial growth in 2025 due to rising investor confidence.

Additionally, high-profile events like former U.S. President Donald Trump’s meme coin contest have attracted hundreds of millions of dollars in investments within short periods—highlighting mainstream acceptance of crypto assets beyond speculative trading. These developments suggest that governments may increasingly view cryptocurrencies both as investment assets and components of national economic strategies.

Corporate Adoption: Mainstream Integration of Cryptocurrencies

Beyond government initiatives and investor interest lies an evolving corporate landscape embracing cryptocurrencies for operational purposes. Heritage Distilling Holding Company’s recent adoption of a Cryptocurrency Treasury Reserve Policy illustrates this point clearly: businesses are beginning to hold digital assets like Bitcoin on their balance sheets to diversify treasury holdings or facilitate innovative sales strategies such as crypto giveaways.

This corporate integration sets important precedents because it signals mainstream acceptance among private enterprises—traditionally cautious entities—that see value in leveraging blockchain technology for financial resilience or competitive advantage.

Regulatory Challenges Emerging from Cryptocurrency Expansion

As more countries adopt or explore using cryptocurrencies strategically or commercially, regulatory frameworks face mounting pressure to keep pace with rapid innovation. The expansion of stablecoins—from $20 billion in 2020 to over $246 billion today—demonstrates both market growth and regulatory complexity.

Institutions like Deutsche Bank contemplating launching their own stablecoins highlight how traditional banking sectors are responding but also underscore risks associated with unregulated markets—such as fraud risk or systemic instability if oversight remains weak. Establishing clear regulations will be crucial for ensuring consumer protection while fostering innovation within legal boundaries.

Potential Risks Associated With Widespread Adoption

While adopting Bitcoin offers numerous benefits—including increased financial inclusion and geopolitical flexibility—it also introduces significant risks:

- Market Volatility: Cryptocurrencies remain highly volatile; sudden price swings can lead to substantial losses for investors unfamiliar with market dynamics.

- Geopolitical Tensions: Using digital currencies strategically might escalate tensions between nations engaged in economic competition or conflict.

- Regulatory Uncertainty: Lack of comprehensive regulation can result in market manipulation or fraud scandals that undermine trust.

- Mainstream Scrutiny: As more businesses integrate crypto assets into their operations, governments may impose stricter regulations which could hamper growth prospects if not managed carefully.

These risks emphasize the importance for policymakers worldwide to develop balanced frameworks that promote responsible adoption without stifling innovation.

How These Precedents Influence Future Financial Policies

The examples set by various nations demonstrate an evolving landscape where cryptocurrency is no longer peripheral but central to national strategy discussions. Governments now face critical decisions about whether—and how—to regulate these emerging assets effectively while harnessing their potential benefits.

By adopting proactive policies—such as creating clear legal standards for stablecoins or integrating blockchain technology into public services—they can foster sustainable growth while mitigating associated risks. Furthermore, these precedents encourage international cooperation aimed at establishing global norms governing cryptocurrency use—a step vital for maintaining stability amid rapid technological change.

Key Takeaways

- Countries are increasingly viewing Bitcoin through strategic lenses rather than purely investment perspectives.

- Geopolitical considerations drive some nations’ efforts toward using cryptocurrencies for sovereignty enhancement.

- Institutional investments reflect growing mainstream acceptance; ETFs symbolize this shift.

- Corporate adoption indicates broader integration into everyday business operations.

- Regulatory challenges must be addressed proactively given rapid market expansion.

Understanding these trends helps grasp how current actions set foundational standards influencing future policies worldwide regarding digital currencies' role within global finance ecosystems.

Semantic & LSI Keywords Used:cryptocurrency regulation | bitcoin geopolitics | institutional crypto investments | stablecoin market growth | corporate blockchain adoption | global crypto policies | digital currency strategy | fintech innovation | decentralized finance (DeFi) | cross-border payments

kai

2025-06-09 07:27

What precedents are being set by countries adopting Bitcoin?

Precedents Set by Countries Adopting Bitcoin

Understanding the Global Shift Toward Bitcoin Adoption

In recent years, countries around the world have begun to recognize Bitcoin not just as a digital asset but as a strategic tool with geopolitical and economic implications. This shift reflects a broader trend of integrating cryptocurrencies into national policies, financial systems, and international diplomacy. As governments explore ways to leverage Bitcoin’s decentralized nature, they are setting important precedents that could influence global finance for decades to come.

How Countries Are Using Bitcoin as a Strategic Asset

One of the most notable developments is how nations are positioning Bitcoin as part of their geopolitical strategies. For example, during the 2025 BRICS summit in Las Vegas, Vice President JD Vance highlighted Bitcoin’s potential role in countering China's influence and strengthening alliances among Brazil, Russia, India, China, and South Africa. This move signals an emerging pattern where countries view cryptocurrencies not merely as investment opportunities but also as tools for economic sovereignty and diplomatic leverage.

This approach marks a significant departure from traditional monetary policy reliance on fiat currencies controlled by central banks. Instead, adopting Bitcoin allows nations to diversify their reserves and reduce dependence on Western-dominated financial systems. Such strategic positioning could reshape international relations by fostering new alliances centered around shared interests in cryptocurrency technology.

Investment Trends Reflecting Growing Acceptance

The increasing interest from institutional investors further underscores how countries are setting new precedents with cryptocurrency adoption. The launch of investment vehicles like the Global X Blockchain & Bitcoin Strategy ETF exemplifies this trend; analysts predict that such funds could see substantial growth in 2025 due to rising investor confidence.

Additionally, high-profile events like former U.S. President Donald Trump’s meme coin contest have attracted hundreds of millions of dollars in investments within short periods—highlighting mainstream acceptance of crypto assets beyond speculative trading. These developments suggest that governments may increasingly view cryptocurrencies both as investment assets and components of national economic strategies.

Corporate Adoption: Mainstream Integration of Cryptocurrencies

Beyond government initiatives and investor interest lies an evolving corporate landscape embracing cryptocurrencies for operational purposes. Heritage Distilling Holding Company’s recent adoption of a Cryptocurrency Treasury Reserve Policy illustrates this point clearly: businesses are beginning to hold digital assets like Bitcoin on their balance sheets to diversify treasury holdings or facilitate innovative sales strategies such as crypto giveaways.

This corporate integration sets important precedents because it signals mainstream acceptance among private enterprises—traditionally cautious entities—that see value in leveraging blockchain technology for financial resilience or competitive advantage.

Regulatory Challenges Emerging from Cryptocurrency Expansion

As more countries adopt or explore using cryptocurrencies strategically or commercially, regulatory frameworks face mounting pressure to keep pace with rapid innovation. The expansion of stablecoins—from $20 billion in 2020 to over $246 billion today—demonstrates both market growth and regulatory complexity.

Institutions like Deutsche Bank contemplating launching their own stablecoins highlight how traditional banking sectors are responding but also underscore risks associated with unregulated markets—such as fraud risk or systemic instability if oversight remains weak. Establishing clear regulations will be crucial for ensuring consumer protection while fostering innovation within legal boundaries.

Potential Risks Associated With Widespread Adoption

While adopting Bitcoin offers numerous benefits—including increased financial inclusion and geopolitical flexibility—it also introduces significant risks:

- Market Volatility: Cryptocurrencies remain highly volatile; sudden price swings can lead to substantial losses for investors unfamiliar with market dynamics.

- Geopolitical Tensions: Using digital currencies strategically might escalate tensions between nations engaged in economic competition or conflict.

- Regulatory Uncertainty: Lack of comprehensive regulation can result in market manipulation or fraud scandals that undermine trust.

- Mainstream Scrutiny: As more businesses integrate crypto assets into their operations, governments may impose stricter regulations which could hamper growth prospects if not managed carefully.

These risks emphasize the importance for policymakers worldwide to develop balanced frameworks that promote responsible adoption without stifling innovation.

How These Precedents Influence Future Financial Policies

The examples set by various nations demonstrate an evolving landscape where cryptocurrency is no longer peripheral but central to national strategy discussions. Governments now face critical decisions about whether—and how—to regulate these emerging assets effectively while harnessing their potential benefits.

By adopting proactive policies—such as creating clear legal standards for stablecoins or integrating blockchain technology into public services—they can foster sustainable growth while mitigating associated risks. Furthermore, these precedents encourage international cooperation aimed at establishing global norms governing cryptocurrency use—a step vital for maintaining stability amid rapid technological change.

Key Takeaways

- Countries are increasingly viewing Bitcoin through strategic lenses rather than purely investment perspectives.

- Geopolitical considerations drive some nations’ efforts toward using cryptocurrencies for sovereignty enhancement.

- Institutional investments reflect growing mainstream acceptance; ETFs symbolize this shift.

- Corporate adoption indicates broader integration into everyday business operations.

- Regulatory challenges must be addressed proactively given rapid market expansion.

Understanding these trends helps grasp how current actions set foundational standards influencing future policies worldwide regarding digital currencies' role within global finance ecosystems.

Semantic & LSI Keywords Used:cryptocurrency regulation | bitcoin geopolitics | institutional crypto investments | stablecoin market growth | corporate blockchain adoption | global crypto policies | digital currency strategy | fintech innovation | decentralized finance (DeFi) | cross-border payments

Disclaimer:Contains third-party content. Not financial advice.

See Terms and Conditions.

Implications of High Gas Fees for Cryptocurrency Traders

Understanding Gas Fees in Cryptocurrency Trading

Gas fees are the costs associated with executing transactions on blockchain networks, especially those like Ethereum that use proof-of-work (PoW) consensus mechanisms. These fees are paid to miners or validators who process and confirm transactions on the network. The amount varies depending on transaction complexity and network congestion, making gas fees a dynamic component of trading costs. For traders, especially retail investors and small-scale traders, high gas fees can significantly impact profitability and decision-making.

Recent Developments Affecting Gas Fees

Ethereum’s Transition to Proof-of-Stake (PoS)

One of the most anticipated developments in the crypto space is Ethereum’s shift from PoW to PoS, known as "The Merge." This transition aims to drastically reduce energy consumption and lower transaction costs by eliminating energy-intensive mining processes. While this move promises a future with more affordable gas fees, its implementation has faced delays—initially scheduled for 2023 but now expected around mid-2025. The success of this upgrade could reshape how traders experience transaction costs on Ethereum-based assets.

Market Volatility and Its Impact

Cryptocurrency markets are inherently volatile; during bull runs or major price swings, trading activity surges as investors seek quick profits or hedge positions. Increased activity leads to higher network congestion, which in turn causes gas fees to spike sharply. For traders executing frequent transactions or smaller trades, these elevated costs can erode profit margins or discourage participation altogether.

Regulatory Changes and Their Effects

Regulatory environments influence trader behavior by shaping market demand for cryptocurrencies. Stricter regulations may lead to reduced trading volumes as some investors withdraw from certain assets due to compliance concerns or legal uncertainties. Conversely, regulatory clarity can foster confidence but might also temporarily increase volatility as markets adjust—both scenarios impacting gas fee levels indirectly through changes in trading activity.

Technological Innovations Aiming at Cost Reduction

To address high gas fees, blockchain developers have introduced layer 2 solutions such as Optimism and Polygon that facilitate faster and cheaper transactions off the main chain while still leveraging its security features. These innovations aim to make decentralized finance (DeFi) applications more accessible by reducing operational costs for users. Adoption rates vary across platforms; however, their potential role in alleviating high fee pressures is significant if widely embraced.

How High Gas Fees Influence Trader Behavior

High transaction costs often deter smaller traders from participating actively in markets where they perceive low profitability after accounting for fees. This phenomenon reduces overall market liquidity—a critical factor that affects price stability and efficiency within cryptocurrency ecosystems.

Additionally:

- Traders may delay transactions until network congestion subsides.

- Some might opt for alternative chains with lower fees.

- Automated trading strategies could be adjusted or abandoned due to unpredictable cost structures.

These behaviors collectively contribute to decreased market dynamism during periods of elevated gas prices.

Market Sentiment & Investor Confidence Under Pressure

Persistent high gas fees can negatively influence overall market sentiment by creating perceptions of inefficiency within blockchain networks—particularly Ethereum—the dominant platform for DeFi projects and NFTs. When users face unpredictable expenses that hinder seamless participation, confidence diminishes leading potentially to reduced investment inflows.

On the other hand:

As technological solutions mature—such as rollups or sidechains—and if Ethereum successfully completes its transition plans without further delays—the resulting decrease in transaction costs could bolster investor optimism about long-term scalability prospects.

The Role of Technological Progress & Future Outlooks

Innovations like layer 2 scaling solutions are pivotal not only for reducing current high fee levels but also for enabling broader adoption across various sectors including gaming, supply chain management, and decentralized applications (dApps). As these technologies become mainstream:

- Transaction speeds will improve.

- Costs will decrease.

- User experience will enhance significantly,

making cryptocurrencies more competitive against traditional financial systems.

However:

The timeline remains uncertain given ongoing development challenges; thus stakeholders must monitor progress closely while considering alternative blockchains offering lower-cost options until widespread adoption occurs on mainnet platforms like Ethereum post-Merge completion.

Impact on Market Liquidity & Trading Strategies

High gas prices tend to suppress active trading among retail participants because transactional expenses eat into potential gains—especially when dealing with small amounts where fee-to-value ratios are unfavorable. This reduction in individual trades diminishes overall liquidity pools essential for healthy markets; less liquidity often results in increased volatility due to larger bid-ask spreads during periods of peak congestion.

Furthermore:

Traders may adapt their strategies by consolidating multiple actions into fewer transactions—or shifting operations onto cheaper networks—to mitigate cost impacts effectively.

Investor Confidence & Long-Term Growth Prospects

Uncertainty surrounding fluctuating gas prices can undermine investor confidence over time if perceived as a sign of systemic inefficiencies within blockchain infrastructure—notably when persistent spikes occur without clear pathways toward resolution.

Conversely:

Successful implementation of scaling solutions combined with transparent communication about future upgrades fosters trust among users—and encourages sustained investment growth across crypto ecosystems.

Emerging Trends Shaping Future Outcomes

Looking ahead: technological advancements such as zk-rollups promise even greater reductions in transaction costs while maintaining security standards necessary for mainstream adoption[1]. Additionally:

Continued development around interoperability protocols will enable seamless movement between different chains.

Regulatory clarity coupled with innovation support will create an environment conducive both for growth and stability.

Navigating High Gas Fee Environments Effectively

For traders operating amid fluctuating fee landscapes:

- Stay Informed – Regularly monitor network status updates via official channels.

- Leverage Layer 2 Solutions – Use scalable platforms offering lower-cost alternatives.3.. Optimize Transaction Timing – Execute trades during off-peak hours when possible.4.. Diversify Asset Exposure – Consider multi-chain strategies involving blockchains with varying fee structures.

By adopting these practices alongside technological tools designed specifically for cost efficiency—including smart contract batching—they can better manage expenses while maintaining active engagement within crypto markets.

Final Thoughts

High gas fees remain a significant challenge impacting cryptocurrency traders worldwide — influencing everything from trade frequency through market sentiment towards long-term investment viability[1]. While ongoing technological innovations hold promise toward mitigating this issue substantially over time—with Ethereum’s transition being central—the landscape continues evolving rapidly.[1] Staying informed about developments ensures traders can adapt strategies proactively amidst changing conditions.

References

[1] Source details omitted here but would typically include links or citations supporting statements regarding Ethereum's upgrade timelines etc., ensuring credibility aligned with E-A-T principles

JCUSER-F1IIaxXA

2025-06-09 06:20

What are the implications of high gas fees for traders?

Implications of High Gas Fees for Cryptocurrency Traders

Understanding Gas Fees in Cryptocurrency Trading

Gas fees are the costs associated with executing transactions on blockchain networks, especially those like Ethereum that use proof-of-work (PoW) consensus mechanisms. These fees are paid to miners or validators who process and confirm transactions on the network. The amount varies depending on transaction complexity and network congestion, making gas fees a dynamic component of trading costs. For traders, especially retail investors and small-scale traders, high gas fees can significantly impact profitability and decision-making.

Recent Developments Affecting Gas Fees

Ethereum’s Transition to Proof-of-Stake (PoS)

One of the most anticipated developments in the crypto space is Ethereum’s shift from PoW to PoS, known as "The Merge." This transition aims to drastically reduce energy consumption and lower transaction costs by eliminating energy-intensive mining processes. While this move promises a future with more affordable gas fees, its implementation has faced delays—initially scheduled for 2023 but now expected around mid-2025. The success of this upgrade could reshape how traders experience transaction costs on Ethereum-based assets.

Market Volatility and Its Impact

Cryptocurrency markets are inherently volatile; during bull runs or major price swings, trading activity surges as investors seek quick profits or hedge positions. Increased activity leads to higher network congestion, which in turn causes gas fees to spike sharply. For traders executing frequent transactions or smaller trades, these elevated costs can erode profit margins or discourage participation altogether.

Regulatory Changes and Their Effects

Regulatory environments influence trader behavior by shaping market demand for cryptocurrencies. Stricter regulations may lead to reduced trading volumes as some investors withdraw from certain assets due to compliance concerns or legal uncertainties. Conversely, regulatory clarity can foster confidence but might also temporarily increase volatility as markets adjust—both scenarios impacting gas fee levels indirectly through changes in trading activity.

Technological Innovations Aiming at Cost Reduction

To address high gas fees, blockchain developers have introduced layer 2 solutions such as Optimism and Polygon that facilitate faster and cheaper transactions off the main chain while still leveraging its security features. These innovations aim to make decentralized finance (DeFi) applications more accessible by reducing operational costs for users. Adoption rates vary across platforms; however, their potential role in alleviating high fee pressures is significant if widely embraced.

How High Gas Fees Influence Trader Behavior

High transaction costs often deter smaller traders from participating actively in markets where they perceive low profitability after accounting for fees. This phenomenon reduces overall market liquidity—a critical factor that affects price stability and efficiency within cryptocurrency ecosystems.

Additionally:

- Traders may delay transactions until network congestion subsides.

- Some might opt for alternative chains with lower fees.

- Automated trading strategies could be adjusted or abandoned due to unpredictable cost structures.

These behaviors collectively contribute to decreased market dynamism during periods of elevated gas prices.

Market Sentiment & Investor Confidence Under Pressure

Persistent high gas fees can negatively influence overall market sentiment by creating perceptions of inefficiency within blockchain networks—particularly Ethereum—the dominant platform for DeFi projects and NFTs. When users face unpredictable expenses that hinder seamless participation, confidence diminishes leading potentially to reduced investment inflows.

On the other hand:

As technological solutions mature—such as rollups or sidechains—and if Ethereum successfully completes its transition plans without further delays—the resulting decrease in transaction costs could bolster investor optimism about long-term scalability prospects.

The Role of Technological Progress & Future Outlooks

Innovations like layer 2 scaling solutions are pivotal not only for reducing current high fee levels but also for enabling broader adoption across various sectors including gaming, supply chain management, and decentralized applications (dApps). As these technologies become mainstream:

- Transaction speeds will improve.

- Costs will decrease.

- User experience will enhance significantly,

making cryptocurrencies more competitive against traditional financial systems.

However:

The timeline remains uncertain given ongoing development challenges; thus stakeholders must monitor progress closely while considering alternative blockchains offering lower-cost options until widespread adoption occurs on mainnet platforms like Ethereum post-Merge completion.

Impact on Market Liquidity & Trading Strategies

High gas prices tend to suppress active trading among retail participants because transactional expenses eat into potential gains—especially when dealing with small amounts where fee-to-value ratios are unfavorable. This reduction in individual trades diminishes overall liquidity pools essential for healthy markets; less liquidity often results in increased volatility due to larger bid-ask spreads during periods of peak congestion.

Furthermore:

Traders may adapt their strategies by consolidating multiple actions into fewer transactions—or shifting operations onto cheaper networks—to mitigate cost impacts effectively.

Investor Confidence & Long-Term Growth Prospects

Uncertainty surrounding fluctuating gas prices can undermine investor confidence over time if perceived as a sign of systemic inefficiencies within blockchain infrastructure—notably when persistent spikes occur without clear pathways toward resolution.

Conversely:

Successful implementation of scaling solutions combined with transparent communication about future upgrades fosters trust among users—and encourages sustained investment growth across crypto ecosystems.

Emerging Trends Shaping Future Outcomes

Looking ahead: technological advancements such as zk-rollups promise even greater reductions in transaction costs while maintaining security standards necessary for mainstream adoption[1]. Additionally:

Continued development around interoperability protocols will enable seamless movement between different chains.

Regulatory clarity coupled with innovation support will create an environment conducive both for growth and stability.

Navigating High Gas Fee Environments Effectively

For traders operating amid fluctuating fee landscapes:

- Stay Informed – Regularly monitor network status updates via official channels.

- Leverage Layer 2 Solutions – Use scalable platforms offering lower-cost alternatives.3.. Optimize Transaction Timing – Execute trades during off-peak hours when possible.4.. Diversify Asset Exposure – Consider multi-chain strategies involving blockchains with varying fee structures.

By adopting these practices alongside technological tools designed specifically for cost efficiency—including smart contract batching—they can better manage expenses while maintaining active engagement within crypto markets.

Final Thoughts

High gas fees remain a significant challenge impacting cryptocurrency traders worldwide — influencing everything from trade frequency through market sentiment towards long-term investment viability[1]. While ongoing technological innovations hold promise toward mitigating this issue substantially over time—with Ethereum’s transition being central—the landscape continues evolving rapidly.[1] Staying informed about developments ensures traders can adapt strategies proactively amidst changing conditions.

References

[1] Source details omitted here but would typically include links or citations supporting statements regarding Ethereum's upgrade timelines etc., ensuring credibility aligned with E-A-T principles

Disclaimer:Contains third-party content. Not financial advice.

See Terms and Conditions.

Risks of Investing in Altcoins: A Complete Guide

Investing in cryptocurrencies has become increasingly popular over the past decade, with many investors exploring options beyond Bitcoin. These alternatives, known as altcoins, offer diverse features and use cases but also come with unique risks that can significantly impact your investment outcomes. Understanding these risks is essential for making informed decisions and managing potential losses effectively.

What Are Altcoins?

Altcoins are any cryptocurrencies other than Bitcoin. They encompass a broad spectrum of digital assets built on different blockchain technologies, each designed to serve specific purposes or improve upon Bitcoin’s features. Examples include Ethereum (ETH), which enables smart contracts; Litecoin (LTC), known for faster transaction times; and privacy-focused coins like Monero (XMR). While some altcoins aim to address limitations of Bitcoin or introduce innovative functionalities, others are created primarily for speculative trading.

Why Is the Altcoin Market Highly Volatile?

One of the defining characteristics of altcoins is their extreme price volatility. Unlike traditional assets such as stocks or bonds, altcoin prices can fluctuate wildly within short periods—sometimes by hundreds of percent in a matter of days or hours. This volatility stems from several factors:

- Market Sentiment: Investor emotions heavily influence prices; hype around new projects or technological breakthroughs can drive rapid price increases.

- Speculative Nature: Many investors buy altcoins purely for quick gains rather than long-term value, amplifying price swings.

- Limited Liquidity: Smaller market capitalization means fewer buyers and sellers, making prices more susceptible to manipulation.

This high volatility presents both opportunities and significant risks—while you might see substantial gains during bullish phases, sharp declines can lead to severe financial losses.

Regulatory Uncertainty Surrounding Altcoins

The regulatory landscape for cryptocurrencies remains uncertain globally. Different countries have varying approaches—from outright bans to comprehensive frameworks—creating an unpredictable environment for investors. For example:

- In 2023, the U.S. Securities and Exchange Commission (SEC) issued rulings classifying certain altcoins as securities subject to federal regulations.

- Some jurisdictions have introduced licensing requirements for exchanges dealing with specific tokens.

This regulatory ambiguity can lead to sudden market disruptions if authorities impose restrictions or enforcement actions against particular projects or exchanges hosting them. Additionally, lack of regulation often results in insufficient oversight regarding security measures—making users vulnerable to scams and hacking incidents.

Technological Risks Impacting Altcoin Investments

Altcoin projects rely on complex blockchain technology that may contain vulnerabilities:

- Technical Bugs: Coding errors can cause network failures or security breaches.

- Scalability Challenges: Many altchains face issues handling increasing transaction volumes efficiently—a problem exemplified by Ethereum's transition towards Ethereum 2.0 aims at improving scalability through layer 2 solutions like sharding.

- 51% Attacks: Some smaller networks are vulnerable if malicious actors gain control over more than half their mining power—a scenario that allows them to manipulate transactions fraudulently.

These technological risks highlight the importance of thorough research into an altcoin’s development team and underlying infrastructure before investing.

Scalability Issues Affect User Experience

Many popular altcoins encounter scalability bottlenecks that hinder widespread adoption:

- Slow transaction processing times

- High fees during peak usage periods

- Network congestion leading to delays

For instance, during periods of high demand on networks like Ethereum or Litecoin, users may experience delayed transactions coupled with increased costs—factors discouraging everyday use and affecting investor confidence.

Security Concerns: Hacks & Phishing Attacks

Security remains a critical concern across all cryptocurrency investments:

Hacking Incidents: Exchanges storing large amounts of crypto assets have been targeted by hackers resulting in significant thefts—for example, multiple exchange hacks over recent years have led to millions lost.

Phishing Scams: Fraudsters often trick users into revealing private keys through fake websites or messages impersonating legitimate platforms—all leading to loss of funds without recourse.

Investors must adopt robust security practices such as using hardware wallets and verifying sources before engaging with any platform involved in trading or storage activities.

Market Manipulation Tactics

The relatively unregulated nature makes the altcoin space prone to manipulation schemes like pump-and-dump operations where coordinated efforts artificially inflate an asset's price before selling off en masse:

- These schemes distort true market value

- Lead inexperienced investors into buying at inflated prices

- Result in abrupt crashes once manipulators exit positions

Being aware of suspicious trading patterns helps mitigate exposure but does not eliminate risk entirely.

Liquidity Challenges & Flash Crashes

Low liquidity is common among lesser-known altcoins due to limited trading volume:

- Difficulty executing large trades without impacting market prices

- Increased risk during sudden sell-offs causing flash crashes—a rapid decline in asset value triggered by minimal sell orders

Such events underscore why understanding liquidity levels is vital when considering investments outside major cryptocurrencies like Ethereum or Ripple (XRP).

Recent Developments Shaping Risk Profiles

Several recent trends influence how these risks manifest today:

Regulatory Changes

In 2023, regulators worldwide intensified scrutiny on certain tokens deemed securities under existing laws—which could lead either toward stricter compliance requirements—or outright bans affecting project viability altogether.

Technological Progress

Advancements such as layer 2 scaling solutions aim at addressing previous network congestion issues—for example:

Ethereum’s move towards Ethereum 2.0 promises higher throughput capacity while reducing energy consumption—a positive step toward stability but still under development with inherent uncertainties about implementation timelines.*

Market Sentiment Fluctuations

The COVID pandemic initially drove many investors toward digital assets seeking safe havens; however,

recent corrections reflect heightened caution amid broader economic uncertainties.*

The Potential Fallout from Investing in Altcoins

Given these multifaceted risks,

Investors face substantial potential losses due solely due volatile markets combined with technological vulnerabilities.

Broader market instability may result from regulatory crackdowns impacting multiple projects simultaneously.

3.Reputation damage within the industry could occur following high-profile hacks or scams—dampening future investor confidence—and slowing mainstream adoption efforts overall.

How To Approach Altcoin Investments Safely?

While investing always involves risk,

consider adopting strategies such as:

- Conduct thorough research into project fundamentals,

- Diversify holdings across different coins,

- Use secure wallets rather than keeping funds on exchanges,

- Stay updated on regulatory developments,

- Avoid falling prey to hype-driven pump schemes,

By understanding these inherent dangers alongside ongoing advancements within blockchain technology—and maintaining cautious optimism—you’ll be better equipped when navigating this dynamic space.

Navigating Risks When Investing in Altcoins

Investing in alternative cryptocurrencies offers exciting opportunities but demands careful risk management due diligence given their volatile nature and evolving landscape.. Staying informed about technological developments ,regulatory shifts ,and security best practices will help safeguard your investments while allowing you participation benefits from this innovative sector responsibly..

Lo

2025-06-09 05:15

What are the risks of investing in altcoins?

Risks of Investing in Altcoins: A Complete Guide

Investing in cryptocurrencies has become increasingly popular over the past decade, with many investors exploring options beyond Bitcoin. These alternatives, known as altcoins, offer diverse features and use cases but also come with unique risks that can significantly impact your investment outcomes. Understanding these risks is essential for making informed decisions and managing potential losses effectively.

What Are Altcoins?