To seize the global opportunities brought about by the rapid development of artificial intelligence (AI) technology and to further promote the deep integration of cutting-edge technology with the real economy and the digital economy, Ju.com officially announces the establishment of a $30 million AI special investment fund.

This fund will systematically invest around core AI technologies and the next generation of intelligent product forms. Key investment areas include, but are not limited to: • AI foundational models and underlying technologies • AI Agent products and solutions, encompassing autonomous decision-making, task execution, and automation scenarios • Intelligent robotics-related products, including software-driven robots, Embodied AI, and human-robot collaboration systems • Convergent applications of AI and Blockchain / Web3, such as smart contract automation, on-chain governance and risk control, and decentralized intelligent execution systems • Commercialization and implementation of AI in fields like fintech, enterprise services, content generation, and data analytics

This special fund will invite several listed companies and industrial capital to co-invest. By leveraging synergies from industrial resources, application scenarios, and financial support, it aims to provide portfolio projects with full-cycle empowerment, from technology validation and commercial implementation to long-term strategic partnerships.

Ju.com has always adhered to a long-term value and technological innovation-oriented approach, continuously building an open, robust, and sustainable technology investment ecosystem. The establishment of this AI special fund represents a crucial strategic move by Ju.com in the context of cutting-edge technology and the intelligent trend, and also reflects our high recognition of the long-term industrial value of AI, AI Agent, and robotics technologies.

In the future, Ju.com will collaborate with outstanding entrepreneurial teams, technical talent, and industrial partners worldwide to jointly promote the large-scale application and industrial upgrading of the next generation of intelligent products.

This is hereby announced.

#AI #Jucom

JU Blog

2026-01-09 04:40

Ju.com Announcement on the Establishment of a $30 Million AI Special Investment Fund

Disclaimer:Contains third-party content. Not financial advice.

See Terms and Conditions.

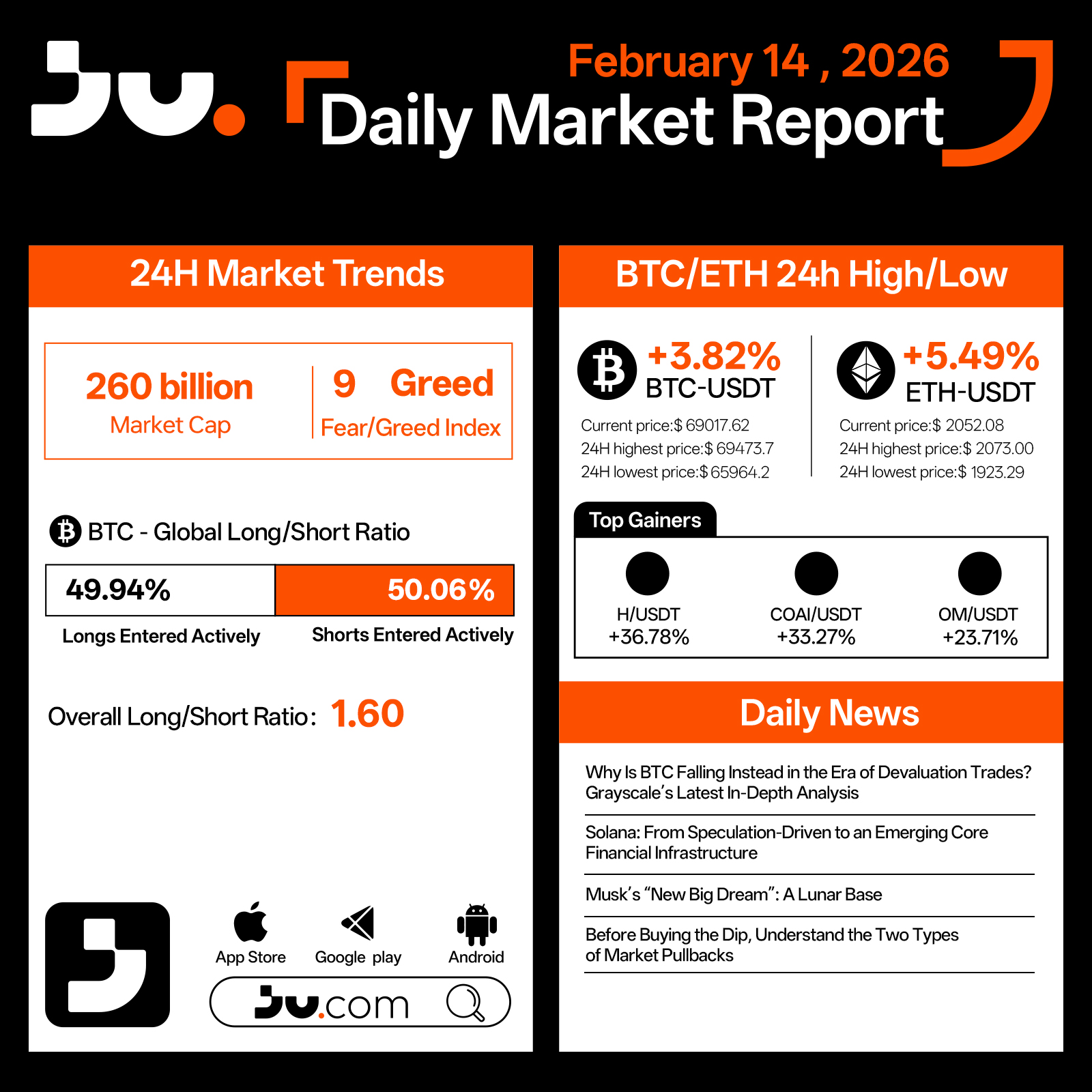

On February 14, the crypto market staged a notable rebound following consecutive sessions of decline, with total market capitalization rising to $260 billion. Although the Fear & Greed Index remains at 9, firmly within extreme fear territory, price action suggests that immediate selling pressure has eased, allowing for short-term recovery momentum.

Bitcoin gained 3.82% to $69,017.62, trading between $65,964.2 and $69,473.7 during the session. Long positions account for 49.94%, while shorts stand at 50.06%, with the aggregate long–short ratio declining to 1.60, reflecting a contraction in leveraged exposure. The rebound appears driven by short covering and tactical dip buying rather than a confirmed structural reversal.

Ethereum outperformed, rising 5.49% to $2,052.08, after dipping to $1,923.29 intraday. As a higher-beta asset, ETH demonstrated stronger recovery elasticity, highlighting renewed risk appetite at lower price levels, though broader market structure remains in a rebuilding phase.

Among leading gainers, H, COAI, and OM posted significant advances, largely attributable to oversold bounces and speculative positioning rather than a broad-based improvement in fundamentals.

Narrative focus centered on Grayscale’s analysis of why Bitcoin has not fully aligned with the “devaluation trade” thesis, emphasizing that macro liquidity dynamics continue to influence crypto pricing. Discussions around Solana’s transition from speculation-driven momentum to a potential core financial infrastructure further underscore evolving sector narratives. Analysts also cautioned investors to distinguish between different types of market pullbacks before engaging in dip-buying strategies.

Overall, February 14 reflects a technical rebound rather than a confirmed trend reversal. While short-term sentiment has improved marginally, extreme fear readings indicate that confidence remains fragile. In the absence of clearer liquidity or policy catalysts, volatility and consolidation are likely to persist in the near term.

#cryptocurrency #blockchain #JU #Jucom

JU Blog

2026-02-14 06:12

Technical Rebound Emerges Amid Persistent Extreme Fear - Daily Market Report | February 14, 2026

Disclaimer:Contains third-party content. Not financial advice.

See Terms and Conditions.

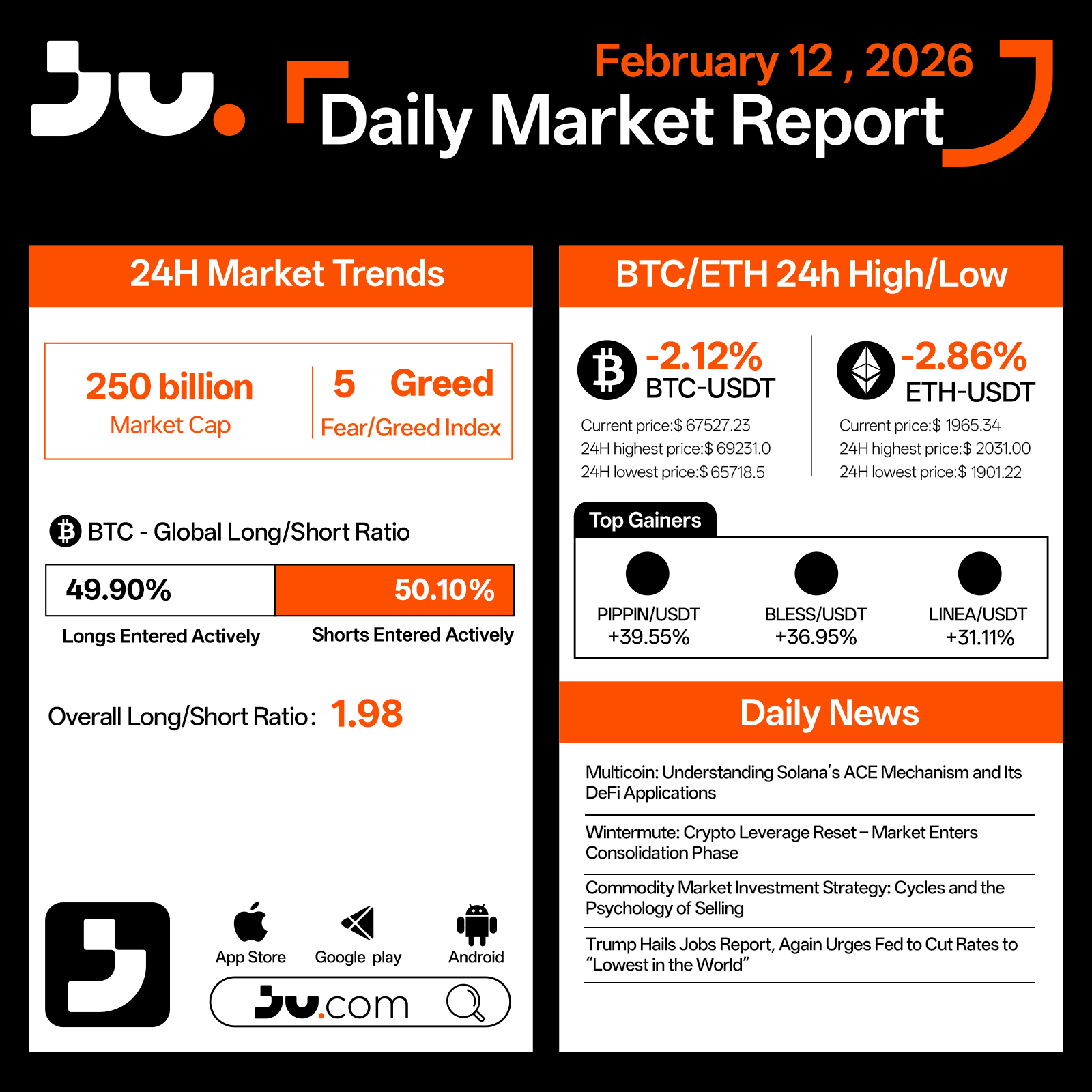

On February 12, the crypto market extended its decline, with total market capitalization falling to $250 billion. The Fear & Greed Index plunged to 5, marking one of the lowest readings of the current cycle and signaling extreme market anxiety. Liquidity remains tight, and post-leverage liquidation dynamics continue to shape price action.

Bitcoin dropped 2.12% to $67,527.23, trading between $65,718.5 and $69,231.0 during the session. Long positions account for 49.90%, while shorts stand at 50.10%, with an aggregate long–short ratio of 1.98, indicating near-balanced positioning despite continued downward pressure. The breakdown below key psychological levels has reinforced cautious sentiment, and volatility remains elevated.

Ethereum declined 2.86% to $1,965.34, with an intraday low of $1,901.22. As a higher-beta asset, ETH continues to exhibit greater downside sensitivity compared to BTC, reflecting ongoing risk reduction across the broader market.

Among top performers, PIPPIN, BLESS, and LINEA recorded strong gains, largely driven by tactical flows and sector rotation rather than a broad-based recovery in sentiment.

From a narrative perspective, Multicoin’s analysis of Solana’s ACE mechanism and its DeFi applications highlights continued innovation within high-performance blockchain ecosystems. Wintermute suggests that following a broad leverage reset, the market may enter a consolidation phase. Discussions surrounding commodity cycles and selling psychology further underscore prevailing macro uncertainty. Meanwhile, renewed political pressure for aggressive rate cuts adds another layer of complexity to risk asset pricing.

Overall, February 12 reflects a market in extreme fear territory. While such readings can historically coincide with late-stage capitulation, the absence of a clear liquidity or policy pivot suggests that consolidation at lower levels may persist before a more sustainable recovery emerges.

#cryptocurrency #blockchain #technical analysis #JU #Jucom

JU Blog

2026-02-12 04:28

Extreme Fear Deepens as Market Tests Lower Boundaries - Daily Market Report | February 12, 2026

Disclaimer:Contains third-party content. Not financial advice.

See Terms and Conditions.

Bitcoin bags are getting blown out today, as the price of BTC falls to nearly $80,000 and marks a new seven-month low.

- The continued downward pressure on its price has pushed Bitcoin into a so-called death cross—when the average price of an asset over the short term falls below the average price over the long term. It’s a technical pattern that typically signals extended bearish momentum. For traders who study charts, it confirms what permabulls don’t want to hear: It’s over—at least for now.

- It’s happening as the crypto market as a whole shrinks to $2.91 trillion, shedding nearly $60 billion in the past 24 hours alone. Almost every single coin in the top 100 by market cap is bleeding red.

- The Fear and Greed Index, which measures market sentiment on a scale from 0 to 100, has cratered to 14 points—just four points above the year's low of 10 back in February. When this index drops below 20, it signals "extreme fear," and right now, traders are absolutely terrified.

- But it's not just crypto drama driving the market selloff. The macro picture is turning nasty. Just weeks ago, markets were pricing in a 97% chance the Federal Reserve would cut interest rates in December. Now? Those odds have collapsed to somewhere between 22% and 43%, depending on which metric you check.

- Fed officials are openly divided, with many signaling they'd prefer to keep rates unchanged through year-end. For risk assets like crypto that thrive on easy money, this is poison.

- On Myriad, a prediction market developed by Decrypt’s parent company Dastan, traders are now overwhelmingly convinced that Bitcoin will not mark a new all-time high this year, placing odds at almost 90% that BTC will not top the $126K mark that it hit on October 6.

- The bearish vibes are so strong, Myriad traders also currently place 40% odds that Bitcoin falls as low as $69K. So how low will it go? Here’s what the charts say.

- Bitcoin opened today at $86,691 and immediately sold off, hitting an intraday low of $80,620 before bouncing slightly to its current price at $85,187. That's a 1.61% drop on the day after being almost 5% down over the last 24 hours. More importantly, for traders, it further confirms the death cross pattern that's been progressively forming since its all-time high in early October. The death cross pattern was first confirmed on Wednesday as Bitcoin slid to around $88,000—now it’s fallen deeper.

- Here's what's happening on the charts: Exponential Moving Averages, or EMAs, help traders identify trend direction by tracking the average price of an asset over the short, medium, and long term. When the short-term 50-day EMA falls below the longer-term 200-day EMA, it means bears are in control and the longer-term bull market structure has been broken.

- For Bitcoin, the 50-day EMA has now decisively crossed below the 200-day EMA. In short, this tells traders market momentum has shifted from bullish to bearish. The gap between both EMAs increases the more the price of BTC trades below those targets—and the bigger the gap, the stronger the trend.

- The price of Bitcoin is now trading well below both EMAs, which creates a situation where each bounce attempt faces immediate resistance, increasing the gap between the two EMAs, making the bearish trend even stronger. Bulls trying to push higher will need to first reclaim the 50-day EMA, then tackle the 200-day—a double wall of resistance that's historically tough to crack in one go.

- As for other technical indicators, the Average Directional Index, or ADX, sits at 41, which is considered "strong." ADX measures trend strength regardless of direction, with readings above 25 indicating a clear trend is in place. At 41, this tells us we’re not seeing just a minor correction, but a potentially extended move lower.

- The Relative Strength Index, or RSI, has plunged to 23.18, placing Bitcoin deep in oversold territory. RSI measures momentum on a scale from 0 to 100, with readings below 30 signaling oversold conditions where assets are potentially undervalued. However, "oversold" doesn't mean the selling has to stop—in strong downtrends, RSI can remain in oversold territory for extended periods as prices continue grinding lower. But, yes, this also provides hopium for momentum traders as it signals that the worst of it may be over. (The worst being an accelerated crash, not necessarily a steady drop.)

- The Squeeze Momentum Indicator is flashing "bearish impulse," meaning selling pressure is intensifying rather than easing. Meanwhile, the Volume Profile Visible Range (VPVP) shows the price of Bitcoin trading "below" key volume nodes, suggesting there's not much buying interest at current levels.

- So, everything is bearish, clearly. But where's the next support? How low can the price of BTC go? The chart reveals several key horizontal levels to watch.

- The immediate danger zone is $80,697, which briefly held today but looked shaky. If that breaks, the next major support sits at $74,555, followed by $65,727, and potentially all the way down to $53,059 if panic really sets in during a crypto winter. Those price levels have previous consolidation zones where significant trading volume accumulated, making them natural landing spots for oversold bounces.

- For resistances, traders will watch for BTC’s price breaking past $90,000 again and look at $100,000 as the major psychological target.

- Ethereum opened at $2,830.7 and dropped as low as $2,621 intraday before stabilizing around $2,798—a 1.16% loss on the day. While not as dramatic as Bitcoin's selloff, ETH's technical picture is equally concerning.

- Unlike Bitcoin, Ethereum hasn't fully confirmed its death cross yet—the 50-day EMA is still technically above the 200-day, giving it a "long" signal on an indicator that is obviously hours away from changing to bearish. The gap is razor-thin and closing fast. More importantly, ETH’s price is trading well below both EMAs, rendering that technical distinction somewhat meaningless. The bearish momentum is clearly established.

- A good way to see the natural support zones is using the Fibonacci retracements: a set of natural clusters that appear during a trend, showing supports and resistances in a specific timeframe—not because of price, but because of natural proportions.

- Right now, ETH is testing the 0.618 Fibonacci level at approximately $2,755. If this level breaks, the next Fibonacci support doesn't appear until $2,180, which would represent a massive 22% drop from current prices, and would resolve a price market on Myriad betting on ETH’s moon or doom.

- The ADX for Ethereum is even stronger than Bitcoin's at 46, indicating the downtrend is rock-solid. Meanwhile, RSI sits at 28.46—not quite as oversold as Bitcoin but definitely in stressed territory. The Squeeze Momentum Indicator shows "bearish impulse" here too, confirming sellers are in control.

- XRP is showing relative strength compared to its larger peers, down just 0.50% to close at $1.98 after opening at $1.99 and hitting an intraday low of $1.81796. Don't let that modest percentage fool you though—the technical damage is real.

- Like Bitcoin, the Ripple-linked XRP has confirmed a full death cross with its 50-day EMA now below the 200-day. The price of XRP is trading beneath both EMAs, and with an ADX of 32, the downtrend has enough strength to continue. While 32 isn't as extreme as Bitcoin's 41 or Ethereum's 46, it's still well above the 25 threshold that confirms a trend is in place rather than just random chop.

- The RSI at 32.86 shows XRP is approaching oversold territory but hasn't quite reached the extreme stress levels of Bitcoin and Ethereum. This could mean two things: either XRP has more downside before finding equilibrium, or it's showing genuine relative strength that could make it a safer harbor if the broader market continues tanking.

- XRP had such a crazy year that its price action shows only two major horizontal support levels that should concern XRP holders—and that would be very painful for hodlers, considering the movement from the all-time high to those targets.

- The next major support zone sits at $1.589, which represents a potential 20% drop from current levels. If that breaks, there's very little support until $0.66, a catastrophic 67% plunge from current prices and almost 80% from all-time high zone that would take XRP back to early 2024 levels.

The Squeeze Momentum Indicator is showing "bearish impulse," and like the other coins, the volume profile indicates XRP’s price is trading below key volume levels, meaning there's not much buying interest stepping in to defend current prices.

#Bitcoin #BitcoinDeathCross #Jucom #cryptocurrency #blockchain $BTC/USDT $JU/USDT $ETH/USDT

Lee | Ju.Com

2025-11-22 13:17

😱 Bitcoin in a Death Cross: How Low Will We Go?📛📛

Disclaimer:Contains third-party content. Not financial advice.

See Terms and Conditions.

While discussions are growing that Bitcoin-focused company Strategy (formerly MicroStrategy) could be removed from MSCI indices, the company’s chairman, Michael Saylor, maintained that the operating model is robust and that this possibility will not affect the company’s roadmap.

- MSCI has proposed removing “digital asset treasury companies” whose portfolios consist largely of cryptocurrencies from its indexes. While it noted that such companies “may exhibit characteristics similar to mutual funds,” it stated that these structures are not suitable for the indexes. The final decision will be announced on January 15th.

- In his latest post, Saylor explained that Strategy is an operating company. He pointed out that, in addition to its Bitcoin reserves, it also has a $500 million enterprise software division that has been serving corporations and public institutions for over 20 years.

- Saylor stated, “We understand that index providers periodically review their methodologies, but Strategy is not an ETF, it is not a closed-end fund, and it is certainly not a passive proxy for Bitcoin. We produce, operate, and grow just like any other business.” He added that inclusion or removal from the index would not change the company's strategy, operations, or long-term belief in BTC.

- JPMorgan issued a note this week warning that Strategy's removal from the index could lead to billions of dollars in passive outflows. Analysts estimate that a potential removal from MSCI could lead to a $2.8 billion outflow from passive funds. Overall, approximately $9 billion of Strategy's market capitalization is estimated to be tied to passive, index-tracking ETFs and mutual funds.

The sharp decline in Bitcoin's price is also putting pressure on Strategy shares, which have lost nearly 40% of their value this year.

#Bitcoin #MicroStrategy #MichaelSaylor #Jucom #cryptocurrency $BTC/USDT $JU/USDT $ETH/USDT

Lee | Ju.Com

2025-11-22 13:06

📛 Bitcoin Bull MicroStrategy May Be Removed from US Indexes – Michael Saylor Answers.

Disclaimer:Contains third-party content. Not financial advice.

See Terms and Conditions.

The price of Cardano (ADA) was down on Friday after the blockchain suffered an unexpected chain split, which was caused by a malformed delegation transaction that triggered a software flaw. That created problems for Cardano users, and prompted a public apology from the user who claimed that they caused it.

- Intersect, the Cardano ecosystem’s governance organization, said in an incident report that the divergence began when the malformed transaction passed validation on newer node versions, but nodes running older software rejected it.

- “This exploited a bug in an underlying software library that was not trapped by validation code,” Intersect wrote. “The execution of this transaction caused a divergence in the blockchain, effectively splitting the network into two distinct chains: one containing the ‘poisoned’ transaction and a ‘healthy’ chain without it.”

- Earlier that day, Cardano co-founder Charles Hoskinson posted on X that it was a “premeditated attack from a disgruntled [stake pool operator]” who was “actively looking at ways to harm the brand and reputation of [Cardano developer Input/Output Global].”

- According to Hoskinson, all Cardano users were impacted. The price of Cardano’s token ADA was down more than 6% recently, following the incident.

- According to the incident report, the mismatch caused operators to build blocks on different branches of the chain until patched node software was deployed. Developers and service providers coordinated an emergency response, and operators were urged to upgrade to rejoin the main chain.

- Intersect said the wallet responsible for the malformed transaction has been identified, while Hoskinson said it will take weeks to clean up the mess.

- “Forensic analysis suggests links to a participant from the Incentivized Testnet (ITN) era,” Intersect wrote. “As this incident constitutes a potential cyberattack on a digital network, relevant authorities, including the Federal Bureau of Investigation, are being engaged to investigate.”

- Hours after the incident, an X user posting under the name Homer J. said they were responsible for submitting the transaction that triggered the split.

- “Sorry Cardano folks, it was me who endangered the network with my careless action yesterday evening,” they wrote, describing the attempt as a personal challenge to reproduce the “bad transaction” and said he relied on AI-generated instructions while blocking traffic on their server.

- “I've felt awful as soon as I realized the scale of what I've caused. I know there's nothing I can do to make up for all the pain and stress I've caused over the past X hours,” they added. “Difficult to quantify the negligence on my behalf. I am sorry, I truly am. I didn't have evil intentions.”

- Homer wrote that he did not sell or short ADA, did not coordinate with anyone else, and did not act for financial gain. “I'm ashamed of my carelessness and take full responsibility for it and whatever consequences will follow,” he said.

- According to Intersect, no user funds were lost, and most retail wallets were unaffected because they were running node components that handled the malformed transaction safely.

- Hoskinson, the outspoken co-founder of Cardano, claimed in a video message that the network “didn’t go down,” though users did encounter issues before the problem was fixed.

“It is important to note that the network did not stall. Block production continued on both chains throughout the incident, and at least some identical transactions appeared on both chains,” Intersect wrote. “However, to ensure the integrity of the ledger, exchanges and third-party providers largely paused deposits and withdrawals as a precautionary measure.”

#Cardano #CardanoNetwork #Jucom #cryptocurrency #blockchain $ADA/USDT $JU/USDT $BTC/USDT

Lee | Ju.Com

2025-11-22 13:03

📛 Cardano Network Disrupted by 'Poisoned' Transaction Attack.

Disclaimer:Contains third-party content. Not financial advice.

See Terms and Conditions.

The Ju.com Thanksgiving Twitter AMA explored the three most critical trends shaping crypto's evolution: leverage reset, Real World Asset (RWA) tokenization breakthrough, and maturing stablecoin payment infrastructure. Here's what you need to know:

📊 Market Leverage Cleanse

Bitcoin futures open interest plunged ~30% from its $47.5B peak, marking one of the largest leverage resets of the current cycle. This isn't a bear signal—it's a healthy market correction:

-

Funding rates returned to neutral levels

Over-leveraged positions cleared, reducing systemic risk

Foundation set for sustainable price appreciation in 2025-2026

💼 RWA Tokenization: From Narrative to $30B Reality

Real World Asset tokenization surpassed $30B market cap in Q3 2025, a 10x increase from 2022 levels:

-

Private credit dominates with 58% market share ($14B)

US Treasuries hold 34% market share ($8.2B)

Institutional validation from BlackRock BUIDL, Ondo, Franklin Templeton

Ju.com's xBrokers framework democratizes access to Hong Kong private placements, Pre-IPO stocks, and institutional-grade products. Licensed brokers hold custody while blockchain tokens represent shares 1:1, ensuring full compliance with secondary market liquidity.

💳 Stablecoin Payment Surge

Stablecoins processed $27 trillion in annual transaction volume, with monthly volumes approaching $1.25 trillion—independent of speculative trading:

-

48% of payment providers cite real-time settlement as top advantage

Sub-Saharan Africa leads with 9.3% adoption rate globally

71% of Latin American companies already use stablecoins for cross-border payments

🚀 Ju.com Product Ecosystem

JuPay: Merchants receive local currency instantly via QR code, customers pay with Bitcoin/USDT—no blockchain knowledge required

JuCard: Crypto converts at point-of-sale, trading profits immediately available for everyday expenses

Ju Exclusive: Curated early-stage opportunities with institutional-level due diligence, cutting through social media hype

🌍 Regional Growth Hotspots

Emerging markets lead payment adoption:

-

Africa, LatAm, Southeast Asia use crypto for actual needs versus speculation

Macro instability drives stablecoins as essential infrastructure

86% of payment companies report infrastructure ready for stablecoin adoption

🎯 2025 Key Outlook

Institutional adoption accelerating: Regulatory frameworks like MiCA and GENIUS Act reduce uncertainty

Payments meet trading: Complete financial ecosystems retain users

Speculation to utility: Crypto evolves into functional currency

💡 Core Takeaways

Three trends define crypto's future: 1️⃣ Cleaner leverage environment supports sustainable growth 2️⃣ RWA tokenization bridges traditional finance with blockchain 3️⃣ Stablecoin payment infrastructure finally works

In the next market cycle, exchanges offering complete financial ecosystems—trading, investing, yield generation, and payments—will capture disproportionate value.

Read the complete analysis and market strategies 👇 https://blog.ju.com/jucom-ama-thanksgiving-crypto-utility/?utm_source=blog

#Jucom #Crypto #RWA #JuPay #JuCard

JU Blog

2025-11-28 13:32

Ju.com Thanksgiving AMA Recap: Crypto Payments, RWA Growth & 2025 Outlook

Disclaimer:Contains third-party content. Not financial advice.

See Terms and Conditions.

The Ethereum co-founder has repeatedly spoken this year about treating privacy as a basic necessity for digital systems.

- Following a recent data breach involving major US banks, where client information from institutions including JPMorgan, Citi, and Morgan Stanley may have been exposed after a cyberattack on mortgage technology vendor SitusAMC, Buterin responded by describing privacy as a form of “hygiene.”

- Ethereum co-founder Vitalik Buterin said end-to-end encrypted messaging is essential for protecting digital privacy, identifying permissionless account creation and metadata privacy as the next major priorities for the sector.

He pointed to Session and SimpleX as two projects working on these areas and disclosed that he has donated 128 ETH to each of them.

Major ETH Donations

- In a post on X this week, Buterin said both applications are attempting to strengthen decentralization and enhance user protections without relying on phone numbers, while also addressing challenges such as multi-device support and resistance to Sybil or denial-of-service attacks.

- Buterin said the donation addresses are publicly available on the projects’ websites and added that, although the platforms are not yet perfect, they represent active efforts to advance privacy-preserving communication.

- He also called for more developers to help tackle the technical problems that still remain, and added that these issues “need more eyes on them.”

- It is important to note that while Signal has emerged as a widely used encrypted messaging app, it faced renewed scrutiny following a March incident in which senior US national security officials accidentally included a reporter in a Signal group discussing strikes on Houthi targets in Yemen.

- Days later, a Pentagon-wide advisory warned against using the app for any non-public information, citing a vulnerability tied to its linked-devices feature.

- The memo said Russian hacking groups were targeting the users of the app through phishing tactics. Signal later attributed the issue to user-targeted attacks rather than problems with its encryption, and that the company had already implemented safeguards and warnings.

Buterin’s Privacy Push

- In an essay published in April, he argued that “privacy is an important guarantor of decentralization” and outlined a path for Ethereum to support stealth addresses, selective disclosure, and application-level zero-knowledge tools to help reduce unnecessary data exposure.

- More recently, he warned that X’s new geo-inference system, which assigns country labels to user accounts, poses privacy risks.

He said such systems can still reveal sensitive location information and may endanger vulnerable users, even when only broad regions are disclosed.

#Ethereum #VitalikButerin #Jucom #cryptocurrency #EncryptedMessages $ETH/USDT $JU/USDT $BTC/USDT

Lee | Ju.Com

2025-11-28 05:01

🔥Ethereum Co-Founder Vitalik Buterin Launches 256 ETH to Boost Next-Generation Encrypted Messaging!

Disclaimer:Contains third-party content. Not financial advice.

See Terms and Conditions.

Google released Gemini 3 Pro in a public preview today, calling it the company's most capable AI model to date.

- The system handles text, images, audio, and video simultaneously while processing up to 1 million tokens of context—roughly equivalent to 700,000 words, or about 10 full-length novels.

- The preview model is available for free for anyone to try here.

- Google said the model outperformed its predecessor, Gemini 2.5 Pro, across nearly every benchmark the company tested.

- On Humanity's Last Exam, an academic reasoning test, Gemini 3 Pro scored 37.5% compared to 2.5 Pro's 21.6%. On ARC-AGI-2, a visual reasoning puzzle benchmark, the gap widened further: 31.1% versus 4.9%.

- Of course, the real challenge at this point in the AI race isn’t technical so much as it is gaining commercial market share.

- Google, which once seemed indomitable in the search space, has given up an enormous amount of ground to OpenAI, which claims some 800 million weekly users ChatGPT versus Gemini, which reportedly has around 650 million monthly users. Google has not said how many weekly numbers it has, but that would be far fewer than its monthly count.

Still, the technical achievements of Gemini 3 are impressive.

Introducing Gemini 3 — our most intelligent model that helps you bring any idea to life.

Gemini 3 is our next step on the path toward AGI and has: 🧠 State-of-the-art reasoning 🖼️ Deep multimodal understanding 💻 Powerful vibe coding so you can go from prompt to app in one shot… pic.twitter.com/zG8r95pGcS

— Google (@Google) November 18, 2025

- Gemini 3 Pro uses what Google calls a sparse mixture-of-experts architecture. Instead of activating all 1 trillion-plus parameters for every query, the system routes each input to specialized subnetworks.

- Only a fraction of the model—the expert at that specific task—runs at any given time, cutting computational costs while maintaining performance.

- Unlike GPT and Claude, which are large, dense models (a jack of all trades), Google’s approach acts like a large organization would operate.

- A company with 1,000 employees doesn't call everyone to every meeting; specific teams handle specific problems. Gemini 3 Pro works the same way, directing questions to the right expert networks.

- Google trained the model on web documents, code repositories, images, audio files, and video—plus synthetic data generated by other AI systems.

- The company filtered the training data for quality and safety, removing pornographic content, violent material, and anything violating child safety laws. Training happened on Google's Tensor Processing Units using JAX and ML Pathways software.

- A quick test of the model showed that it was very capable. In our usual coding test asking to generate a stealth game, this was the first model that generated a 3D game instead of a 2D experience. Other runs provided 2D versions, but all were functional and fast.

- This approach follows the style of ChatGPT or Perplexity which encourage further interactions by sharing follow-up questions and suggestions, but Google’s implementation is a lot cleaner and more helpful.

- While generating code, the interface provides tips to help in subsequent prompts, so the user can guide the model into generating better code, fixing bugs, and improving the app’s logic, UI, etc. It also gives users the option to deploy their code and code Gemini-powered apps.

Overall, this model seems to be especially focused on coding tasks. Creativity is not its strong point, but it can be easy to guide with a good system prompt and examples, as it has a very large token context window.

- An archived version of Gemini 3’s model card—a document that provides essential information about the model's design, intended use, performance, and limitations—published by Google DeepMind shows that Gemini 3 Pro can generate up to 64,000 tokens of output and maintains a knowledge cutoff of January 2025.

- Google acknowledged the model may hallucinate and occasionally experiences slowness or timeouts. An official model card is not currently available.

- As mentioned, Google AI Studio is currently offering everyone free access to Gemini 3 Pro. Vertex AI and the Gemini API also support the model. Gemini 3 Pro is not yet available through the Gemini app, however—not even for paying Gemini Pro subscribers.

- The November release positions Google against Anthropic's Claude Sonnet 4.5, Grok 4.1 and even OpenAI's GPT-5.1. Benchmark scores suggest Gemini 3 Pro leads in reasoning and multimodal tasks, though real-world performance varies by use case.

Google distributed Gemini 3 Pro through its cloud platforms subject to existing terms of service. The company's generative AI prohibited use policy applies, blocking use in dangerous activities, security compromises, sexually explicit content, violence, hate speech, and misinformation. #Google#AIModel#Gemini3#Jucom #cryptocurrency $BTC/USDT $ETH/USDT $JU/USDT

Lee | Ju.Com

2025-11-19 11:02

📣 Google Releases Its Most Powerful AI Model, Gemini 3 — Here's What You Need to Know.

Disclaimer:Contains third-party content. Not financial advice.

See Terms and Conditions.

A UK operation against Russian sanctions evasion has resulted in 128 arrests and the seizure of $32.6 million in cryptocurrency and cash.

The UK's National Crime Agency (NCA) has revealed that a UK-led operation to crack down on Russian sanctions evasion has resulted in the arrest of 128 people and the seizure of $32.6 million in cryptocurrency and cash.🚨🚨🚨

The operation, dubbed "Operation Destabilize," was first announced in 2024. As of December last year, it had resulted in 84 arrests and the seizure of $25.5 million.💡💡💡

However, the latest NCA data shows that the operation has also resulted in the arrest of a further 45 people suspected of money laundering and the seizure of more than $6.6 million in cash.⭐️⭐️⭐️

#InternationalNews #cryptocurrency #blockchain #Jucom #finance $BTC/USDT $ETH/USDT $JU/USDT

Lee | Ju.Com

2025-11-22 04:50

⭐️⭐️⭐️#InternationalNews

Disclaimer:Contains third-party content. Not financial advice.

See Terms and Conditions.

It’s been just over a month since Bitcoin hit an All-Time-High of $126,272.76 on October 6 , but things have gone from bad to worse since then. Now, that peak seems like a distant memory.

- Bitcoin fell more than 9% in the week ending November 14 , and was trading below $92,000 on Monday. The sharp decline — partly due to whales selling — has pushed BTC below several key technical levels.

- Last week, Bitcoin entered a “bear market,” meaning it fell 20% or more from its recent peak. Over the weekend, BTC also appeared in a “death cross” technical pattern — when the 50-day moving Medium crossed below the 200-day Medium . Not only that, Bitcoin officially wiped out all of its gains for 2025 .

- All these signals indicate that negative sentiment is surrounding Bitcoin. But does that mean “crypto winter” is coming?

- “ I don’t think we’re in a crypto winter. I think we’re seeing Bitcoin mature ,” Louis LaValle, CEO of Frontier Investments, told MarketWatch.

- He argues that this is not a typical recession model where people give up, prices crash 70–80%, liquidation disappears, and interest evaporates. Instead, Bitcoin is going through a market structure shift , not a traditional bear cycle.

Beware of margin call risk

- Kevin Kelly — portfolio manager at Amplify ETFs — said that in the past, Bitcoin has often fallen in price without institutional involvement.

- But this bear cycle is quite different because BTC is now a “mature asset,” with more liquidation and more institutional acceptance, such as JP Morgan reportedly accepting Bitcoin as collateral .

- Data from CryptoQuant shows that investors who are selling BTC are still profitable , meaning there are no signs of capitulation or margin calls. However, retail investors are not buying the Dip , while whales are buying at low prices.

- CryptoQuant's Julio Moreno said that the amount of BTC held in US ETFs has dropped sharply from 441,000 BTC on October 10 to just 271,000 BTC, reflecting weak demand from the US. At the same time, the " Medium order" in the spot market also shows that retail has not returned.

Technical perspective

- While on-chain data hasn't shown anything too serious, weak demand hasn't been enough to stop the sell-off.

- Analyst Luke Lango said the recent death cross is a worrying sign. He noted that over the past 13 years, every time Bitcoin broke the 50-week moving Medium during a bull run, the market crashed in the following 1-2 years.

- BTC is now down about 27% from its recent peak — still within “normal range,” as the Medium Bitcoin bear market decline is about 30.8% (based on data going back to 2014). In 2022, there have been two declines of more than 45%.

- Kelly said that tightening global liquidation , the Fed's delay in cutting interest rates, and the TGA's withdrawal of liquidation from the system have made BTC much more vulnerable.

- He assessed the current situation as a combination of weak liquidation , continuous sell-offs, and declining sentiment , rather than a single shock.

“The Zone of Extreme Fear”

- The market has entered “extreme fear territory” after Bitcoin failed to hold the psychological $100,000 mark, according to Kelly.

- But investors have not lost interest. After the hot growth period since the January 2023 Dip , a “digestion wave” is normal.

- History also shows that when the market falls into “extreme fear zones,” it is a good opportunity to cash in — especially for long-term investors who Medium over time.

Macro still favors Bitcoin

- Frank Holmes — co-founder of HIVE Digital Technologies — says the macro backdrop is becoming more positive for both Bitcoin and gold.

- “ Excessive government spending and constant money printing create long-term support for scarce and decentralized assets ,” he observed.

Holmes also emphasized that even if new user growth slows in the short term, structural trends such as rising debt, monetary expansion, and geopolitical Shard still favor Bitcoin in the long term.

#Bitcoin #CryptoMarket #Jucom #cryptocurrency #blockchain $BTC/USDT $ETH/USDT $JU/USDT

Lee | Ju.Com

2025-11-19 11:27

💢 Bitcoin Just Wiped Out All Its 2025 Gains. What Would a “Crypto Winter” Look Like?

Disclaimer:Contains third-party content. Not financial advice.

See Terms and Conditions.

- The crypto market is showing its first meaningful recovery after a harsh November sell-off, and several metrics now resemble the same conditions seen around Thanksgiving in both 2022 and 2023.

- Bitcoin has reclaimed the $91,000 level, ETH is back above $3,000, and the wider market has returned to a cautious green. This bounce comes as traders enter a long US holiday weekend that has historically set the tone for December.

Market Indicators Turn Positive After Weeks of Fear

- Fear and Greed Index data shows sentiment improving from 11 last week to 22 today, although it remains in “Extreme Fear.”

- This shift aligns with a steady rise in average crypto RSI, which climbed from 38.5 seven days ago to 58.3 today. The reading signals growing strength after deep oversold conditions earlier in the month.

- Momentum also flipped. The normalized MACD across major assets has turned positive for the first time since early November.

- About 82% of tracked cryptocurrencies now show positive trend momentum. Bitcoin, Ethereum, and Solana appear in the bullish zone of CoinMarketCap’s MACD heatmap.

- Price action supports this shift. Bitcoin is up 6% on the week. Ethereum has gained nearly 8%. Solana climbed almost 8% in the same period.

- The market cap has grown to $3.21 trillion, rising 1.1% over the last 24 hours.

A Familiar Post-Thanksgiving Setup Has Emerged

- The current recovery mirrors a structure seen twice before. In both 2022 and 2023, the market entered Thanksgiving after a sharp drawdown and then stabilized into December.

- In 2022, Bitcoin fell to near $16,000 following the FTX collapse. By Thanksgiving, selling pressure had exhausted, and the market traded sideways into Christmas.

- It was a deep bear consolidation phase rather than a rally.

- In 2023, Bitcoin entered Thanksgiving at $37,000 after a steep September-October correction. Strong ETF expectations and improving liquidity conditions pushed BTC to $43,600 by Christmas. It was a classic early-bull December rally.

- This year, the pattern again repeats one familiar element: the November crash came early, and by Thanksgiving, selling momentum had eased.

- Bitcoin’s 90-day Taker CVD has shifted from persistent sell dominance to neutral, signalling that aggressive sellers have stepped back. Funding rates and leverage data support the same interpretation.

BREAKING: The S&P 500 closes the day +0.7% higher, adding +$2.5 trillion of market cap since last week’s low. Happy Thanksgiving to all! pic.twitter.com/tsjKylr5UV

Liquidity Damage Still Shapes the Current Cycle

- BitMine chairman Tom Lee described the market as “limping” after the October 10 liquidation shock.

- He said market makers were forced to shrink their balance sheets, weakening market depth across exchanges. That fragility persisted through November.

- However, Lee also argued that Bitcoin tends to make its biggest moves in short bursts when liquidity recovers. He expects a strong December rally if the Federal Reserve signals a softer stance.

- On-chain data aligns with this view. Nexo collateral figures show users still prefer borrowing against Bitcoin rather than selling it.

- BTC makes up more than 53% of all collateral on the platform. This behavior suppresses immediate sell pressure, helping stabilize spot markets. But it also adds hidden leverage that could amplify future volatility.

'@Nexo users aren’t selling their Bitcoin, they’re borrowing against it. BTC now accounts for 54.3% of all collateral on the platform, holding a steady 53–57% range for months. It confirms Bitcoin is the dominant asset users leverage when they need liquidity. pic.twitter.com/bhmL9UdUvO

We May Be Entering a Two-Year Holiday Pattern

Three factors now look similar to the post-Thanksgiving conditions of 2022 and 2023:

- Seller exhaustion: Taker CVD shifting to neutral signals the end of forced selling for now.

- Momentum recovery: MACD and RSI metrics have reversed sharply after bottoming earlier in November.

- Liquidity stabilization: Market makers are still wounded, but volatility has cooled, and ETF outflows have slowed.

If this pattern continues, December could produce one of two outcomes based on the last two years:

- A sideways consolidation like 2022 if liquidity remains thin.

- A short, sharp rally like 2023 if macro conditions turn supportive.

The deciding factor will likely be the Federal Reserve’s tone in early December and the behavior of Bitcoin ETF flows. Thin liquidity means even moderate inflows could move prices quickly.

#Bitcoin Testing 90k if it holds its the first step to a Santa Rally pic.twitter.com/QhHQNfDQPk

December May Deliver a Large Move in Either Direction

- The market has entered a transition phase rather than a clear trend. Sentiment is still extremely fearful, but price and momentum indicators show recovery.

- Bitcoin’s position above $91,000 suggests buyers are willing to defend key levels, yet order-book depth remains weak.

- With selling pressure fading and technical momentum rising, the environment now resembles the same post-Thanksgiving setups that marked the last two end-of-year cycles.

Bitcoin dominance looks weak here. ETH/BTC is holding above the 0.03-0.032 support zone. It seems like we could see ETH outperformance in December. pic.twitter.com/IRQS05mETi

- If the pattern holds, December will not be flat. It will likely bring a decisive move as liquidity conditions shift.

- The direction, however, will depend less on crypto narratives and more on macro signals and ETF demand in the coming weeks.

- The post Crypto Market Hints at a Two-Year Post-Thanksgiving Pattern Returning appeared first on BeInCrypto.

Average Crypto RSI On Thanksgiving 2025. Source: CoinMarketCapAverage Crypto MACD On Thanksgiving 2025. Source: CoinMarketCapBitcoin Performance Between Thanksgiving and Christmas (2021–2024) #CryptoMarket #Thanksgiving #Jucom #cryptocurrency #blockchain $BTC/USDT $JU/USDT $ETH/USDT

Lee | Ju.Com

2025-11-28 05:10

‼️ Crypto Market Hints at a Two-Year Post-Thanksgiving Pattern Returning!

Disclaimer:Contains third-party content. Not financial advice.

See Terms and Conditions.

Ju.com launches its Thanksgiving 2025 campaign from November 26 to December 10, 2025 (UTC), offering traders substantial rewards through a points-based system. Win premium prizes including IWC Portuguese watches valued at $84,700, 60-gram gold bars worth $37,740, and complete Apple product bundles!

How the Campaign Works

The core mechanism is straightforward: users earn points by completing deposit, spot trading, and futures trading tasks. Every 10 accumulated points converts into one golden egg smashing opportunity with 100% guaranteed USDT rewards. Points can also be directly redeemed for premium physical prizes. Throughout the entire campaign period, participants can accumulate up to 840 points maximum.

Three-Tier Points System

The campaign features three distinct task categories designed for different trading volume profiles. Regular tasks offer a total of 30 points: complete KYC verification and deposit at least 200 USDT for 10 points, execute 500 USDT in spot trades for another 10 points, and complete 1,000 USDT in futures contracts for an additional 10 points. These entry-level tasks require only 1.5 USDT in total fees, making them perfect for newcomers.

Daily tasks represent the primary point accumulation method. Sign in daily to earn 10 points, trade 1,000 USDT in spot markets for 10 points, and execute 10,000 USDT in futures for another 10 points. Completing all daily tasks consistently over the 15-day period can yield up to 450 points. Finally, ladder tasks provide additional points for reaching higher futures trading volumes, with a maximum of 360 points available.

Premium Prize Redemptions

The technology category offers an impressive selection: AirPods 4 requires 600 points, DJI Osmo Pocket camera needs 650 points, Dyson HD16 hair dryer costs 700 points, Apple Watch Ultra 3 demands 750 points, while both the MacBook Air M4 512GB and iPhone 17 Pro Max 1TB are priced at 800 points each.

The campaign's top-tier rewards are truly exceptional. The 60-gram pure gold bar requires 850 points and is valued at approximately $37,740 based on current market prices. The IWC Portuguese series watch also costs 850 points with a retail value of $84,700, representing the ultimate grand prize. If you prefer liquid assets, direct USDT redemption is available: 5 USDT for 400 points, 10 USDT for 500 points, and 20 USDT for 550 points.

Golden Egg Lucky Draw

The golden egg feature is a campaign highlight. Every 10 points can be exchanged for one golden egg smashing chance, with each attempt guaranteeing USDT bonus rewards that are instantly credited to your account. This gamification element makes participation more engaging and exciting.

Participation Requirements

There are several important conditions to note. All participants must complete KYC identity verification. Trading volume calculations include both buy and sell orders, so you only need to execute half the displayed value to meet requirements. USDT bonuses are valid for 7 days and can be used as futures margin and to offset fees, losses, and funding costs, but cannot be directly withdrawn. Physical prizes ship within 15 business days after the campaign ends, with the option to receive equivalent USDT value instead.

Optimal Participation Strategies

For new users, the low-cost approach is recommended. Focus on completing regular and daily tasks to accumulate 480 points with minimal fees of approximately 106.5 USDT. This strategy provides enough points to redeem AirPods 4 or participate in multiple golden egg draws while keeping risks low and costs manageable.

Active traders or institutional users should consider the high-volume approach. Utilize ladder tasks to earn additional points by concentrating planned trades within the campaign period. This allows you to complete existing trading strategies while simultaneously earning bonus point rewards, maximizing overall returns.

For timing optimization, spend the first three days completing regular tasks to establish your baseline point pool. Then log in daily for sign-in points and strategically complete trading tasks based on market volatility. Remember, don't engage in meaningless high-frequency trading just to chase points. Rational participation is the key to genuine benefits.

Time is limited for this campaign, so start participating now and win premium rewards through your trading activity!

Join the Party Here: https://www.jucoin.com/zh-CN/activity/Thanksgiving1126?utm_campaign=5962936122166452&utm_source=opevent

Read the complete strategy guide with detailed analysis: 👇 https://blog.ju.com/jucom-thanksgiving-rewards-2025/?utm_source=blog

#Jucom #ThanksgivingRewards #Crypto #USDT

JU Blog

2025-11-26 12:51

Ju.com Thanksgiving 2025: Win Apple Ecosystem, Gold Bars & USDT Rewards!

Disclaimer:Contains third-party content. Not financial advice.

See Terms and Conditions.

Amundi, Europe’s largest asset manager, has introduced its first tokenized share class for a euro money market fund.

- The fund is now offered in a hybrid structure, allowing investors to choose between the traditional version and the new blockchain-based one. The first transaction was recorded on the Ethereum network on Nov. 4.

- The rollout was developed in collaboration with CACEIS, a European asset-servicing group that provided the tokenization infrastructure, investor wallets, and the digital order system used to process subscriptions and redemptions.

- According to the companies, tokenizing the fund streamlines order processing, widens access to new investor channels, and enables 24/7 trading.

- Amundi said the fund holds short-term, high-quality euro-denominated debt, primarily comprising money-market instruments and overnight repurchase agreements with European sovereigns.

According to the company’s website, it manages about 2.3 trillion euros ($2.6 trillion) in assets and serves more than 100 million retail clients. Amundi is based in Paris, France.

BlackRock and Franklin Templeton drive growth in tokenized funds

- Tokenized money market funds investing in US Treasurys have expanded rapidly in 2025. RWA.xyz data shows BlackRock’s onchain money market product currently holds $2.3 billion in tokenized assets, while Franklin Templeton’s money market fund has more than $826 million in assets.

- Both funds have been expanding across multiple blockchains. On Nov. 12, Franklin Templeton announced that its tokenization platform joined the Canton Network, enabling its money market fund to operate within a permissioned ecosystem built for financial institutions.

- BlackRock has also expanded its tokenized fund beyond Ethereum, adding support for Aptos, Arbitrum, Avalanche, Optimism and Polygon.

- A Bank for International Settlements bulletin released on Wednesday noted that tokenized money market funds had climbed to $9 billion in value by the end of October, up from about $770 million at the end of 2023.

However, the report warned that the growing adoption of tokenized Treasury portfolios as collateral could expose the financial system to new operational and liquidity vulnerabilities.

#Amundi #BlackRock #TokenizedShare #Jucom #cryptocurrency $BTC/USDT $ETH/USDT $JU/USDT

Lee | Ju.Com

2025-11-28 04:56

📣 Amundi brings euro money market fund onchain with first tokenized share.

Disclaimer:Contains third-party content. Not financial advice.

See Terms and Conditions.

The U.S. Department of Justice on Tuesday charged the founder of a Chicago-based crypto ATM company with taking in at least $10 million in criminal proceeds, and moving the money into digital wallets to conceal its origins.

- The indictment, unsealed in the Northern District of Illinois, accused Firas Isa of running the operation through Virtual Assets LLC, a company that did business as Crypto Dispensers and operated cash-to-cryptocurrency ATMs across the United States.

- According to the filing, victims and criminals sent the funds to Isa, his company, or a co-conspirator. While Bitcoin ATMs are supposed to institute know-your-customer (KYC) policies to curb money laundering through the machines, prosecutors said Isa converted the illicit funds the Crypto Dispensers ATMs received into cryptocurrency before transferring it to other wallets.

- “The indictment alleges that Isa knew the money was derived from fraud,” the DOJ wrote.

- The DOJ did not say in the indictment which cryptocurrencies or wallet providers were allegedly used by Isa in the scheme. Isa did not immediately respond to a request for comment by Decrypt.

- Isa and Virtual Assets LLC were each charged with one count of money-laundering conspiracy, a charge that carries a maximum sentence of 20 years in federal prison. Both entered not-guilty pleas. A status hearing was set for January 30, 2026, before U.S. District Judge Elaine Bucklo.

- The charge arrived at a time when federal prosecutors are adjusting how they police the crypto market. In April, the Justice Department said it would dissolve its National Cryptocurrency Enforcement Team and stop bringing criminal cases against exchanges, mixing services, or cold-wallet holders for the actions of their users.

- Last week, the DOJ, FBI, and U.S. Secret Service announced a new Scam Center Strike Force aimed at combating crypto scams that originated in China.

- Prosecutors noted that the indictment against Isa and Virtual Assets is an allegation, and they are presumed innocent unless the government proves guilt beyond a reasonable doubt.

If Isa or Virtual Assets LLC were convicted, they would be required to forfeit any property involved in the alleged money-laundering offense, including a personal money judgment, and the government could seek substitute assets if the original property could not be recovered.

#Bitcoin #BitcoinATM #Jucom #cryptocurrency #blockchain $BTC/USDT $ETH/USDT $JU/USDT

Lee | Ju.Com

2025-11-19 11:12

📛 Bitcoin ATM Company Founder Charged in Alleged $10 Million Money Laundering Scheme!

Disclaimer:Contains third-party content. Not financial advice.

See Terms and Conditions.

Publicly traded bank U.S. Bank is testing a stablecoin on the Stellar blockchain, the firm announced on Tuesday.

The Minneapolis-based bank is collaborating with consulting firm PwC and the Stellar Development Foundation on the project.

- “It’s another way to move money on a blockchain, and we look at blockchain as an alternative payment rail,” said Mike Villano, senior VP and head of digital asset products at US Bank, on the Future of Finance podcast. “We’re very interested to see what use cases are going to manifest from that and what customers are going to be most interested in.”

- The firm joins a growing list of banks nationwide that are considering diving into the stablecoin waters, as institutional appetites grow following the signing of the GENIUS Act, which regulates the issuance and trading of the tokens.

- Last month, Citi, Goldman Sachs, Barclays, and Bank of America, among others, were included in a list of banks that are considering a joint stablecoin venture. Prior to that, both Citi and Bank of America had individually showcased their interest in stablecoins earlier this year.

- “The primary objective was to demonstrate the promise of blockchain in a trusted, bank-grade environment,” Kurt Fields, a Blockchain leader at PwC, said of U.S. Bank's engagement.

- The firm’s work alongside Stellar is in part because of the layer-1 network’s underlying architecture, which allows for freezing or undoing transactions at the blockchain level.

- “One of the great things about the Stellar platform, as we did some more research and development on it, was learning that they have the ability at their base operating layer to freeze assets and unwind transactions,” said Villano. “Often, you might write that into the business logic in itself, but in this instance you can do it at the core blockchain layer.”

- Stellar’s payments and remittances focused blockchain has been live since 2014. It currently ranks 19th by stablecoin market cap with around $212 million worth of stables currently living on the network—$200 million or 94% of which is issued as Circle’s USDC dollar-backed stablecoin.

- The network has seen stablecoin outflows of more than 20% in the last seven days, according to data from DefiLlama.

- Its partnership with Stellar isn’t U.S. Bank’s only connection to stablecoins. In October, the firm announced it would custody the reserves for crypto bank Anchorage Digital’s stablecoins.

Shares of U.S. Bancorp are up 2.8% on Tuesday, recently changing hands at $49.08 per share.

#USBank #Stablecoin #StellarNetwork #Jucom #cryptocurrency $BTC/USDT $JU/USDT $ETH/USDT

Lee | Ju.Com

2025-11-26 03:53

📣 US Bank Is Testing a Stablecoin on Stellar Network!

Disclaimer:Contains third-party content. Not financial advice.

See Terms and Conditions.

Texas has become the first US state to purchase Bitcoin for its treasury, making a $10 million acquisition as part of a broader strategic initiative. The move comes during a market pullback that some view as a favorable entry point.

- This decision positions Texas as an early leader in state-level digital asset adoption and may influence how other states approach cryptocurrency in the future.

Texas Starts With ETF Access

- State officials said Texas executed the transaction through BlackRock’s spot Bitcoin ETF as a regulated and practical entry point.

- The purchase was presented as a step toward integrating Bitcoin into long-term treasury planning and improving diversification.

- Texas Blockchain Council President Lee Bratcher later confirmed the move, noting that treasury teams had monitored market conditions closely and executed the purchase on November 20, when Bitcoin briefly dipped to $87,000.

- Officials added that direct self-custody remains the goal, but the ETF offers a compliant solution while the state builds its custody framework.

TEXAS BOUGHT THE DIP! Texas becomes the FIRST state to purchase Bitcoin with a $10M investment on Nov. 20th at an approximately $87k basis! Congratulations to Comptroller @KHancock4TX and the dedicated investments team at Texas Treasury who have been watching this market… pic.twitter.com/wsMqI9HrPD

- The acquisition marks the beginning of a broader reserve strategy focused on developing infrastructure, oversight, and digital asset controls. This initial allocation will help test workflows, risk management, and governance processes before any future expansion.

- More broadly, Texas’s move comes as institutional interest in Bitcoin grows, supported by strong ETF inflows and wider participation from major financial firms.

A Symbolic First Step

- While $10 million is a small share of state reserves, the symbolic impact is significant. It marks the first instance of a US state treating Bitcoin as a treasury-level asset.

- Analysts say this early government involvement could shape how other states approach digital asset exposure. It may spark debates on reserve diversification, tech competitiveness, and long-term fiscal planning.

- If more states follow, Texas could become the catalyst for a new phase of public-sector engagement with cryptocurrency.

The post Texas Becomes the First State to Buy Bitcoin — What Happens Next? appeared first on BeInCrypto.

#Texas#TexasBecomes #Jucom #Bitcoin #cryptocurrency $BTC/USDT $ETH/USDT $JU/USDT

Lee | Ju.Com

2025-11-26 03:43

📣 Texas Becomes the First State to Buy Bitcoin — What Happens Next?

Disclaimer:Contains third-party content. Not financial advice.

See Terms and Conditions.

A solo miner earned about 3.15 Bitcoin for mining the network’s 924,569th block on Friday, securing $266,000 worth of the asset, despite only having a sliver of a chance.

- The individual, who onlookers believe was using a machine that’s designed for hobbyists, had a less than 1 in 100,000 chance per day of earning the reward, according to data from CKPool, a website that provides resources for people to mine Bitcoin on their own. The miner ultimately received 3.146 BTC, which includes the 3.125 BTC reward plus fees.

- Some companies use massive amounts of computational resources to mine Bitcoin, but the individual that earned the payday on Friday was using a machine with a hash rate of around 1.2 terahash per second, or TH/s, resembling a Bitaxe Gamma—a compact, hobbyist machine that sells for about $100 or less.

- In April, when a solo miner mined a block using a 1.2 TH/s machine, it was estimated that a machine like that would have a 0.00068390% chance per day of mining a block.

- Unless a solo miner comes forward to identify themself, it’s ultimately impossible to know what machine they used, Bitcoin miner retailer Solo Satoshi noted on X in October.

- Most entities mining Bitcoin use so-called pools, where their computational resources are combined with others, but solo miners take matters into their own hands.

- “Another block for the plebs,” an account that goes by Bee Evolved said on X. “Stop telling yourself it can’t be yours, this is living proof that you can do it.”

- This year, there’s been an uptick in the number of solo miners that have beaten the odds, but experts still compare the process of mining Bitcoin individually to playing the lottery.

- Although CKPool (which isn’t actually a mining pool) has been responsible for a number of blocks mined by solo miners this year, a winner has been crowned only 13 times, meaning that the lucrative instances occur a little over once a month, according to Mempool Space.

- Bitcoin miners compete using machines that constantly crunch complex calculations, in a race to find a “nonce,” also known as a “number used once.” As part of Bitcoin’s proof-of-work consensus mechanism, payouts come in the form of newly minted Bitcoin.

Some individuals are motivated by the prospect of a payday, but by contributing to the network’s security, Bitcoin’s backers say that solo miners also improve the network’s overall decentralization.

#Bitcoin #BitcoinMiner #Jucom #blockchain #blockchain $BTC/USDT $JU/USDT $ETH/USDT

Lee | Ju.Com

2025-11-22 13:10

🔥 Solo Bitcoin Miner Hits the Jackpot, Winning $266K BTC Reward!🎁

Disclaimer:Contains third-party content. Not financial advice.

See Terms and Conditions.

The U.S. Office of the Comptroller of the Currency (OCC) has released new policy guidance that allows banks to hold cryptocurrencies to pay for “gas fees,” which are transaction fees used on blockchain networks.

- The regulation titled “Interpretive Letter No. 1186” stated that national banks may hold digital assets on their balance sheets that may be reasonably needed for their operations.

- Transactions on blockchain networks are subject to fees paid in the network's specific token. According to the OCC, this requires banks to hold these assets to conduct transactions on the network.

- The guidance specifically states that banks will be required to pay network fees on behalf of customers or for custodial services, particularly for activities expressly permitted under the GENIUS Act.

- The OCC stated that banks are “legally required to pay network fees to facilitate permitted cryptoasset activities and to hold on their balance sheets the crypto assets they reasonably need to cover those fees.”

The OCC has been reserved for digital assets for years, but President Donald Trump's pro-crypto administration has shifted its stance.

#TheOCC #USAgency #Jucom #cryptocurrency #blockchain $BTC/USDT $ETH/USDT $JU/USDT

Lee | Ju.Com

2025-11-19 11:04

📣 The OCC, a Key US Agency, Announces New Bullish Decision for Cryptocurrencies!

Disclaimer:Contains third-party content. Not financial advice.

See Terms and Conditions.

Yield- farming protocol Yearn Finance has once again been in the spotlight after it was suspected of being the target of a sophisticated attack that saw a large amount of Liquid Staking (LST) Token being drained from its Yearn Ether (yETH) product, which consolidates several popular LSTs into a single Token and is XEM a key Shard of the Yearn ecosystem.

on-chain data shows the yETH pool was drained in a single transaction through a vulnerability that allowed the attacker to create a near-infinite amount of yETH.

- This tactic wiped out the entire liquidation in the pool in an instant. Around 1,000 ETH – worth nearly $3 million at current prices – was transferred directly to Tornado Cash immediately after the transaction, in a clear sign of cover-up.

- The incident was further complicated by blockchain analysis showing that the attacker used multiple newly deployed smart contracts, some of which self-destructed immediately after completing their tasks.

- The total damage is currently unknown, but the yETH pool had approximately $11 million in liquidation at the time of the incident.

- The first person to detect the abnormal signs was an account X named Togbe.

- Chia with The Block, they said that they were monitoring large transactions when they noticed an unusual amount of yETH being Mint and transferred from the pool at a dizzying speed.

- According to initial analysis, the attacker used the “super Mint” mechanism to create an amount of yETH exceeding the limit and drain all assets in the pool, accepting to sacrifice a part of ETH in exchange for a profit of about 1,000 ETH.

Yearn Finance confirmed on X that the team is investigating the yETH pool incident. The protocol also emphasized that Yearn Vaults (including V2 and V3) were not affected, reassuring users holding assets in these vaults.

#DeFi #YearnFinance #Jucom #cryptocurrency #blockchain $BTC/USDT $JU/USDT $ETH/USDT

Lee | Ju.Com

2025-12-01 02:37

🚨 DeFi project Yearn Finance was hacked, losing 3 million USD!

Disclaimer:Contains third-party content. Not financial advice.

See Terms and Conditions.