🚀 MegaETH: The Real-Time Blockchain Innovation Arena

MegaETH is a breakthrough Ethereum Layer 2 project delivering sub-millisecond latency and 100,000+ TPS through its "node specialization" architecture, pushing on-chain application performance to Web2 levels. Backed by Dragonfly and angel investors including Vitalik Buterin and Joseph Lubin.

💰 Financing Highlights:

- Total raised: $107M (Seed $20M + Community rounds $77M)

- Valuation surge: $100M → $999M FDV (10× growth in 10 months)

- Community heat: Sonar public sale 27.8× oversubscribed

- Investors: 16,000+ participants; Hyperliquid perps implied $5B+ FDV at peak

🔧 Core Technical Innovations:

- Single active sequencer: Eliminates consensus overhead for extreme low latency

- Node specialization architecture: Separates sequencer, prover, and full-node roles

- In-memory execution engine: Optimized for parallel transaction processing

- EigenDA data layer: Provides up to 15 Mb/s bandwidth support

- Full EVM compatibility: Seamless Solidity contract migration

🎯 MegaMafia Accelerator (Core Ecosystem Strategy):

MegaMafia is not a traditional incubator—it's a deep experimental arena around real-time blockchain performance, focusing on "zero-to-one" native innovation:

Phase 1 Results:

- 15 projects raised $40M+ collectively

- Backed by Paradigm, Wintermute, Robot Ventures, Kraken Ventures, Franklin Templeton

- Notable raises: CAP Labs ($1.9M), Valhalla ($1.5M), GTE ($25M+)

Phase 2 Expansion:

- 11 new projects, 25+ total ecosystem projects

- Pivoting to consumer innovation, attracting non-crypto-native users

🌟 Ecosystem Star Projects:

【DeFi - Real-Time Finance】

• Valhalla: DEX aggregator focused on MEV protection

• Cap Money: Third-category stablecoin capturing exogenous yield via MEV and RWA

• Teko Finance: Cross-chain lending protocol

• Benchmark: On-chain fixed-income platform

【Gaming - Web2-Grade Experience】

• Showdown: Real-time TCG with high-frequency interactions

• Stomp: Competitive on-chain gaming

• Legend.Trade: On-chain sports trading platform

【Consumer Apps - On-Chain Culture】

• Euphoria: Real-time options trading with "tap-to-trade" UX (impossible on traditional L2s)

• Noise: Assetizing attention - trade "narrative heat" instead of token prices

• Nectar AI: AI-driven social recommendation system

• Pump Party: Meme token social platform

• Blitzo: Payment-as-entertainment platform

【Infrastructure & Frontier】

• Funes World: "GitHub of the physical world" - 1,000+ building 3D models (4,000-year span), backed by Dragonfly and HashKey

• Cilium: On-chain identity protocol

• Ubitel: Communication infrastructure

• Dorado: Gamified on-chain entertainment platform

💡 Ecosystem Insights:

MegaETH differentiates itself not through "porting" Ethereum apps, but via:

1️⃣ Product Paradigm Reconstruction: Developers ask "What new scenarios can real-time performance enable?" instead of "How do I migrate existing apps?"

2️⃣ Extreme Scenario Nativity: Many projects simply cannot run on traditional chains (e.g., Euphoria's millisecond-level options trading, Noise's real-time heat capture)

3️⃣ Web2-Grade UX: Eliminates "confirmation anxiety," making on-chain interactions as smooth as Web2 apps

4️⃣ Humanistic Value: Funes World uses blockchain to permanently preserve human civilization's memory, transcending financial speculation

🗓️ Key Milestones:

- June 2024: Seed round $20M (valuation $100M)

- Dec 2024: Echo community round $10M (valuation $200M)

- March 2025: Testnet launch with breakthrough performance metrics

- June 2025: Fluffle NFT round $27M (valuation $540M)

- Oct 2025: Sonar public sale $50M (valuation $999M)

- Nov 2025: Pre-deposit Bridge launch (1,000M deposit cap)

- Q4 2025: Mainnet closed beta

- Jan 2026: TGE token distribution

- Mid 2026: PoS staking implementation

⚖️ Technical Trade-offs:

Strengths: Sub-millisecond latency, 100k+ TPS, EVM compatible

Risks: Centralized sequencer dependency, single-point-of-failure risk (team plans mitigation via sequencer rotation and fraud proofs)

👥 Team Background:

- Lei Yang (CTO): MIT PhD, distributed systems expert

- Yilong Li (CEO): Stanford PhD, blockchain security engineer

- Shuyao Kong (CBO): "Bing-xiong," ConsenSys background, strong industry resources

- Team traits: Top academic credentials + rich blockchain experience + rigorous technical research

🎖️ Investment Value Summary:

MegaETH represents a significant exploration of blockchain performance limits. Unlike traditional L2s' "wheel-reinventing" homogeneity, it builds genuine moats through "real-time app incubation + high-performance EVM chain."

Core Highlights:

✓ Compelling technical narrative: Real-time blockchain pioneer

✓ Strong ecosystem differentiation: 25+ native innovation projects, not simple forks

✓ Top-tier capital backing: Vitalik, Paradigm, Dragonfly, etc.

✓ High market recognition: 10× valuation growth in 10 months, 27.8× oversubscription

✓ Ecosystem flourishing pre-mainnet: Unprecedented phenomenon

Risk Warnings:

⚠ Centralized sequencer issue requires ongoing attention to decentralization roadmap

⚠ Mainnet performance versus promised metrics remains to be verified

⚠ High-performance environment requires developers to relearn product design logic

This is an innovative ecosystem worth long-term attention and research. Investors should view it as a venture bet on next-generation on-chain application infrastructure, closely monitoring mainnet performance, ecosystem development, and technical roadmap execution.

Read the complete in-depth research report for technical architecture details, team interviews, project analysis, and investment strategies: 👇

https://blog.ju.com/megaeth-ecosystem-report/?utm_source=blog

JU Blog

2025-11-28 13:55

MegaETH Ecosystem In-Depth Research Report

Disclaimer:Contains third-party content. Not financial advice.

See Terms and Conditions.

The Ethereum co-founder has repeatedly spoken this year about treating privacy as a basic necessity for digital systems.

- Following a recent data breach involving major US banks, where client information from institutions including JPMorgan, Citi, and Morgan Stanley may have been exposed after a cyberattack on mortgage technology vendor SitusAMC, Buterin responded by describing privacy as a form of “hygiene.”

- Ethereum co-founder Vitalik Buterin said end-to-end encrypted messaging is essential for protecting digital privacy, identifying permissionless account creation and metadata privacy as the next major priorities for the sector.

He pointed to Session and SimpleX as two projects working on these areas and disclosed that he has donated 128 ETH to each of them.

Major ETH Donations

- In a post on X this week, Buterin said both applications are attempting to strengthen decentralization and enhance user protections without relying on phone numbers, while also addressing challenges such as multi-device support and resistance to Sybil or denial-of-service attacks.

- Buterin said the donation addresses are publicly available on the projects’ websites and added that, although the platforms are not yet perfect, they represent active efforts to advance privacy-preserving communication.

- He also called for more developers to help tackle the technical problems that still remain, and added that these issues “need more eyes on them.”

- It is important to note that while Signal has emerged as a widely used encrypted messaging app, it faced renewed scrutiny following a March incident in which senior US national security officials accidentally included a reporter in a Signal group discussing strikes on Houthi targets in Yemen.

- Days later, a Pentagon-wide advisory warned against using the app for any non-public information, citing a vulnerability tied to its linked-devices feature.

- The memo said Russian hacking groups were targeting the users of the app through phishing tactics. Signal later attributed the issue to user-targeted attacks rather than problems with its encryption, and that the company had already implemented safeguards and warnings.

Buterin’s Privacy Push

- In an essay published in April, he argued that “privacy is an important guarantor of decentralization” and outlined a path for Ethereum to support stealth addresses, selective disclosure, and application-level zero-knowledge tools to help reduce unnecessary data exposure.

- More recently, he warned that X’s new geo-inference system, which assigns country labels to user accounts, poses privacy risks.

He said such systems can still reveal sensitive location information and may endanger vulnerable users, even when only broad regions are disclosed.

#Ethereum #VitalikButerin #Jucom #cryptocurrency #EncryptedMessages $ETH/USDT $JU/USDT $BTC/USDT

Lee | Ju.Com

2025-11-28 05:01

🔥Ethereum Co-Founder Vitalik Buterin Launches 256 ETH to Boost Next-Generation Encrypted Messaging!

Disclaimer:Contains third-party content. Not financial advice.

See Terms and Conditions.

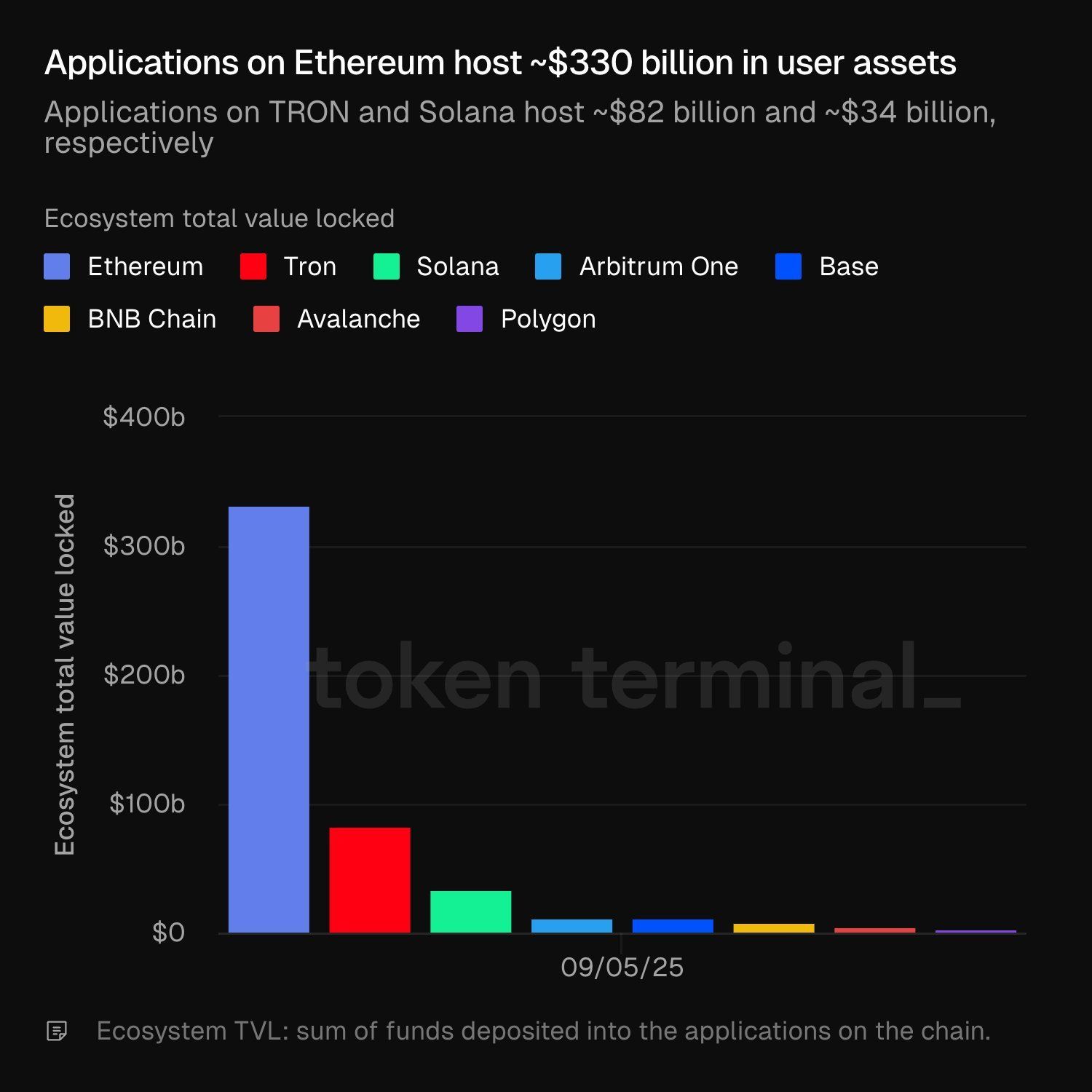

What Is Ethereum’s Role in Smart Contracts?

Ethereum has become a cornerstone of blockchain technology, especially when it comes to enabling smart contracts. These self-executing agreements are transforming how transactions and digital interactions occur across various industries. Understanding Ethereum’s role in this ecosystem is essential for anyone interested in blockchain innovation, decentralized applications (dApps), or the future of digital finance.

How Ethereum Supports Smart Contracts

At its core, Ethereum provides a decentralized platform that allows developers to create and deploy smart contracts without relying on centralized authorities. Unlike traditional contracts that require intermediaries like lawyers or banks, smart contracts on Ethereum automatically execute predefined rules once certain conditions are met. This automation reduces costs, increases transparency, and minimizes the risk of manipulation.

Ethereum's blockchain acts as an immutable ledger where these contracts are stored and executed. Once deployed, they run exactly as programmed—no third-party intervention needed—ensuring trustless interactions between parties. This feature makes Ethereum particularly appealing for applications requiring high security and transparency.

Programming Languages Powering Smart Contracts

One of the key strengths of Ethereum is its support for specialized programming languages designed explicitly for writing smart contracts. Solidity is by far the most popular language used within the ecosystem; it resembles JavaScript in syntax but offers features tailored to blockchain development.

Developers can craft complex logic within their smart contracts using Solidity, enabling functionalities such as token creation (ERC-20 tokens), voting mechanisms, financial derivatives, or even gaming logic. The flexibility provided by these languages allows for innovative use cases across sectors like finance (DeFi), gaming (NFTs), supply chain management, and more.

Gas Fees: The Cost of Running Smart Contracts

Executing smart contracts on Ethereum isn’t free; it involves paying gas fees measured in Ether (ETH). Gas represents computational effort required to process transactions or contract executions on the network. When users initiate a transaction involving a smart contract—say transferring tokens or executing a DeFi trade—they must pay an amount proportional to the complexity involved.

This fee mechanism helps prevent spam attacks but also introduces considerations around cost efficiency during periods of high network congestion. Recent upgrades aim to optimize gas consumption while maintaining security standards—a critical factor influencing user adoption and developer activity.

Smart Contracts’ Role in Decentralized Applications

Smart contracts form the backbone of decentralized applications (dApps). These apps operate without central servers; instead, they rely entirely on code running securely on blockchains like Ethereum. From simple token swaps via platforms like Uniswap to complex lending protocols such as Aave or Compound—these dApps leverage smart contract logic extensively.

The ability to automate processes ensures that dApps can offer services with increased transparency and reduced reliance on intermediaries—a significant advantage over traditional centralized systems. As a result, industries ranging from finance to entertainment have embraced this technology for creating innovative solutions that prioritize user control over assets and data.

Security Challenges Associated With Smart Contracts

While offering numerous benefits—including automation and decentralization—smart contracts also pose security risks if not properly coded or audited. Bugs within contract code can lead to vulnerabilities exploitable by hackers; notable incidents include The DAO hack in 2016 which resulted in millions lost due to flawed code execution.

To mitigate these risks:

- Developers conduct thorough audits before deployment.

- Specialized firms provide security assessments.

- Formal verification methods are increasingly adopted.

Despite advancements in security practices, vulnerabilities remain possible due to human error or unforeseen edge cases within complex logic structures.

Scalability Issues And Upgrades Like Ethereum 2.0

As demand grows for dApps built atop Ethereum’s platform—including DeFi projects and NFTs—the network faces scalability challenges limiting transaction throughput and increasing fees during peak times. To address this:

- Ethereum 2.x aims at transitioning from proof-of-work (PoW) consensus mechanisms toward proof-of-stake (PoS).

- It introduces sharding techniques allowing parallel processing across multiple chains.

These upgrades promise faster transaction speeds with lower costs while enhancing overall network security—a crucial step toward mainstream adoption of blockchain-based solutions involving smart contracts.

Layer 2 Solutions Enhancing Performance

In addition to core upgrades:

- Layer 2 solutions such as Polygon (formerly Matic), Optimism, Arbitrum facilitate off-chain processing.

- They enable faster transactions at reduced costs by batching operations before settling them back onto mainnet.

These innovations help bridge current performance gaps until full-scale upgrades mature.

Regulatory Environment And Its Impact On Smart Contract Adoption

Legal frameworks surrounding blockchain technology continue evolving worldwide—and their influence directly affects how businesses develop with smart contracts on platforms like Ethereum:

- Governments seek clarity around issues such as securities classification for tokens created via smart contract protocols.

- Regulatory uncertainty may hinder innovation if overly restrictive policies emerge.

Conversely:

- Clear guidelines foster trust among users,

- Encourage institutional participation,

- Promote responsible development practices aligned with legal standards.

Importance Of Compliance And Auditing

Given potential legal implications:

- Regular audits ensure compliance with applicable regulations,

- Transparent documentation builds user confidence,3.. Collaboration between developers & regulators promotes sustainable growth.

Future Outlook: Risks And Opportunities

Despite impressive progress made through recent updates like ETH 2.x enhancements:

Risks remain, including:

- Security vulnerabilities leading potentially catastrophic losses,

- Regulatory uncertainties stalling broader adoption,

- Environmental concerns related mainly to energy-intensive proof-of-work models,

Opportunities abound through ongoing innovations:

1.. Continued scalability improvements will make dApps more accessible globally,2.. Growing sectors such as DeFi & NFTs expand use cases leveraging robust smart contract capabilities,3.. Increasing regulatory clarity could accelerate institutional involvement,

By balancing technological advancements with rigorous security measures—and aligning developments with evolving legal landscapes—Ethereum continues shaping its pivotal role at the heart of modern decentralized ecosystems.

Understanding how Ethereum supports intelligent automation through secure & scalable infrastructure reveals why it's considered foundational within blockchain technology today—and why ongoing developments will determine its future trajectory amidst emerging challenges & opportunities alike

JCUSER-IC8sJL1q

2025-05-09 12:40

What is Ethereum’s role in smart contracts?

What Is Ethereum’s Role in Smart Contracts?

Ethereum has become a cornerstone of blockchain technology, especially when it comes to enabling smart contracts. These self-executing agreements are transforming how transactions and digital interactions occur across various industries. Understanding Ethereum’s role in this ecosystem is essential for anyone interested in blockchain innovation, decentralized applications (dApps), or the future of digital finance.

How Ethereum Supports Smart Contracts

At its core, Ethereum provides a decentralized platform that allows developers to create and deploy smart contracts without relying on centralized authorities. Unlike traditional contracts that require intermediaries like lawyers or banks, smart contracts on Ethereum automatically execute predefined rules once certain conditions are met. This automation reduces costs, increases transparency, and minimizes the risk of manipulation.

Ethereum's blockchain acts as an immutable ledger where these contracts are stored and executed. Once deployed, they run exactly as programmed—no third-party intervention needed—ensuring trustless interactions between parties. This feature makes Ethereum particularly appealing for applications requiring high security and transparency.

Programming Languages Powering Smart Contracts

One of the key strengths of Ethereum is its support for specialized programming languages designed explicitly for writing smart contracts. Solidity is by far the most popular language used within the ecosystem; it resembles JavaScript in syntax but offers features tailored to blockchain development.

Developers can craft complex logic within their smart contracts using Solidity, enabling functionalities such as token creation (ERC-20 tokens), voting mechanisms, financial derivatives, or even gaming logic. The flexibility provided by these languages allows for innovative use cases across sectors like finance (DeFi), gaming (NFTs), supply chain management, and more.

Gas Fees: The Cost of Running Smart Contracts

Executing smart contracts on Ethereum isn’t free; it involves paying gas fees measured in Ether (ETH). Gas represents computational effort required to process transactions or contract executions on the network. When users initiate a transaction involving a smart contract—say transferring tokens or executing a DeFi trade—they must pay an amount proportional to the complexity involved.

This fee mechanism helps prevent spam attacks but also introduces considerations around cost efficiency during periods of high network congestion. Recent upgrades aim to optimize gas consumption while maintaining security standards—a critical factor influencing user adoption and developer activity.

Smart Contracts’ Role in Decentralized Applications

Smart contracts form the backbone of decentralized applications (dApps). These apps operate without central servers; instead, they rely entirely on code running securely on blockchains like Ethereum. From simple token swaps via platforms like Uniswap to complex lending protocols such as Aave or Compound—these dApps leverage smart contract logic extensively.

The ability to automate processes ensures that dApps can offer services with increased transparency and reduced reliance on intermediaries—a significant advantage over traditional centralized systems. As a result, industries ranging from finance to entertainment have embraced this technology for creating innovative solutions that prioritize user control over assets and data.

Security Challenges Associated With Smart Contracts

While offering numerous benefits—including automation and decentralization—smart contracts also pose security risks if not properly coded or audited. Bugs within contract code can lead to vulnerabilities exploitable by hackers; notable incidents include The DAO hack in 2016 which resulted in millions lost due to flawed code execution.

To mitigate these risks:

- Developers conduct thorough audits before deployment.

- Specialized firms provide security assessments.

- Formal verification methods are increasingly adopted.

Despite advancements in security practices, vulnerabilities remain possible due to human error or unforeseen edge cases within complex logic structures.

Scalability Issues And Upgrades Like Ethereum 2.0

As demand grows for dApps built atop Ethereum’s platform—including DeFi projects and NFTs—the network faces scalability challenges limiting transaction throughput and increasing fees during peak times. To address this:

- Ethereum 2.x aims at transitioning from proof-of-work (PoW) consensus mechanisms toward proof-of-stake (PoS).

- It introduces sharding techniques allowing parallel processing across multiple chains.

These upgrades promise faster transaction speeds with lower costs while enhancing overall network security—a crucial step toward mainstream adoption of blockchain-based solutions involving smart contracts.

Layer 2 Solutions Enhancing Performance

In addition to core upgrades:

- Layer 2 solutions such as Polygon (formerly Matic), Optimism, Arbitrum facilitate off-chain processing.

- They enable faster transactions at reduced costs by batching operations before settling them back onto mainnet.

These innovations help bridge current performance gaps until full-scale upgrades mature.

Regulatory Environment And Its Impact On Smart Contract Adoption

Legal frameworks surrounding blockchain technology continue evolving worldwide—and their influence directly affects how businesses develop with smart contracts on platforms like Ethereum:

- Governments seek clarity around issues such as securities classification for tokens created via smart contract protocols.

- Regulatory uncertainty may hinder innovation if overly restrictive policies emerge.

Conversely:

- Clear guidelines foster trust among users,

- Encourage institutional participation,

- Promote responsible development practices aligned with legal standards.

Importance Of Compliance And Auditing

Given potential legal implications:

- Regular audits ensure compliance with applicable regulations,

- Transparent documentation builds user confidence,3.. Collaboration between developers & regulators promotes sustainable growth.

Future Outlook: Risks And Opportunities

Despite impressive progress made through recent updates like ETH 2.x enhancements:

Risks remain, including:

- Security vulnerabilities leading potentially catastrophic losses,

- Regulatory uncertainties stalling broader adoption,

- Environmental concerns related mainly to energy-intensive proof-of-work models,

Opportunities abound through ongoing innovations:

1.. Continued scalability improvements will make dApps more accessible globally,2.. Growing sectors such as DeFi & NFTs expand use cases leveraging robust smart contract capabilities,3.. Increasing regulatory clarity could accelerate institutional involvement,

By balancing technological advancements with rigorous security measures—and aligning developments with evolving legal landscapes—Ethereum continues shaping its pivotal role at the heart of modern decentralized ecosystems.

Understanding how Ethereum supports intelligent automation through secure & scalable infrastructure reveals why it's considered foundational within blockchain technology today—and why ongoing developments will determine its future trajectory amidst emerging challenges & opportunities alike

Disclaimer:Contains third-party content. Not financial advice.

See Terms and Conditions.

📰 Điều gì đang thúc đẩy đà tăng của Ethereum — Và liệu nó có thể kéo dài? 🚀

Xem chia sẻ của Jucoin CEO Sammi Li về chủ đề này trên DecryptMedia 👇🏻

🔗 https://decrypt.co/335292/whats-driving-ethereums-surge-and-can-it-last

#JuCoin #JucoinVietnam #Ethereum #ETH #Blockchain

Lee | Ju.Com

2025-08-15 06:24

📰 Điều gì đang thúc đẩy đà tăng của Ethereum — Và liệu nó có thể kéo dài? 🚀

Disclaimer:Contains third-party content. Not financial advice.

See Terms and Conditions.

Two leading Federal Reserve chair candidates are advocating aggressive rate cuts despite inflation concerns, potentially creating powerful tailwinds for cryptocurrency markets. With Trump considering 11 candidates to replace Jerome Powell in May 2026, dovish monetary policy could drive substantial crypto gains.

🏛️ Leading Dovish Candidates:

-

Marc Sumerlin: Former Bush admin economist advocating 50+ basis point cuts

David Zervos: Jefferies Chief Market Strategist supporting 200+ basis point total reduction

Key Position: Both believe current monetary policy is "offensively tight" despite PPI data

Trump Alignment: Both support lower borrowing costs and economic stimulus

📈 How Rate Cuts Boost Crypto:

-

Lower Opportunity Costs: Reduced bond/savings yields push investors toward crypto

Increased Liquidity: More money flowing into alternative investments

Dollar Weakness: Makes Bitcoin more attractive as store of value

Risk Appetite: Cheaper borrowing costs encourage higher-yield asset allocation

Historical Precedent: 2020-2021 crypto rally coincided with Fed accommodation

💎 Crypto Market Benefits:

-

Bitcoin: Enhanced digital store of value appeal during dollar weakness

Ethereum: Increased DeFi activity from improved liquidity conditions

Layer-1 Protocols: More developer activity and ecosystem growth

Infrastructure: Crypto companies access cheaper capital for expansion

Stablecoins: Expanded usage in lower-rate environments

🔍 Selection Process Impact:

-

11 Candidates: Diverse backgrounds from Fed officials to market strategists

Timeline: Prolonged uncertainty could create short-term volatility

Market Experience: Candidates like Zervos bring crypto-aware perspectives

Policy Clarity: Dovish positioning provides directional support regardless of final pick

📊 Historical Correlation:

-

2022 Struggle: Crypto fell as rates rose aggressively

2023-2024 Recovery: Crypto rallied as rate hikes peaked and cuts expected

Transmission Speed: Crypto markets react immediately to Fed policy changes

Sustained Impact: Rate cut campaigns provide ongoing support over months

⚠️ Key Considerations:

-

Regulatory uncertainty remains despite monetary tailwinds

Timing matters - gradual vs aggressive cuts create different market dynamics

Fed chair's approach to financial stability could impact crypto oversight

Monetary policy alone cannot drive sustained crypto adoption

🎯 Investment Implications: The combination of dovish Fed leadership and Trump's pro-crypto stance creates potentially explosive conditions for digital assets. Lower rates reduce competition from traditional investments while institutional appetite for alternatives increases dramatically.

Bottom Line: Fed chair candidates advocating aggressive rate cuts could unleash massive liquidity into crypto markets. Historical data shows strong correlations between accommodative monetary policy and crypto rallies. The May 2026 appointment could mark a pivotal moment for digital asset adoption.

Read the complete analysis on Fed chair candidates and crypto market implications: 👇 https://blog.jucoin.com/fed-chair-rate-cuts-crypto/?utm_source=blog

#FedChair #RateCuts #Crypto #Bitcoin #Ethereum

JU Blog

2025-08-16 08:50

💰 Fed Chair Rate Cuts Could Spark Massive Crypto Rally

Disclaimer:Contains third-party content. Not financial advice.

See Terms and Conditions.

📰 Tom Lee đặt mục tiêu #Ethereum đạt 15,000 USD vào năm 2025, nhờ vào kho $ETH kỷ lục 5 tỷ USD của #BitMine. Chiến lược này tận dụng tăng trưởng #Stablecoin từ 250 tỷ USD lên 2 nghìn tỷ USD và 60% thị phần của #Ethereum trong mảng token hóa tài sản thực.

🔎 Đọc thêm: https://blog.jucoin.com/tom-lee-ethereum-prediction/

#JuCoin #JucoinVietnam #JucoinInsight #Ethereum #ETH #Crypto #Blockchain #CryptoNews #PricePrediction #Tokenization #Stablecoin

Lee | Ju.Com

2025-08-15 06:25

🌟Jucoin Insight | Dự đoán giá #Ethereum của Tom Lee: Mục tiêu 15,000 USD vào 2025! 🚀

Disclaimer:Contains third-party content. Not financial advice.

See Terms and Conditions.

What is Account Abstraction (EIP-4337)?

Understanding Ethereum Accounts and Their Limitations

Ethereum, the leading blockchain platform for decentralized applications, has traditionally relied on two main types of accounts: externally owned accounts (EOAs) and contract accounts. EOAs are controlled by private keys and are used by users to send transactions, while contract accounts are governed by smart contracts that execute code autonomously. However, this binary structure presents certain limitations in terms of flexibility, security, and user experience.

For example, EOAs require users to manage private keys securely—an often complex task that can lead to loss of funds if mishandled. Contract accounts lack the ability to perform certain operations without external triggers or specific transaction structures. As Ethereum's ecosystem expands into areas like DeFi (Decentralized Finance), NFTs (Non-Fungible Tokens), and enterprise solutions, these constraints hinder seamless user interactions and advanced functionalities.

This context has driven the development of Account Abstraction, a concept aimed at redefining how Ethereum accounts function—making them more versatile and adaptable to modern needs.

What Is Account Abstraction?

Account abstraction refers to a paradigm shift in Ethereum's account model that allows for more flexible account behaviors beyond simple storage of Ether or tokens. Instead of being limited to basic transaction validation via private keys, abstracted accounts can incorporate custom logic for authorization, multi-signature schemes, social recovery mechanisms, or even biometric authentication.

Specifically related to EIP-4337—a prominent proposal within this space—it introduces a new layer where user operations are processed differently from traditional transactions. This enables users to execute complex actions without relying solely on externally owned wallets or traditional smart contracts as intermediaries.

In essence, account abstraction aims to make blockchain interactions more intuitive while enhancing security features such as multi-factor authentication or time-locks directly integrated into account logic.

The Context Behind EIP-4337 Development

The push towards account abstraction stems from several challenges faced by the Ethereum community:

User Experience: Managing private keys is cumbersome for many users; losing access means losing funds.

Security Risks: Private key management exposes vulnerabilities; compromised keys lead directly to asset theft.

Smart Contract Limitations: Existing models do not support advanced features like social recovery or flexible authorization schemes natively.

Scalability & Usability Needs: As DeFi grows exponentially with millions engaging in financial activities on-chain — there’s a pressing need for smarter account management systems that can handle complex workflows efficiently.

In response these issues have prompted proposals like EIP-4337 which aim at creating an improved framework where user operations can be processed more flexibly while maintaining compatibility with existing infrastructure.

Key Features of EIP-4337

Introduced in 2021 by members of the Ethereum community through extensive discussions and development efforts, EIP-4337 proposes several core innovations:

Abstract Accounts & Signers

The proposal introduces two primary components:

- Abstract Accounts: These are enhanced wallet-like entities capable of executing arbitrary transactions based on custom logic embedded within them.

- Abstract Signers: They facilitate signing transactions without exposing sensitive details—enabling features like multi-signature requirements seamlessly integrated into the account itself rather than relying solely on external wallets.

Improved Security Mechanisms

EIP-4337 emphasizes security enhancements such as:

- Multi-signature requirements ensuring multiple approvals before executing critical actions.

- Time-locks preventing immediate transfers—adding layers against unauthorized access.

- Social recovery options allowing trusted contacts or mechanisms restoring access if private keys are lost.

Compatibility & Transition

A significant aspect is backward compatibility with existing Ethereum infrastructure—meaning developers can adopt new features gradually without disrupting current applications or wallets during transition phases.

Recent Progress and Community Engagement

Since its proposal in 2021:

- The idea has gained substantial support among developers aiming at making blockchain interactions safer and easier.

- Multiple projects have begun testing implementations within testnets; some wallets now experiment with integrating abstracted account capabilities.

- Discussions continue around scalability concerns; critics worry about increased complexity potentially impacting network performance if not carefully managed.

Despite ongoing debates about potential scalability bottlenecks—which could arise from added computational overhead—the consensus remains optimistic about its long-term benefits when properly implemented.

Challenges Facing Implementation

While promising, adopting EIP-4337 involves navigating several hurdles:

Scalability Concerns

Adding sophisticated logic directly into accounts might increase transaction processing times or block sizes unless optimized effectively—a crucial consideration given Ethereum’s current throughput limits.

Regulatory Implications

Enhanced security features such as social recovery could raise questions around compliance with legal standards related to identity verification and anti-money laundering regulations across jurisdictions worldwide.

Adoption Timeline

Although initial testing phases began around 2022–2023—with some projects already integrating elements—the full rollout depends heavily on network upgrades (like Shanghai/Capella upgrades) scheduled over upcoming ETH network hard forks.

How Account Abstraction Shapes Future Blockchain Use Cases

If successfully implemented at scale:

- Users will enjoy simplified onboarding processes—no longer needing complex seed phrases managed manually.

- Developers will gain tools for building smarter dApps capable of handling multi-layered permissions natively within user accounts themselves.

- Security protocols will become more robust through customizable safeguards embedded directly into wallet logic rather than relying solely on external hardware solutions.

This evolution aligns well with broader trends toward decentralization combined with enhanced usability—a key factor driving mainstream adoption beyond crypto enthusiasts toward everyday consumers.

By reimagining how identities interact within blockchain ecosystems through proposals like EIP-4337—and addressing longstanding usability issues—it paves the way toward a future where decentralized finance becomes accessible yet secure enough for mass adoption. As ongoing developments unfold over 2024+, observing how communities adapt these innovations will be crucial in understanding their impact across various sectors—from finance institutions adopting blockchain-based identity solutions to individual users seeking safer ways to manage digital assets efficiently.

JCUSER-WVMdslBw

2025-05-14 12:53

What is account abstraction (EIP-4337)?

What is Account Abstraction (EIP-4337)?

Understanding Ethereum Accounts and Their Limitations

Ethereum, the leading blockchain platform for decentralized applications, has traditionally relied on two main types of accounts: externally owned accounts (EOAs) and contract accounts. EOAs are controlled by private keys and are used by users to send transactions, while contract accounts are governed by smart contracts that execute code autonomously. However, this binary structure presents certain limitations in terms of flexibility, security, and user experience.

For example, EOAs require users to manage private keys securely—an often complex task that can lead to loss of funds if mishandled. Contract accounts lack the ability to perform certain operations without external triggers or specific transaction structures. As Ethereum's ecosystem expands into areas like DeFi (Decentralized Finance), NFTs (Non-Fungible Tokens), and enterprise solutions, these constraints hinder seamless user interactions and advanced functionalities.

This context has driven the development of Account Abstraction, a concept aimed at redefining how Ethereum accounts function—making them more versatile and adaptable to modern needs.

What Is Account Abstraction?

Account abstraction refers to a paradigm shift in Ethereum's account model that allows for more flexible account behaviors beyond simple storage of Ether or tokens. Instead of being limited to basic transaction validation via private keys, abstracted accounts can incorporate custom logic for authorization, multi-signature schemes, social recovery mechanisms, or even biometric authentication.

Specifically related to EIP-4337—a prominent proposal within this space—it introduces a new layer where user operations are processed differently from traditional transactions. This enables users to execute complex actions without relying solely on externally owned wallets or traditional smart contracts as intermediaries.

In essence, account abstraction aims to make blockchain interactions more intuitive while enhancing security features such as multi-factor authentication or time-locks directly integrated into account logic.

The Context Behind EIP-4337 Development

The push towards account abstraction stems from several challenges faced by the Ethereum community:

User Experience: Managing private keys is cumbersome for many users; losing access means losing funds.

Security Risks: Private key management exposes vulnerabilities; compromised keys lead directly to asset theft.

Smart Contract Limitations: Existing models do not support advanced features like social recovery or flexible authorization schemes natively.

Scalability & Usability Needs: As DeFi grows exponentially with millions engaging in financial activities on-chain — there’s a pressing need for smarter account management systems that can handle complex workflows efficiently.

In response these issues have prompted proposals like EIP-4337 which aim at creating an improved framework where user operations can be processed more flexibly while maintaining compatibility with existing infrastructure.

Key Features of EIP-4337

Introduced in 2021 by members of the Ethereum community through extensive discussions and development efforts, EIP-4337 proposes several core innovations:

Abstract Accounts & Signers

The proposal introduces two primary components:

- Abstract Accounts: These are enhanced wallet-like entities capable of executing arbitrary transactions based on custom logic embedded within them.

- Abstract Signers: They facilitate signing transactions without exposing sensitive details—enabling features like multi-signature requirements seamlessly integrated into the account itself rather than relying solely on external wallets.

Improved Security Mechanisms

EIP-4337 emphasizes security enhancements such as:

- Multi-signature requirements ensuring multiple approvals before executing critical actions.

- Time-locks preventing immediate transfers—adding layers against unauthorized access.

- Social recovery options allowing trusted contacts or mechanisms restoring access if private keys are lost.

Compatibility & Transition

A significant aspect is backward compatibility with existing Ethereum infrastructure—meaning developers can adopt new features gradually without disrupting current applications or wallets during transition phases.

Recent Progress and Community Engagement

Since its proposal in 2021:

- The idea has gained substantial support among developers aiming at making blockchain interactions safer and easier.

- Multiple projects have begun testing implementations within testnets; some wallets now experiment with integrating abstracted account capabilities.

- Discussions continue around scalability concerns; critics worry about increased complexity potentially impacting network performance if not carefully managed.

Despite ongoing debates about potential scalability bottlenecks—which could arise from added computational overhead—the consensus remains optimistic about its long-term benefits when properly implemented.

Challenges Facing Implementation

While promising, adopting EIP-4337 involves navigating several hurdles:

Scalability Concerns

Adding sophisticated logic directly into accounts might increase transaction processing times or block sizes unless optimized effectively—a crucial consideration given Ethereum’s current throughput limits.

Regulatory Implications

Enhanced security features such as social recovery could raise questions around compliance with legal standards related to identity verification and anti-money laundering regulations across jurisdictions worldwide.

Adoption Timeline

Although initial testing phases began around 2022–2023—with some projects already integrating elements—the full rollout depends heavily on network upgrades (like Shanghai/Capella upgrades) scheduled over upcoming ETH network hard forks.

How Account Abstraction Shapes Future Blockchain Use Cases

If successfully implemented at scale:

- Users will enjoy simplified onboarding processes—no longer needing complex seed phrases managed manually.

- Developers will gain tools for building smarter dApps capable of handling multi-layered permissions natively within user accounts themselves.

- Security protocols will become more robust through customizable safeguards embedded directly into wallet logic rather than relying solely on external hardware solutions.

This evolution aligns well with broader trends toward decentralization combined with enhanced usability—a key factor driving mainstream adoption beyond crypto enthusiasts toward everyday consumers.

By reimagining how identities interact within blockchain ecosystems through proposals like EIP-4337—and addressing longstanding usability issues—it paves the way toward a future where decentralized finance becomes accessible yet secure enough for mass adoption. As ongoing developments unfold over 2024+, observing how communities adapt these innovations will be crucial in understanding their impact across various sectors—from finance institutions adopting blockchain-based identity solutions to individual users seeking safer ways to manage digital assets efficiently.

Disclaimer:Contains third-party content. Not financial advice.

See Terms and Conditions.

The crypto market experienced significant losses in August 2025, with most major tokens posting notable declines. Here's what's driving the downturn and what investors need to know:

💰 Major Losses Overview:

-

Bitcoin (BTC): -8% to $113,562

Ethereum (ETH): -5.2% to $4,166

Cardano (ADA): -6.3% to $0.8526

XRP: -3.77% to $2.89

Dogecoin (DOGE): -2.21% to $0.2127

🎯 Key Market Drivers:

1️⃣ Jackson Hole Uncertainty: Fed rate cut expectations dropped from 98% to 15%, dampening institutional risk appetite

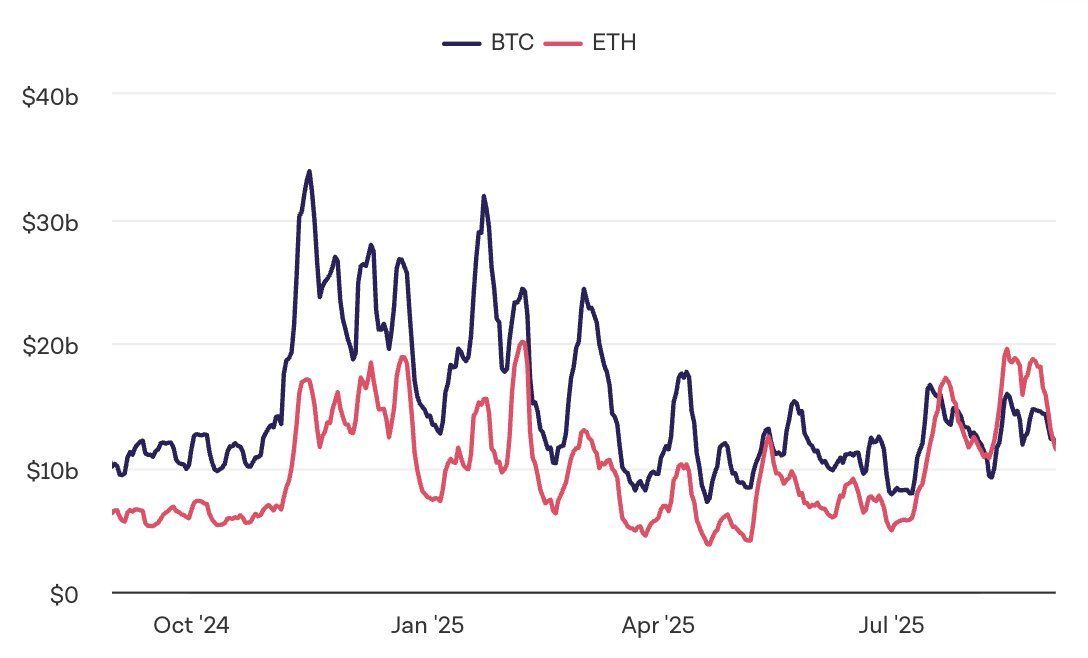

2️⃣ ETF Volatility: Ethereum ETFs saw $196.6 million outflows after a record $2.8 billion inflow the previous week

3️⃣ Regulatory Delays: Stalled altcoin ETF approvals and unclear stablecoin legislation adding market anxiety

4️⃣ Technical Liquidations: Over $1.2 billion in long positions liquidated as Bitcoin hit resistance at $124,000

🚨 Security Concerns:

-

AI-powered wallet drainers targeting developers

$2.17 billion in crypto hacks recorded in 2025

GreedyBear exploit affecting 150+ fake browser extensions

🏆 Biggest Altcoin Losers (24h):

-

Gari Network (GARI): -23.15%

Useless Coin (USELESS): -17.98%

League of Kingdoms Arena (LOKA): -10.03%

Livepeer (LPT): -9.90%

💡 What's Next:

-

All eyes on Powell's Jackson Hole speech for Fed policy signals

ETF flows remain key indicator for short-term price action

Most analysts view this as temporary correction, not trend reversal

Long-term fundamentals remain intact despite current volatility

The market correction appears driven by macro uncertainty rather than fundamental crypto weaknesses. Investors are consolidating positions ahead of key policy announcements.

Read the complete market analysis with detailed charts and expert insights: 👇 https://blog.jucoin.com/crypto-losses-recent-key-market-declines-explained/

#CryptoLosses #Bitcoin #Ethereum

JU Blog

2025-08-20 10:37

📉 Crypto Market Takes Sharp Hit: Major Tokens Down 3-8% This Week

Disclaimer:Contains third-party content. Not financial advice.

See Terms and Conditions.

n a landmark Bankless interview marking Ethereum's 10th anniversary, co-founder Vitalik Buterin unveiled his comprehensive roadmap transforming Ethereum from "world computer" to "world ledger" - the platform that stores civilization's assets and records.

💰 Key Vision Highlights:

-

Identity Evolution: Clear pivot to "world ledger" positioning for institutional adoption

Privacy Revolution: ZK-powered privacy becomes DEFAULT, not optional

Massive Scaling: 10,000 TPS on Layer 1 through ZK-proof verification

Treasury Strategy: Cautious support for ETH treasury companies worth $12B

🎯 Technical Roadmap:

1️⃣ ZK-EVM Integration: Complete within one year for simplified verification 2️⃣ Privacy-by-Default: Direct wallet integration eliminating specialized privacy apps 3️⃣ Protocol Simplification: Reduced complexity while preserving programmability 4️⃣ Gas Limit Scaling: Progressive increases toward 10,000 TPS capacity

🏆 Revolutionary Features Coming:

-

Privacy Wallets: Seamless public/private balance management in MetaMask

Scalable Privacy Pools: Exclude bad actors while protecting legitimate users

Cross-L2 Interoperability: Minutes instead of hours for withdrawals

Hardware Accessibility: Even "$7 Raspberry Pi" can validate ZK-proofs

💡 Strategic Insights:

-

Barbell Strategy: L1 optimized for security, L2 for performance and UX

Quantum Resistance: Post-quantum cryptography implementation planned

Cypherpunk Renaissance: Return to original privacy-focused values

Conservative Leverage: Warning against overleveraged ETH treasury risks

🔥 Market Implications:

With BlackRock endorsing Ethereum as the "master ledger for the world" and 3.04 million ETH ($12B) held by treasury companies, Buterin's vision positions Ethereum as foundational global infrastructure while maintaining decentralized ethos.

The transition from experimental platform to civilization-scale registry represents the next phase of blockchain adoption - moving beyond speculation toward real economic utility.

Read the complete technical analysis and implementation timeline: 👇 https://blog.jucoin.com/vitalik-buterin-ethereum-world-ledger-vision/

#Ethereum #VitalikButerin #ETH

JU Blog

2025-08-13 07:46

🚀 Vitalik Buterin Reveals Ethereum's "World Ledger" Vision for the Next Decade!

Disclaimer:Contains third-party content. Not financial advice.

See Terms and Conditions.

Everyone's asking when will ETH go up? 📊 Here's our Ethereum Price Prediction for 2025. Not financial advice. DYOR. 🧠 This video is for entertainment purposes only.

Ju.com Media

2025-08-04 08:44

Ethereum Price Prediction for 2025 📈

Disclaimer:Contains third-party content. Not financial advice.

See Terms and Conditions.

How Has the Net Staking Participation Rate Evolved on Ethereum Since the Merge?

Understanding Ethereum’s Transition to Proof of Stake

Ethereum's transition from proof-of-work (PoW) to proof-of-stake (PoS), known as "The Merge," took place on September 15, 2022. This significant upgrade aimed to enhance the network’s scalability, security, and energy efficiency. Unlike PoW, which relies on miners solving complex puzzles to validate transactions, PoS depends on validators who stake their ETH tokens to participate in consensus. This shift was driven by a desire to reduce energy consumption and improve network sustainability while maintaining decentralization.

Initial Impact of The Merge on Validator Participation

Immediately following The Merge, there was a notable surge in validator activity. Many users and institutions saw staking as an attractive opportunity due to the potential for earning rewards through newly minted ETH. This initial enthusiasm led to a rapid increase in active validators—participants actively involved in validating transactions and securing the network.

This spike reflected both market optimism and confidence in Ethereum’s new consensus mechanism. Validators were incentivized not only by staking rewards but also by supporting a more sustainable blockchain infrastructure. During this period, participation rates reached high levels compared with pre-Merge figures.

Trends in Validator Growth Post-Merge

Since that initial surge, data indicates that while validator participation has stabilized somewhat, there has been consistent growth in total validator numbers over time. The number of active validators tends to fluctuate based on market conditions but generally shows an upward trend.

This steady increase suggests ongoing interest from individual investors and institutional players alike who recognize staking as a long-term opportunity within Ethereum's ecosystem. As more ETH is staked—either directly or via third-party services—the overall security of the network continues improving due to increased decentralization efforts.

Factors Influencing Staking Participation Rates

Several key factors influence how many validators participate actively:

Market Volatility: Cryptocurrency markets are inherently volatile; during downturns or periods of high fluctuation, some validators may choose temporarily or permanently exit their positions either for risk mitigation or profit-taking.

Staking Rewards: The attractiveness of staking rewards plays a crucial role; higher yields tend to encourage more participation while reductions can lead some participants to withdraw.

Regulatory Environment: Legal clarity around crypto assets impacts validator engagement significantly. Favorable regulations can boost confidence among participants; uncertainty may cause hesitation or withdrawal.

Network Security Measures: Protocol upgrades like Casper FFG aim at preventing centralization risks by incentivizing diverse validator participation across different entities.

Challenges: Centralization Risks & Economic Incentives

While increased validator numbers are positive for decentralization and security, there's always concern about centralization—where control over large portions of staked ETH could threaten network integrity. If too few entities hold significant stakes (a phenomenon called "rich-get-richer"), it could undermine Ethereum's decentralized ethos despite technical safeguards like Casper FFG designed for fairness.

Economic incentives remain vital: if staking rewards diminish due to protocol changes or market conditions such as declining ETH prices relative to fiat currencies, fewer users might find validation profitable enough—potentially reducing overall participation rates over time.

Market Volatility’s Effect on Validator Engagement

The cryptocurrency landscape is highly sensitive; sharp price swings often impact user behavior regarding staking activities:

- During bullish phases with rising ETH prices and strong market sentiment, more users are motivated by potential gains.

- Conversely, during bearish trends or high volatility episodes—such as sudden dips—they might withdraw their stakes temporarily or entirely exit until conditions stabilize.

Such fluctuations can cause short-term dips but typically do not significantly alter long-term growth trends if underlying fundamentals remain strong.

Regulatory Developments Shaping Future Participation

Regulatory clarity remains one of the most influential external factors affecting net staking rates post-Merge:

- Countries like the United States have begun clarifying rules around crypto assets which tend toward encouraging institutional involvement.

- Conversely, regulatory crackdowns or ambiguous policies could deter smaller investors from participating further into staking activities due to compliance concerns or legal uncertainties.

As governments worldwide refine their stance towards cryptocurrencies—including proposals related specifically to securities classification—the future landscape for Ethereum validators will be shaped accordingly.

Maintaining Decentralization & Economic Incentives for Sustained Growth

Ensuring that validation remains decentralized requires continuous efforts beyond just increasing numbers:

- Protocol updates should promote fair distribution among diverse participants.

- Reward structures must balance profitability with inclusivity so smaller holders can participate without disproportionate influence.

- Education campaigns can help new users understand benefits and risks associated with staking under evolving regulatory environments.

Tracking Long-Term Trends: Is Validator Participation Sustainable?

Overall data suggests that since The Merge,

- Validator counts have grown steadily,

- Initial enthusiasm has transitioned into sustained interest,

- Fluctuations driven by market dynamics are normal but do not threaten overall upward momentum,

indicating robust confidence within parts of the community about Ethereum’s future prospects under PoS governance.

Final Thoughts: What Does It Mean for Users & Investors?

For existing stakeholders considering whether they should stake their ETH—or newcomers evaluating entry points—the evolving net participation rate offers valuable insights into network health:

- A high level indicates strong community engagement,

- Growing validator numbers suggest increasing trust,

- Stability amidst volatility reflects resilience,

making it clear that despite challenges posed by external factors like regulation and market swings—all signs point toward continued maturation of Ethereum's proof-of-stake ecosystem.

References

Lo

2025-05-11 06:24

How has the net staking participation rate evolved on Ethereum (ETH) since the Merge?

How Has the Net Staking Participation Rate Evolved on Ethereum Since the Merge?

Understanding Ethereum’s Transition to Proof of Stake

Ethereum's transition from proof-of-work (PoW) to proof-of-stake (PoS), known as "The Merge," took place on September 15, 2022. This significant upgrade aimed to enhance the network’s scalability, security, and energy efficiency. Unlike PoW, which relies on miners solving complex puzzles to validate transactions, PoS depends on validators who stake their ETH tokens to participate in consensus. This shift was driven by a desire to reduce energy consumption and improve network sustainability while maintaining decentralization.

Initial Impact of The Merge on Validator Participation

Immediately following The Merge, there was a notable surge in validator activity. Many users and institutions saw staking as an attractive opportunity due to the potential for earning rewards through newly minted ETH. This initial enthusiasm led to a rapid increase in active validators—participants actively involved in validating transactions and securing the network.

This spike reflected both market optimism and confidence in Ethereum’s new consensus mechanism. Validators were incentivized not only by staking rewards but also by supporting a more sustainable blockchain infrastructure. During this period, participation rates reached high levels compared with pre-Merge figures.

Trends in Validator Growth Post-Merge

Since that initial surge, data indicates that while validator participation has stabilized somewhat, there has been consistent growth in total validator numbers over time. The number of active validators tends to fluctuate based on market conditions but generally shows an upward trend.

This steady increase suggests ongoing interest from individual investors and institutional players alike who recognize staking as a long-term opportunity within Ethereum's ecosystem. As more ETH is staked—either directly or via third-party services—the overall security of the network continues improving due to increased decentralization efforts.

Factors Influencing Staking Participation Rates

Several key factors influence how many validators participate actively:

Market Volatility: Cryptocurrency markets are inherently volatile; during downturns or periods of high fluctuation, some validators may choose temporarily or permanently exit their positions either for risk mitigation or profit-taking.

Staking Rewards: The attractiveness of staking rewards plays a crucial role; higher yields tend to encourage more participation while reductions can lead some participants to withdraw.

Regulatory Environment: Legal clarity around crypto assets impacts validator engagement significantly. Favorable regulations can boost confidence among participants; uncertainty may cause hesitation or withdrawal.

Network Security Measures: Protocol upgrades like Casper FFG aim at preventing centralization risks by incentivizing diverse validator participation across different entities.

Challenges: Centralization Risks & Economic Incentives

While increased validator numbers are positive for decentralization and security, there's always concern about centralization—where control over large portions of staked ETH could threaten network integrity. If too few entities hold significant stakes (a phenomenon called "rich-get-richer"), it could undermine Ethereum's decentralized ethos despite technical safeguards like Casper FFG designed for fairness.

Economic incentives remain vital: if staking rewards diminish due to protocol changes or market conditions such as declining ETH prices relative to fiat currencies, fewer users might find validation profitable enough—potentially reducing overall participation rates over time.

Market Volatility’s Effect on Validator Engagement

The cryptocurrency landscape is highly sensitive; sharp price swings often impact user behavior regarding staking activities:

- During bullish phases with rising ETH prices and strong market sentiment, more users are motivated by potential gains.

- Conversely, during bearish trends or high volatility episodes—such as sudden dips—they might withdraw their stakes temporarily or entirely exit until conditions stabilize.

Such fluctuations can cause short-term dips but typically do not significantly alter long-term growth trends if underlying fundamentals remain strong.

Regulatory Developments Shaping Future Participation

Regulatory clarity remains one of the most influential external factors affecting net staking rates post-Merge:

- Countries like the United States have begun clarifying rules around crypto assets which tend toward encouraging institutional involvement.

- Conversely, regulatory crackdowns or ambiguous policies could deter smaller investors from participating further into staking activities due to compliance concerns or legal uncertainties.

As governments worldwide refine their stance towards cryptocurrencies—including proposals related specifically to securities classification—the future landscape for Ethereum validators will be shaped accordingly.

Maintaining Decentralization & Economic Incentives for Sustained Growth

Ensuring that validation remains decentralized requires continuous efforts beyond just increasing numbers:

- Protocol updates should promote fair distribution among diverse participants.

- Reward structures must balance profitability with inclusivity so smaller holders can participate without disproportionate influence.

- Education campaigns can help new users understand benefits and risks associated with staking under evolving regulatory environments.

Tracking Long-Term Trends: Is Validator Participation Sustainable?

Overall data suggests that since The Merge,

- Validator counts have grown steadily,

- Initial enthusiasm has transitioned into sustained interest,

- Fluctuations driven by market dynamics are normal but do not threaten overall upward momentum,

indicating robust confidence within parts of the community about Ethereum’s future prospects under PoS governance.

Final Thoughts: What Does It Mean for Users & Investors?

For existing stakeholders considering whether they should stake their ETH—or newcomers evaluating entry points—the evolving net participation rate offers valuable insights into network health:

- A high level indicates strong community engagement,

- Growing validator numbers suggest increasing trust,

- Stability amidst volatility reflects resilience,

making it clear that despite challenges posed by external factors like regulation and market swings—all signs point toward continued maturation of Ethereum's proof-of-stake ecosystem.

References

Disclaimer:Contains third-party content. Not financial advice.

See Terms and Conditions.

Cross-Chain Bridges Connecting Solana (SOL), Ethereum (ETH), and Avalanche (AVAX)

Understanding Cross-Chain Bridges in Blockchain Ecosystems

Cross-chain bridges are essential components of the modern blockchain landscape, enabling interoperability between different networks. They serve as connectors that facilitate the transfer of digital assets, such as tokens and NFTs, across diverse blockchain platforms. This capability is vital for expanding decentralized finance (DeFi) applications, enhancing liquidity, and fostering innovation within the crypto space.

By allowing users to move assets seamlessly from one blockchain to another, cross-chain bridges help overcome limitations inherent in isolated networks. For example, Ethereum’s widespread adoption often leads to congestion and high transaction fees. Bridging assets to faster or more scalable chains like Solana or Avalanche can mitigate these issues while maintaining access to a broad ecosystem of DeFi protocols.

Key Cross-Chain Bridges Supporting Solana and Ethereum

Several prominent protocols enable asset transfers between Solana (SOL) and Ethereum (ETH). These include Connext Network, Multichain, and Celer Network—each offering unique features tailored for security, scalability, and user experience.

Connext Network

Launched in 2020, Connext is a decentralized protocol supporting multiple blockchains including Solana and Ethereum. It facilitates fast asset transfers with low latency by leveraging state channels—a technology that allows transactions off-chain before settling on the main chain. Recently expanded support has increased its utility within DeFi markets by enabling seamless movement of tokens like USDC or wrapped ETH across these networks.

Multichain

Originally launched in 2021 under different branding but now known as Multichain—this protocol supports an extensive range of blockchains beyond just SOL and ETH. Its primary focus is on providing secure cross-chain asset transfers with minimal delays. Recent updates have improved scalability features significantly in 2024; this has attracted more developers seeking reliable infrastructure for multi-network DeFi applications.

Celer Network

Celer Network offers a suite of tools designed for building scalable cross-chain applications since its inception in 2020. It supports both Solana and Ethereum among other chains through its layer-2 scaling solutions called State Channels & Virtual Chains. The platform’s recent emphasis on scalability enhancements has led to increased adoption among DeFi projects aiming for high throughput without compromising security.

Connecting Solana with Avalanche: The Role of Specialized Bridges

While bridging SOL directly with ETH involves well-established protocols like Connext or Multichain, connecting Solana with Avalanche introduces additional options tailored specifically for interoperability between these two high-performance chains.

Avalanche Bridge: Native Solution for Asset Transfers

Launched by the Avalanche team in 2022, the Avalanche Bridge provides native support for transferring assets such as AVAX tokens between Avalanche’s network and other blockchains including Solana. Its design emphasizes security while ensuring quick transaction finality—making it popular among NFT marketplaces and DeFi platforms seeking efficient cross-platform liquidity flows.

Supporting Protocols: Connext & Multichain

Both Connext Network and Multichain extend their support beyond SOL-Ethereum interactions to include SOL-Avalanche transfers as well:

Connext offers decentralized solutions that prioritize security during asset migration.

Multichain ensures robust performance through continuous protocol upgrades aimed at improving scalability when moving assets across these chains.

These integrations allow users to leverage each network's strengths—such as Solana's speed or Avalanche's low fees—in their broader crypto activities.

Implications of Cross-Chain Connectivity

The development of interconnected ecosystems involving Solana, Ethereum, and Avalanche carries significant implications:

Enhanced Interoperability: Users can access diverse dApps spanning multiple networks without needing separate wallets or complex processes.

Increased Scalability: Transferring assets onto faster chains reduces congestion on congested networks like Ethereum during peak periods.

Broader Market Access: Asset mobility enables participation across various NFT marketplaces or DeFi protocols regardless of underlying blockchain constraints.

Security Considerations: While benefits are clear — especially regarding efficiency — risks associated with bridge exploits remain prevalent due to protocol complexity.

Regulatory Challenges: As cross-chain activity grows exponentially; regulators may scrutinize these mechanisms more closely due to potential misuse scenarios such as money laundering or unregulated token swaps.

Timeline Highlights & Recent Developments

Understanding key milestones helps contextualize current capabilities:

Connext was launched in 2020; recent updates have enhanced multi-assets support along with improved security features throughout 2023.

Multichain debuted officially around 2021; its latest upgrade cycle occurred early 2024 focusing heavily on scalability improvements which boosted user confidence.

Celer Network, also starting operations in late 2019/early 2020s’, focused heavily last year on increasing throughput capacity via layer-two scaling techniques.

Avalanche Bridge, introduced mid-last decade but saw significant growth after major updates rolled out into early this year—including expanded supported tokens facilitating broader use cases especially within NFT sectors.

Risks & Future Outlook

Despite promising advancements toward seamless interoperability among major blockchains like SOL/Ethereum/AVAX—the landscape isn’t without challenges:

Security vulnerabilities: Cross-chain bridges are complex systems susceptible to exploits if not properly secured—a concern highlighted by past incidents involving bridge hacks resulting in substantial losses.*

Regulatory environment: As governments worldwide develop frameworks governing digital assets’ transferability across borders—and increasingly scrutinize crypto exchanges—the regulatory landscape could impact how these bridges operate moving forward.*

Looking ahead:

The continued evolution will likely see further integration efforts driven by industry collaborations aiming at reducing risks while expanding functionality—for example through standardized protocols that enhance trustworthiness—and possibly integrating emerging technologies such as zk-rollups or optimistic rollups into bridge architectures.

By understanding how specific cross-chain bridges connect prominent blockchains like Solana (SOL), Ethereum (ETH),and Avalanche (AVAX), stakeholders—from developers to investors—can better navigate this rapidly evolving ecosystem while appreciating both opportunitiesand inherent risks involvedin multi-network operations

kai

2025-05-14 21:31

What cross-chain bridges connect Solana (SOL) with Ethereum (ETH) and Avalanche (AVAX)?

Cross-Chain Bridges Connecting Solana (SOL), Ethereum (ETH), and Avalanche (AVAX)

Understanding Cross-Chain Bridges in Blockchain Ecosystems

Cross-chain bridges are essential components of the modern blockchain landscape, enabling interoperability between different networks. They serve as connectors that facilitate the transfer of digital assets, such as tokens and NFTs, across diverse blockchain platforms. This capability is vital for expanding decentralized finance (DeFi) applications, enhancing liquidity, and fostering innovation within the crypto space.

By allowing users to move assets seamlessly from one blockchain to another, cross-chain bridges help overcome limitations inherent in isolated networks. For example, Ethereum’s widespread adoption often leads to congestion and high transaction fees. Bridging assets to faster or more scalable chains like Solana or Avalanche can mitigate these issues while maintaining access to a broad ecosystem of DeFi protocols.

Key Cross-Chain Bridges Supporting Solana and Ethereum

Several prominent protocols enable asset transfers between Solana (SOL) and Ethereum (ETH). These include Connext Network, Multichain, and Celer Network—each offering unique features tailored for security, scalability, and user experience.

Connext Network

Launched in 2020, Connext is a decentralized protocol supporting multiple blockchains including Solana and Ethereum. It facilitates fast asset transfers with low latency by leveraging state channels—a technology that allows transactions off-chain before settling on the main chain. Recently expanded support has increased its utility within DeFi markets by enabling seamless movement of tokens like USDC or wrapped ETH across these networks.

Multichain

Originally launched in 2021 under different branding but now known as Multichain—this protocol supports an extensive range of blockchains beyond just SOL and ETH. Its primary focus is on providing secure cross-chain asset transfers with minimal delays. Recent updates have improved scalability features significantly in 2024; this has attracted more developers seeking reliable infrastructure for multi-network DeFi applications.

Celer Network

Celer Network offers a suite of tools designed for building scalable cross-chain applications since its inception in 2020. It supports both Solana and Ethereum among other chains through its layer-2 scaling solutions called State Channels & Virtual Chains. The platform’s recent emphasis on scalability enhancements has led to increased adoption among DeFi projects aiming for high throughput without compromising security.

Connecting Solana with Avalanche: The Role of Specialized Bridges

While bridging SOL directly with ETH involves well-established protocols like Connext or Multichain, connecting Solana with Avalanche introduces additional options tailored specifically for interoperability between these two high-performance chains.

Avalanche Bridge: Native Solution for Asset Transfers

Launched by the Avalanche team in 2022, the Avalanche Bridge provides native support for transferring assets such as AVAX tokens between Avalanche’s network and other blockchains including Solana. Its design emphasizes security while ensuring quick transaction finality—making it popular among NFT marketplaces and DeFi platforms seeking efficient cross-platform liquidity flows.

Supporting Protocols: Connext & Multichain

Both Connext Network and Multichain extend their support beyond SOL-Ethereum interactions to include SOL-Avalanche transfers as well:

Connext offers decentralized solutions that prioritize security during asset migration.

Multichain ensures robust performance through continuous protocol upgrades aimed at improving scalability when moving assets across these chains.

These integrations allow users to leverage each network's strengths—such as Solana's speed or Avalanche's low fees—in their broader crypto activities.

Implications of Cross-Chain Connectivity

The development of interconnected ecosystems involving Solana, Ethereum, and Avalanche carries significant implications:

Enhanced Interoperability: Users can access diverse dApps spanning multiple networks without needing separate wallets or complex processes.

Increased Scalability: Transferring assets onto faster chains reduces congestion on congested networks like Ethereum during peak periods.

Broader Market Access: Asset mobility enables participation across various NFT marketplaces or DeFi protocols regardless of underlying blockchain constraints.

Security Considerations: While benefits are clear — especially regarding efficiency — risks associated with bridge exploits remain prevalent due to protocol complexity.

Regulatory Challenges: As cross-chain activity grows exponentially; regulators may scrutinize these mechanisms more closely due to potential misuse scenarios such as money laundering or unregulated token swaps.

Timeline Highlights & Recent Developments

Understanding key milestones helps contextualize current capabilities:

Connext was launched in 2020; recent updates have enhanced multi-assets support along with improved security features throughout 2023.

Multichain debuted officially around 2021; its latest upgrade cycle occurred early 2024 focusing heavily on scalability improvements which boosted user confidence.

Celer Network, also starting operations in late 2019/early 2020s’, focused heavily last year on increasing throughput capacity via layer-two scaling techniques.

Avalanche Bridge, introduced mid-last decade but saw significant growth after major updates rolled out into early this year—including expanded supported tokens facilitating broader use cases especially within NFT sectors.

Risks & Future Outlook

Despite promising advancements toward seamless interoperability among major blockchains like SOL/Ethereum/AVAX—the landscape isn’t without challenges:

Security vulnerabilities: Cross-chain bridges are complex systems susceptible to exploits if not properly secured—a concern highlighted by past incidents involving bridge hacks resulting in substantial losses.*

Regulatory environment: As governments worldwide develop frameworks governing digital assets’ transferability across borders—and increasingly scrutinize crypto exchanges—the regulatory landscape could impact how these bridges operate moving forward.*

Looking ahead:

The continued evolution will likely see further integration efforts driven by industry collaborations aiming at reducing risks while expanding functionality—for example through standardized protocols that enhance trustworthiness—and possibly integrating emerging technologies such as zk-rollups or optimistic rollups into bridge architectures.

By understanding how specific cross-chain bridges connect prominent blockchains like Solana (SOL), Ethereum (ETH),and Avalanche (AVAX), stakeholders—from developers to investors—can better navigate this rapidly evolving ecosystem while appreciating both opportunitiesand inherent risks involvedin multi-network operations

Disclaimer:Contains third-party content. Not financial advice.

See Terms and Conditions.

For the first time in 7 years, $ETH > $BTC in 7-day spot volume, per The Block. 🔁 👉 Bitcoin whales are rotating heavily into Ethereum.

With capital reallocating + rate cut anticipation, analysts now eye fresh ATHs in Q4 for majors.

#Ethereum #Bitcoin #cryptocurrency #blockchain

Carmelita

2025-09-04 16:37

🚨 Historic Shift on CEXs

Disclaimer:Contains third-party content. Not financial advice.

See Terms and Conditions.

How the Beacon Chain Coordinates Validator Duties and Shard Transitions in Ethereum