Daily Market Report - Nov 28, 2025

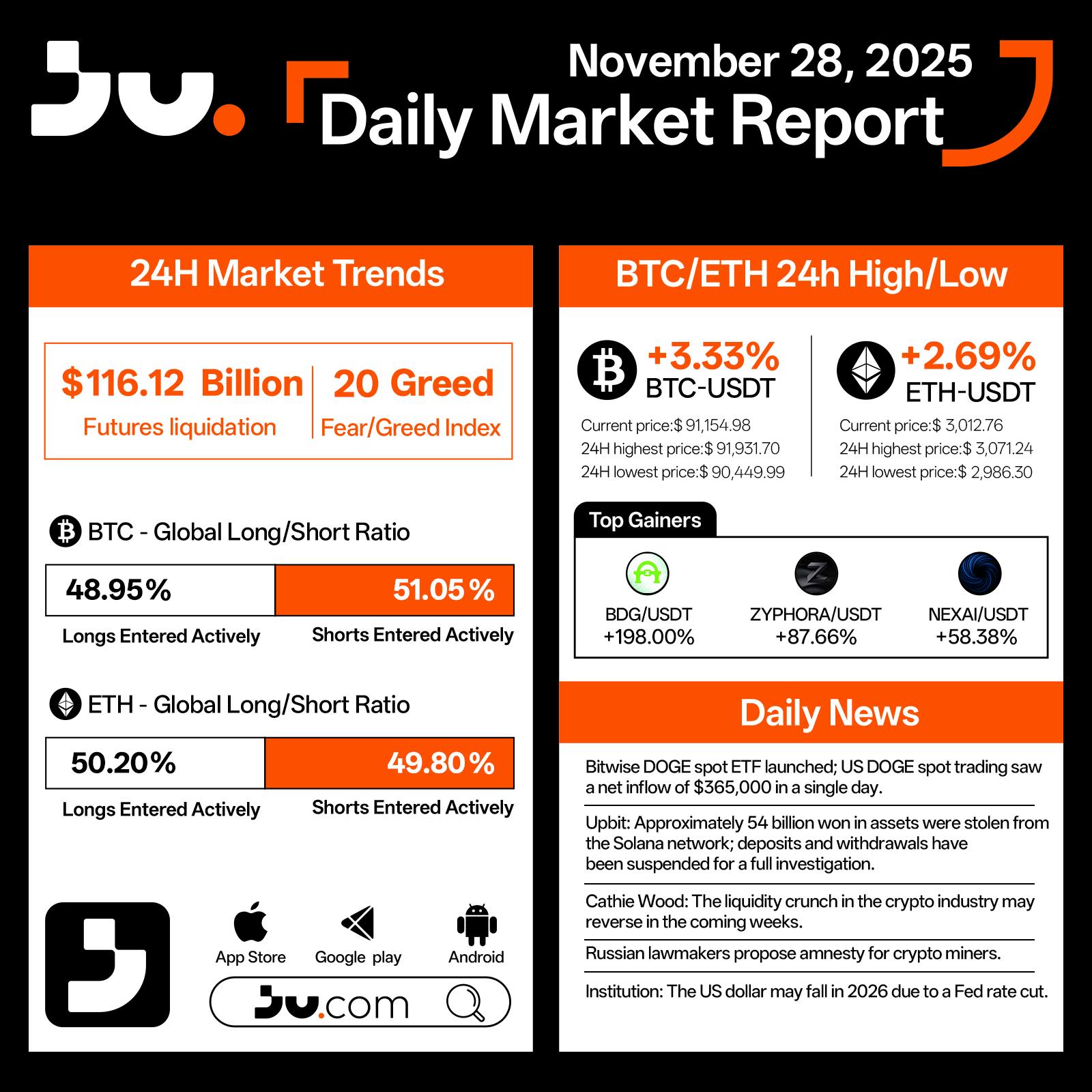

Crypto markets strengthened further on November 28, with sentiment showing noticeable improvement. Total futures liquidations over the past 24 hours dropped to $116.12 billion, while the Fear & Greed Index rose to 20, marking the most optimistic reading of the week. Bitcoin (BTC) climbed 3.33% to $91,154.98, trading between a high of $91,931.70 and a low of $90,449.99. Ethereum (ETH) followed with a 2.69% gain, settling at $3,012.76, with intraday volatility ranging from $3,071.24 down to $2,986.30.

BTC’s global long–short ratio remained slightly bearish with 48.95% longs and 51.05% shorts, while ETH maintained a mild long bias at 50.20% longs versus 49.80% shorts, showing a cautiously optimistic market posture. Among the day’s top performers, BDG/USDT surged 198%, ZYPHORA/USDT rose 87.66%, and NEXAI/USDT advanced 58.38%, highlighting strong speculative flows within specific high-momentum sectors.

Several major developments shaped today’s narrative. The Bitwise DOGE spot ETF officially launched, recording a $365,000 net inflow in its first day of trading. South Korea’s Upbit suffered a significant security breach involving approximately 54 billion KRW in Solana-based assets, prompting an immediate suspension of deposits and withdrawals. Cathie Wood suggested that liquidity conditions in the crypto sector may shift in the coming weeks, potentially marking the beginning of a new capital cycle. Russian lawmakers proposed an amnesty policy for crypto miners, signaling a shift toward more structured regulatory oversight. Meanwhile, institutional analysts projected that the US dollar could weaken again in 2026, driven by expectations of a Federal Reserve rate cut.

With BTC and ETH extending their upward momentum and speculative activity gaining strength, market sentiment has clearly improved. As the month draws to a close, traders will closely monitor ETF flows, regulatory developments, and security risks to gauge whether this recovery can sustain into early December.

#cryptocurrency #blockchain #Bitcoin #ETH

JU Blog

2025-11-28 04:48

BTC and ETH Extend Rally as Market Sentiment Improves - November 28, 2025

Disclaimer:Contains third-party content. Not financial advice.

See Terms and Conditions.

📰 Điều gì đang thúc đẩy đà tăng của Ethereum — Và liệu nó có thể kéo dài? 🚀

Xem chia sẻ của Jucoin CEO Sammi Li về chủ đề này trên DecryptMedia 👇🏻

🔗 https://decrypt.co/335292/whats-driving-ethereums-surge-and-can-it-last

#JuCoin #JucoinVietnam #Ethereum #ETH #Blockchain

Lee | Ju.Com

2025-08-15 06:24

📰 Điều gì đang thúc đẩy đà tăng của Ethereum — Và liệu nó có thể kéo dài? 🚀

Disclaimer:Contains third-party content. Not financial advice.

See Terms and Conditions.

n a landmark Bankless interview marking Ethereum's 10th anniversary, co-founder Vitalik Buterin unveiled his comprehensive roadmap transforming Ethereum from "world computer" to "world ledger" - the platform that stores civilization's assets and records.

💰 Key Vision Highlights:

-

Identity Evolution: Clear pivot to "world ledger" positioning for institutional adoption

Privacy Revolution: ZK-powered privacy becomes DEFAULT, not optional

Massive Scaling: 10,000 TPS on Layer 1 through ZK-proof verification

Treasury Strategy: Cautious support for ETH treasury companies worth $12B

🎯 Technical Roadmap:

1️⃣ ZK-EVM Integration: Complete within one year for simplified verification 2️⃣ Privacy-by-Default: Direct wallet integration eliminating specialized privacy apps 3️⃣ Protocol Simplification: Reduced complexity while preserving programmability 4️⃣ Gas Limit Scaling: Progressive increases toward 10,000 TPS capacity

🏆 Revolutionary Features Coming:

-

Privacy Wallets: Seamless public/private balance management in MetaMask

Scalable Privacy Pools: Exclude bad actors while protecting legitimate users

Cross-L2 Interoperability: Minutes instead of hours for withdrawals

Hardware Accessibility: Even "$7 Raspberry Pi" can validate ZK-proofs

💡 Strategic Insights:

-

Barbell Strategy: L1 optimized for security, L2 for performance and UX

Quantum Resistance: Post-quantum cryptography implementation planned

Cypherpunk Renaissance: Return to original privacy-focused values

Conservative Leverage: Warning against overleveraged ETH treasury risks

🔥 Market Implications:

With BlackRock endorsing Ethereum as the "master ledger for the world" and 3.04 million ETH ($12B) held by treasury companies, Buterin's vision positions Ethereum as foundational global infrastructure while maintaining decentralized ethos.

The transition from experimental platform to civilization-scale registry represents the next phase of blockchain adoption - moving beyond speculation toward real economic utility.

Read the complete technical analysis and implementation timeline: 👇 https://blog.jucoin.com/vitalik-buterin-ethereum-world-ledger-vision/

#Ethereum #VitalikButerin #ETH

JU Blog

2025-08-13 07:46

🚀 Vitalik Buterin Reveals Ethereum's "World Ledger" Vision for the Next Decade!

Disclaimer:Contains third-party content. Not financial advice.

See Terms and Conditions.

Everyone's asking when will ETH go up? 📊 Here's our Ethereum Price Prediction for 2025. Not financial advice. DYOR. 🧠 This video is for entertainment purposes only.

Ju.com Media

2025-08-04 08:44

Ethereum Price Prediction for 2025 📈

Disclaimer:Contains third-party content. Not financial advice.

See Terms and Conditions.

How Has the Net Staking Participation Rate Evolved on Ethereum Since the Merge?

Understanding Ethereum’s Transition to Proof of Stake

Ethereum's transition from proof-of-work (PoW) to proof-of-stake (PoS), known as "The Merge," took place on September 15, 2022. This significant upgrade aimed to enhance the network’s scalability, security, and energy efficiency. Unlike PoW, which relies on miners solving complex puzzles to validate transactions, PoS depends on validators who stake their ETH tokens to participate in consensus. This shift was driven by a desire to reduce energy consumption and improve network sustainability while maintaining decentralization.

Initial Impact of The Merge on Validator Participation

Immediately following The Merge, there was a notable surge in validator activity. Many users and institutions saw staking as an attractive opportunity due to the potential for earning rewards through newly minted ETH. This initial enthusiasm led to a rapid increase in active validators—participants actively involved in validating transactions and securing the network.

This spike reflected both market optimism and confidence in Ethereum’s new consensus mechanism. Validators were incentivized not only by staking rewards but also by supporting a more sustainable blockchain infrastructure. During this period, participation rates reached high levels compared with pre-Merge figures.

Trends in Validator Growth Post-Merge

Since that initial surge, data indicates that while validator participation has stabilized somewhat, there has been consistent growth in total validator numbers over time. The number of active validators tends to fluctuate based on market conditions but generally shows an upward trend.

This steady increase suggests ongoing interest from individual investors and institutional players alike who recognize staking as a long-term opportunity within Ethereum's ecosystem. As more ETH is staked—either directly or via third-party services—the overall security of the network continues improving due to increased decentralization efforts.

Factors Influencing Staking Participation Rates

Several key factors influence how many validators participate actively:

Market Volatility: Cryptocurrency markets are inherently volatile; during downturns or periods of high fluctuation, some validators may choose temporarily or permanently exit their positions either for risk mitigation or profit-taking.

Staking Rewards: The attractiveness of staking rewards plays a crucial role; higher yields tend to encourage more participation while reductions can lead some participants to withdraw.

Regulatory Environment: Legal clarity around crypto assets impacts validator engagement significantly. Favorable regulations can boost confidence among participants; uncertainty may cause hesitation or withdrawal.

Network Security Measures: Protocol upgrades like Casper FFG aim at preventing centralization risks by incentivizing diverse validator participation across different entities.

Challenges: Centralization Risks & Economic Incentives

While increased validator numbers are positive for decentralization and security, there's always concern about centralization—where control over large portions of staked ETH could threaten network integrity. If too few entities hold significant stakes (a phenomenon called "rich-get-richer"), it could undermine Ethereum's decentralized ethos despite technical safeguards like Casper FFG designed for fairness.

Economic incentives remain vital: if staking rewards diminish due to protocol changes or market conditions such as declining ETH prices relative to fiat currencies, fewer users might find validation profitable enough—potentially reducing overall participation rates over time.

Market Volatility’s Effect on Validator Engagement

The cryptocurrency landscape is highly sensitive; sharp price swings often impact user behavior regarding staking activities:

- During bullish phases with rising ETH prices and strong market sentiment, more users are motivated by potential gains.

- Conversely, during bearish trends or high volatility episodes—such as sudden dips—they might withdraw their stakes temporarily or entirely exit until conditions stabilize.

Such fluctuations can cause short-term dips but typically do not significantly alter long-term growth trends if underlying fundamentals remain strong.

Regulatory Developments Shaping Future Participation

Regulatory clarity remains one of the most influential external factors affecting net staking rates post-Merge:

- Countries like the United States have begun clarifying rules around crypto assets which tend toward encouraging institutional involvement.

- Conversely, regulatory crackdowns or ambiguous policies could deter smaller investors from participating further into staking activities due to compliance concerns or legal uncertainties.

As governments worldwide refine their stance towards cryptocurrencies—including proposals related specifically to securities classification—the future landscape for Ethereum validators will be shaped accordingly.

Maintaining Decentralization & Economic Incentives for Sustained Growth

Ensuring that validation remains decentralized requires continuous efforts beyond just increasing numbers:

- Protocol updates should promote fair distribution among diverse participants.

- Reward structures must balance profitability with inclusivity so smaller holders can participate without disproportionate influence.

- Education campaigns can help new users understand benefits and risks associated with staking under evolving regulatory environments.

Tracking Long-Term Trends: Is Validator Participation Sustainable?

Overall data suggests that since The Merge,

- Validator counts have grown steadily,

- Initial enthusiasm has transitioned into sustained interest,

- Fluctuations driven by market dynamics are normal but do not threaten overall upward momentum,

indicating robust confidence within parts of the community about Ethereum’s future prospects under PoS governance.

Final Thoughts: What Does It Mean for Users & Investors?

For existing stakeholders considering whether they should stake their ETH—or newcomers evaluating entry points—the evolving net participation rate offers valuable insights into network health:

- A high level indicates strong community engagement,

- Growing validator numbers suggest increasing trust,

- Stability amidst volatility reflects resilience,

making it clear that despite challenges posed by external factors like regulation and market swings—all signs point toward continued maturation of Ethereum's proof-of-stake ecosystem.

References

Lo

2025-05-11 06:24

How has the net staking participation rate evolved on Ethereum (ETH) since the Merge?

How Has the Net Staking Participation Rate Evolved on Ethereum Since the Merge?

Understanding Ethereum’s Transition to Proof of Stake

Ethereum's transition from proof-of-work (PoW) to proof-of-stake (PoS), known as "The Merge," took place on September 15, 2022. This significant upgrade aimed to enhance the network’s scalability, security, and energy efficiency. Unlike PoW, which relies on miners solving complex puzzles to validate transactions, PoS depends on validators who stake their ETH tokens to participate in consensus. This shift was driven by a desire to reduce energy consumption and improve network sustainability while maintaining decentralization.

Initial Impact of The Merge on Validator Participation

Immediately following The Merge, there was a notable surge in validator activity. Many users and institutions saw staking as an attractive opportunity due to the potential for earning rewards through newly minted ETH. This initial enthusiasm led to a rapid increase in active validators—participants actively involved in validating transactions and securing the network.

This spike reflected both market optimism and confidence in Ethereum’s new consensus mechanism. Validators were incentivized not only by staking rewards but also by supporting a more sustainable blockchain infrastructure. During this period, participation rates reached high levels compared with pre-Merge figures.

Trends in Validator Growth Post-Merge

Since that initial surge, data indicates that while validator participation has stabilized somewhat, there has been consistent growth in total validator numbers over time. The number of active validators tends to fluctuate based on market conditions but generally shows an upward trend.

This steady increase suggests ongoing interest from individual investors and institutional players alike who recognize staking as a long-term opportunity within Ethereum's ecosystem. As more ETH is staked—either directly or via third-party services—the overall security of the network continues improving due to increased decentralization efforts.

Factors Influencing Staking Participation Rates

Several key factors influence how many validators participate actively:

Market Volatility: Cryptocurrency markets are inherently volatile; during downturns or periods of high fluctuation, some validators may choose temporarily or permanently exit their positions either for risk mitigation or profit-taking.

Staking Rewards: The attractiveness of staking rewards plays a crucial role; higher yields tend to encourage more participation while reductions can lead some participants to withdraw.

Regulatory Environment: Legal clarity around crypto assets impacts validator engagement significantly. Favorable regulations can boost confidence among participants; uncertainty may cause hesitation or withdrawal.

Network Security Measures: Protocol upgrades like Casper FFG aim at preventing centralization risks by incentivizing diverse validator participation across different entities.

Challenges: Centralization Risks & Economic Incentives

While increased validator numbers are positive for decentralization and security, there's always concern about centralization—where control over large portions of staked ETH could threaten network integrity. If too few entities hold significant stakes (a phenomenon called "rich-get-richer"), it could undermine Ethereum's decentralized ethos despite technical safeguards like Casper FFG designed for fairness.

Economic incentives remain vital: if staking rewards diminish due to protocol changes or market conditions such as declining ETH prices relative to fiat currencies, fewer users might find validation profitable enough—potentially reducing overall participation rates over time.

Market Volatility’s Effect on Validator Engagement

The cryptocurrency landscape is highly sensitive; sharp price swings often impact user behavior regarding staking activities:

- During bullish phases with rising ETH prices and strong market sentiment, more users are motivated by potential gains.

- Conversely, during bearish trends or high volatility episodes—such as sudden dips—they might withdraw their stakes temporarily or entirely exit until conditions stabilize.

Such fluctuations can cause short-term dips but typically do not significantly alter long-term growth trends if underlying fundamentals remain strong.

Regulatory Developments Shaping Future Participation

Regulatory clarity remains one of the most influential external factors affecting net staking rates post-Merge:

- Countries like the United States have begun clarifying rules around crypto assets which tend toward encouraging institutional involvement.

- Conversely, regulatory crackdowns or ambiguous policies could deter smaller investors from participating further into staking activities due to compliance concerns or legal uncertainties.

As governments worldwide refine their stance towards cryptocurrencies—including proposals related specifically to securities classification—the future landscape for Ethereum validators will be shaped accordingly.

Maintaining Decentralization & Economic Incentives for Sustained Growth

Ensuring that validation remains decentralized requires continuous efforts beyond just increasing numbers:

- Protocol updates should promote fair distribution among diverse participants.

- Reward structures must balance profitability with inclusivity so smaller holders can participate without disproportionate influence.

- Education campaigns can help new users understand benefits and risks associated with staking under evolving regulatory environments.

Tracking Long-Term Trends: Is Validator Participation Sustainable?

Overall data suggests that since The Merge,

- Validator counts have grown steadily,

- Initial enthusiasm has transitioned into sustained interest,

- Fluctuations driven by market dynamics are normal but do not threaten overall upward momentum,

indicating robust confidence within parts of the community about Ethereum’s future prospects under PoS governance.

Final Thoughts: What Does It Mean for Users & Investors?

For existing stakeholders considering whether they should stake their ETH—or newcomers evaluating entry points—the evolving net participation rate offers valuable insights into network health:

- A high level indicates strong community engagement,

- Growing validator numbers suggest increasing trust,

- Stability amidst volatility reflects resilience,

making it clear that despite challenges posed by external factors like regulation and market swings—all signs point toward continued maturation of Ethereum's proof-of-stake ecosystem.

References

Disclaimer:Contains third-party content. Not financial advice.

See Terms and Conditions.

How the Beacon Chain Coordinates Validator Duties and Shard Transitions in Ethereum

Understanding how Ethereum's Beacon Chain manages validator responsibilities and facilitates shard transitions is essential for grasping the network’s ongoing evolution toward scalability and security. As part of Ethereum 2.0, the Beacon Chain introduces a new proof-of-stake (PoS) consensus mechanism that replaces traditional proof-of-work (PoW). This shift aims to make the network more sustainable, efficient, and capable of handling increased transaction volumes through sharding.

The Role of the Beacon Chain in Validator Coordination

The Beacon Chain acts as the backbone for validator management within Ethereum 2.0. Validators are responsible for proposing new blocks, validating transactions, and maintaining network security. Unlike miners in PoW systems, validators are chosen based on their staked ETH—meaning their financial commitment directly influences their chances of participating in block creation.

Validator selection is governed by a randomized process that ensures fairness while incentivizing honest participation. When selected to propose a block during a specific slot—a fixed time interval—the validator must create or validate transactions within that window. To prevent malicious activities such as double proposals or equivocation, Ethereum employs slashing mechanisms: if validators act dishonestly or fail to perform duties correctly, they risk losing part or all of their staked ETH.

The Beacon Chain organizes these activities into epochs—larger time frames composed of multiple slots (typically 32). Each epoch allows for validator rotations and updates to be processed systematically, ensuring smooth operation across the entire network.

Managing Shard Transitions for Scalability

One of Ethereum 2.0’s primary goals is scalability through sharding—a technique where the blockchain is split into smaller pieces called shards that operate concurrently. Each shard handles its own subset of transactions and smart contracts, significantly increasing overall throughput compared to a single monolithic chain.

Shard transitions involve several key steps:

- Initialization: The Beacon Chain assigns validators to different shards based on current network needs.

- Activation Phases: Shards are gradually activated through phased rollouts—initially testing shard functionality via dedicated testnets like the Shard Canary Network launched in 2023.

- Data Migration: During transition phases, data from existing chains migrates into shards seamlessly without disrupting ongoing operations.

- Cross-Linking Mechanisms: To enable communication between shards—such as transferring assets or verifying cross-shard data—the protocol implements cross-linking structures that connect individual shard chains back to the main chain.

This architecture allows multiple transactions across different shards simultaneously without bottlenecking at one point—a significant improvement over traditional blockchain models prone to congestion during high demand periods.

Recent Developments Supporting Validator Coordination & Sharding

Ethereum's recent advancements underscore its commitment toward achieving full scalability with robust security measures:

Shard Canary Network (SCN): Launched in 2023 as an experimental environment for testing shard functionalities under real-world conditions before deploying on mainnet.

Mainnet Merge: Expected late 2023 or early 2024 marks a pivotal milestone where Ethereum will combine its existing PoW mainnet with the PoS-based Beacon Chain—a process known as "the Merge." This event will fully transition validation duties onto PoS while integrating sharding features progressively afterward.

These developments demonstrate continuous progress towards decentralization and efficiency but also highlight technical challenges such as ensuring secure cross-shard communication and maintaining validator incentives throughout complex upgrades.

Challenges Facing Validator Coordination & Shard Transition

While promising, transitioning from traditional blockchain architectures involves notable hurdles:

Technical Complexity: Implementing seamless communication between numerous shards requires sophisticated protocols; any vulnerabilities could compromise security.

Validator Participation Rates: The success hinges on active validator engagement; low participation could slow down progress or cause instability.

Network Security Risks: As complexity increases with sharding—and especially during transitional phases—the attack surface expands if not properly managed.

Regulatory Uncertainty: Evolving legal frameworks around cryptocurrencies may influence adoption rates among validators and users alike.

Addressing these issues demands rigorous testing—including testnets like SCN—and community support aligned with long-term development goals.

Key Facts About Ethereum’s Transition Timeline

| Event | Date/Expected Timeline | Significance |

|---|---|---|

| Launch of Beacon Chain | December 2020 | Foundation layer supporting staking |

| Launch of Shard Canary Network | 2023 | Testing environment for shard functionality |

| Expected Mainnet Merge | Late 2023 / Early 2024 | Full transition from PoW to PoS |

As these milestones approach, stakeholders closely monitor progress due to their impact on scalability improvements and overall network health.

Monitoring Future Developments in Validator Management & Sharding

Ethereum’s journey towards full-scale adoption relies heavily on effective coordination mechanisms provided by its consensus layer—the Beacon Chain—and successful implementation of sharding technology. Continuous upgrades aim not only at increasing transaction capacity but also at reinforcing decentralization by enabling more participants worldwide to become validators securely.

Staying informed about upcoming updates like protocol upgrades or testnet launches helps users understand how these changes might influence transaction speeds, costs (gas fees), security assurances, and overall user experience within this rapidly evolving ecosystem.

Final Thoughts: Navigating Growth Through Innovation

Ethereum's innovative approach via its beacon chain architecture exemplifies how layered coordination can transform blockchain networks into scalable platforms capable of supporting global applications—from decentralized finance (DeFi) projects to enterprise solutions—all while maintaining high-security standards through proof-of-stake validation processes combined with advanced sharding techniques.

By understanding how validator duties are managed alongside complex shard transitions—and keeping an eye on upcoming milestones—you can better appreciate both current capabilities and future potentialities shaping one of today’s most influential blockchain ecosystems

JCUSER-F1IIaxXA

2025-05-11 06:19

How does the Beacon Chain coordinate validator duties and shard transitions in Ethereum (ETH)?

How the Beacon Chain Coordinates Validator Duties and Shard Transitions in Ethereum

Understanding how Ethereum's Beacon Chain manages validator responsibilities and facilitates shard transitions is essential for grasping the network’s ongoing evolution toward scalability and security. As part of Ethereum 2.0, the Beacon Chain introduces a new proof-of-stake (PoS) consensus mechanism that replaces traditional proof-of-work (PoW). This shift aims to make the network more sustainable, efficient, and capable of handling increased transaction volumes through sharding.

The Role of the Beacon Chain in Validator Coordination

The Beacon Chain acts as the backbone for validator management within Ethereum 2.0. Validators are responsible for proposing new blocks, validating transactions, and maintaining network security. Unlike miners in PoW systems, validators are chosen based on their staked ETH—meaning their financial commitment directly influences their chances of participating in block creation.

Validator selection is governed by a randomized process that ensures fairness while incentivizing honest participation. When selected to propose a block during a specific slot—a fixed time interval—the validator must create or validate transactions within that window. To prevent malicious activities such as double proposals or equivocation, Ethereum employs slashing mechanisms: if validators act dishonestly or fail to perform duties correctly, they risk losing part or all of their staked ETH.

The Beacon Chain organizes these activities into epochs—larger time frames composed of multiple slots (typically 32). Each epoch allows for validator rotations and updates to be processed systematically, ensuring smooth operation across the entire network.

Managing Shard Transitions for Scalability

One of Ethereum 2.0’s primary goals is scalability through sharding—a technique where the blockchain is split into smaller pieces called shards that operate concurrently. Each shard handles its own subset of transactions and smart contracts, significantly increasing overall throughput compared to a single monolithic chain.

Shard transitions involve several key steps:

- Initialization: The Beacon Chain assigns validators to different shards based on current network needs.

- Activation Phases: Shards are gradually activated through phased rollouts—initially testing shard functionality via dedicated testnets like the Shard Canary Network launched in 2023.

- Data Migration: During transition phases, data from existing chains migrates into shards seamlessly without disrupting ongoing operations.

- Cross-Linking Mechanisms: To enable communication between shards—such as transferring assets or verifying cross-shard data—the protocol implements cross-linking structures that connect individual shard chains back to the main chain.

This architecture allows multiple transactions across different shards simultaneously without bottlenecking at one point—a significant improvement over traditional blockchain models prone to congestion during high demand periods.

Recent Developments Supporting Validator Coordination & Sharding

Ethereum's recent advancements underscore its commitment toward achieving full scalability with robust security measures:

Shard Canary Network (SCN): Launched in 2023 as an experimental environment for testing shard functionalities under real-world conditions before deploying on mainnet.

Mainnet Merge: Expected late 2023 or early 2024 marks a pivotal milestone where Ethereum will combine its existing PoW mainnet with the PoS-based Beacon Chain—a process known as "the Merge." This event will fully transition validation duties onto PoS while integrating sharding features progressively afterward.

These developments demonstrate continuous progress towards decentralization and efficiency but also highlight technical challenges such as ensuring secure cross-shard communication and maintaining validator incentives throughout complex upgrades.

Challenges Facing Validator Coordination & Shard Transition

While promising, transitioning from traditional blockchain architectures involves notable hurdles:

Technical Complexity: Implementing seamless communication between numerous shards requires sophisticated protocols; any vulnerabilities could compromise security.

Validator Participation Rates: The success hinges on active validator engagement; low participation could slow down progress or cause instability.

Network Security Risks: As complexity increases with sharding—and especially during transitional phases—the attack surface expands if not properly managed.

Regulatory Uncertainty: Evolving legal frameworks around cryptocurrencies may influence adoption rates among validators and users alike.

Addressing these issues demands rigorous testing—including testnets like SCN—and community support aligned with long-term development goals.

Key Facts About Ethereum’s Transition Timeline

| Event | Date/Expected Timeline | Significance |

|---|---|---|

| Launch of Beacon Chain | December 2020 | Foundation layer supporting staking |

| Launch of Shard Canary Network | 2023 | Testing environment for shard functionality |

| Expected Mainnet Merge | Late 2023 / Early 2024 | Full transition from PoW to PoS |

As these milestones approach, stakeholders closely monitor progress due to their impact on scalability improvements and overall network health.

Monitoring Future Developments in Validator Management & Sharding

Ethereum’s journey towards full-scale adoption relies heavily on effective coordination mechanisms provided by its consensus layer—the Beacon Chain—and successful implementation of sharding technology. Continuous upgrades aim not only at increasing transaction capacity but also at reinforcing decentralization by enabling more participants worldwide to become validators securely.

Staying informed about upcoming updates like protocol upgrades or testnet launches helps users understand how these changes might influence transaction speeds, costs (gas fees), security assurances, and overall user experience within this rapidly evolving ecosystem.

Final Thoughts: Navigating Growth Through Innovation

Ethereum's innovative approach via its beacon chain architecture exemplifies how layered coordination can transform blockchain networks into scalable platforms capable of supporting global applications—from decentralized finance (DeFi) projects to enterprise solutions—all while maintaining high-security standards through proof-of-stake validation processes combined with advanced sharding techniques.

By understanding how validator duties are managed alongside complex shard transitions—and keeping an eye on upcoming milestones—you can better appreciate both current capabilities and future potentialities shaping one of today’s most influential blockchain ecosystems

Disclaimer:Contains third-party content. Not financial advice.

See Terms and Conditions.

What Does "Gas Fee" Refer to on the Ethereum (ETH) Network?

Understanding Gas Fees in Ethereum Transactions

On the Ethereum network, a "gas fee" is a fundamental concept that determines how transactions are processed and validated. Essentially, it is a fee paid by users to incentivize miners—those who validate and include transactions in new blocks—to prioritize their requests. Unlike traditional banking fees or flat transaction costs, gas fees are dynamic and fluctuate based on network activity, transaction complexity, and market demand.

When you send Ether (ETH), interact with smart contracts, or perform any operation requiring computational effort on Ethereum, you pay a gas fee proportional to the work involved. This system ensures that resources are allocated efficiently across the network while preventing spam transactions that could clog the system.

The Role of Gas in Transaction Processing

Every transaction on Ethereum consumes computational power measured in units called "gas." Think of gas as a measure of work needed for executing operations—sending ETH might require less gas than executing complex smart contract functions involving multiple steps or data processing.

Before initiating a transaction, users specify two key parameters: gas limit and gas price. The gas limit caps how much computational effort can be spent; if exceeded during execution due to unforeseen complexity or errors, the transaction fails but still consumes some fees. The gas price indicates how much you're willing to pay per unit of gas—higher prices tend to incentivize miners to include your transaction sooner during periods of high demand.

Once executed successfully, total transaction cost equals:

Total Cost = Gas Used × Gas PriceThis amount is paid directly to miners as part of their reward for validating transactions.

Factors Influencing Gas Fees

Several factors impact how much users pay in gas fees:

Network Congestion: During times when many users are transacting simultaneously—such as during token launches or major updates—the demand for block space increases. This surge drives up average gas prices.

Transaction Complexity: Simple transfers like sending ETH typically require less computation than interacting with complex smart contracts which may involve multiple function calls and data storage.

Market Dynamics: Fluctuations in ETH's market value influence what users are willing to pay per unit of gas; higher ETH prices often correlate with increased overall fees.

User Settings: Users can manually set their desired maximum fee (gas limit) and tip (gas price). Choosing lower values may result in delayed processing or failed transactions if insufficiently funded.

Recent Innovations Shaping Gas Fees

Ethereum has introduced several upgrades aimed at improving how these fees function:

EIP-1559: Implemented in August 2021, this upgrade revolutionized fee structure by introducing a base fee burned with each transaction—a mechanism designed to stabilize costs amid fluctuating demand. It also allows users to specify tips voluntarily for faster inclusion without overpaying excessively.

Layer 2 Solutions: To address high costs during peak times, developers have built layer 2 scaling solutions such as Optimism, Polygon (formerly Matic), and Arbitrum. These platforms process most transactions off-chain before settling them onto Ethereum’s mainnet later at reduced costs.

Sharding Plans: Future upgrades like sharding aim to split the blockchain into smaller parts ("shards"), enabling parallel processing of transactions which should significantly lower individual costs while increasing throughput.

Impacts on Users and Developers

High gas fees have tangible effects across different user groups within the ecosystem:

For casual users engaging occasionally with dApps or transferring small amounts of ETH, elevated charges can make participation expensive or discouraging.

Developers face challenges designing cost-effective applications; they often need optimization strategies such as batching operations or leveraging layer 2 solutions.

Economically disadvantaged participants might find high fees exclusionary unless mitigated through innovative scaling techniques.

Furthermore, concerns about economic inequality arise because miners receive substantial portions of these fees—a situation critics argue favors large-scale mining operations over smaller participants—and regulatory bodies may scrutinize these mechanisms more closely as crypto markets mature.

Why Understanding Gas Fees Matters

For anyone involved—or interested—in blockchain technology and decentralized finance (DeFi), grasping what constitutes a "gas fee" helps demystify why certain transactions cost more at specific times—and why delays occur when networks become congested. It also highlights ongoing efforts within the community aimed at making blockchain interactions more affordable without sacrificing security or decentralization principles.

By staying informed about recent developments like EIP-1559 reforms and Layer 2 scaling options—as well as upcoming upgrades such as sharding—users can better plan their activities on Ethereum efficiently while supporting innovations designed for sustainability and fairness within this rapidly evolving ecosystem.

Key Takeaways:

- A gas fee is payment made by users for computational resources required during an Ethereum transaction.

- It varies based on network congestion & complexity; higher demand leads to higher costs.

- Recent updates like EIP-1559 introduced mechanisms aiming for more predictable & stable pricing structures.

- Layer 2 solutions help reduce expenses by handling most activity off-chain before final settlement on mainnet.

Understanding these elements empowers both casual participants and developers alike — ensuring smarter engagement within one of today’s most influential blockchain ecosystems.

JCUSER-WVMdslBw

2025-05-22 07:13

What does "Gas fee" refer to on the Ethereum (ETH) network?

What Does "Gas Fee" Refer to on the Ethereum (ETH) Network?

Understanding Gas Fees in Ethereum Transactions

On the Ethereum network, a "gas fee" is a fundamental concept that determines how transactions are processed and validated. Essentially, it is a fee paid by users to incentivize miners—those who validate and include transactions in new blocks—to prioritize their requests. Unlike traditional banking fees or flat transaction costs, gas fees are dynamic and fluctuate based on network activity, transaction complexity, and market demand.

When you send Ether (ETH), interact with smart contracts, or perform any operation requiring computational effort on Ethereum, you pay a gas fee proportional to the work involved. This system ensures that resources are allocated efficiently across the network while preventing spam transactions that could clog the system.

The Role of Gas in Transaction Processing

Every transaction on Ethereum consumes computational power measured in units called "gas." Think of gas as a measure of work needed for executing operations—sending ETH might require less gas than executing complex smart contract functions involving multiple steps or data processing.

Before initiating a transaction, users specify two key parameters: gas limit and gas price. The gas limit caps how much computational effort can be spent; if exceeded during execution due to unforeseen complexity or errors, the transaction fails but still consumes some fees. The gas price indicates how much you're willing to pay per unit of gas—higher prices tend to incentivize miners to include your transaction sooner during periods of high demand.

Once executed successfully, total transaction cost equals:

Total Cost = Gas Used × Gas PriceThis amount is paid directly to miners as part of their reward for validating transactions.

Factors Influencing Gas Fees

Several factors impact how much users pay in gas fees:

Network Congestion: During times when many users are transacting simultaneously—such as during token launches or major updates—the demand for block space increases. This surge drives up average gas prices.

Transaction Complexity: Simple transfers like sending ETH typically require less computation than interacting with complex smart contracts which may involve multiple function calls and data storage.

Market Dynamics: Fluctuations in ETH's market value influence what users are willing to pay per unit of gas; higher ETH prices often correlate with increased overall fees.

User Settings: Users can manually set their desired maximum fee (gas limit) and tip (gas price). Choosing lower values may result in delayed processing or failed transactions if insufficiently funded.

Recent Innovations Shaping Gas Fees

Ethereum has introduced several upgrades aimed at improving how these fees function:

EIP-1559: Implemented in August 2021, this upgrade revolutionized fee structure by introducing a base fee burned with each transaction—a mechanism designed to stabilize costs amid fluctuating demand. It also allows users to specify tips voluntarily for faster inclusion without overpaying excessively.

Layer 2 Solutions: To address high costs during peak times, developers have built layer 2 scaling solutions such as Optimism, Polygon (formerly Matic), and Arbitrum. These platforms process most transactions off-chain before settling them onto Ethereum’s mainnet later at reduced costs.

Sharding Plans: Future upgrades like sharding aim to split the blockchain into smaller parts ("shards"), enabling parallel processing of transactions which should significantly lower individual costs while increasing throughput.

Impacts on Users and Developers

High gas fees have tangible effects across different user groups within the ecosystem:

For casual users engaging occasionally with dApps or transferring small amounts of ETH, elevated charges can make participation expensive or discouraging.

Developers face challenges designing cost-effective applications; they often need optimization strategies such as batching operations or leveraging layer 2 solutions.

Economically disadvantaged participants might find high fees exclusionary unless mitigated through innovative scaling techniques.

Furthermore, concerns about economic inequality arise because miners receive substantial portions of these fees—a situation critics argue favors large-scale mining operations over smaller participants—and regulatory bodies may scrutinize these mechanisms more closely as crypto markets mature.

Why Understanding Gas Fees Matters

For anyone involved—or interested—in blockchain technology and decentralized finance (DeFi), grasping what constitutes a "gas fee" helps demystify why certain transactions cost more at specific times—and why delays occur when networks become congested. It also highlights ongoing efforts within the community aimed at making blockchain interactions more affordable without sacrificing security or decentralization principles.

By staying informed about recent developments like EIP-1559 reforms and Layer 2 scaling options—as well as upcoming upgrades such as sharding—users can better plan their activities on Ethereum efficiently while supporting innovations designed for sustainability and fairness within this rapidly evolving ecosystem.

Key Takeaways:

- A gas fee is payment made by users for computational resources required during an Ethereum transaction.

- It varies based on network congestion & complexity; higher demand leads to higher costs.

- Recent updates like EIP-1559 introduced mechanisms aiming for more predictable & stable pricing structures.

- Layer 2 solutions help reduce expenses by handling most activity off-chain before final settlement on mainnet.

Understanding these elements empowers both casual participants and developers alike — ensuring smarter engagement within one of today’s most influential blockchain ecosystems.

Disclaimer:Contains third-party content. Not financial advice.

See Terms and Conditions.

Although ($ETH/USDT) ETH ETFs have recorded net capital withdrawals, derivatives signals are very positive:

Open Interest on Binance remains high.

The pressure to liquidate has cooled significantly.

ETH supply on exchanges has decreased sharply.

The "whales" are actively collecting goods, creating a solid foundation for recovery.

Do you think ETH will soon conquer the $5000 mark? Let's discuss with me! 👇

#Jucoin #ETH

Lee | Ju.Com

2025-09-05 05:34

🔥Ethereum ($ETH) shows signs of an explosion, will it reach $5000? 🚀

Disclaimer:Contains third-party content. Not financial advice.

See Terms and Conditions.

The world’s largest public Ethereum holding company, BitMine, has spent another $65 million USD to buy 14,665 ETH, bringing its total ETH holdings to over $8 billion USD.

This move shows the strong belief of institutions in the long-term potential of ETH, especially in the context of a sharp decrease in supply on exchanges.

What do you think about the future of ETH? Let’s discuss it with me! 👇

#JuCoin #ETH

Lee | Ju.Com

2025-09-05 05:32

📣 Breaking News: BitMine “Whales” Just Bought Another $65 Million USD of ETH! 🚀

Disclaimer:Contains third-party content. Not financial advice.

See Terms and Conditions.

What is DAT? In short, DAT (Digital Asset Treasury) means an enterprise or institution adds digital assets (such as BTC, ETH, SOL) to its balance sheet as part of its strategic reserves. Unlike ETFs — passive investment vehicles — DAT emphasizes active management, boosting returns via staking, financing, derivatives trading, and more.

This model was pioneered by Bitcoin. Since MicroStrategy announced in 2020 that it would hold BTC in its treasury, the logic of corporates buying crypto as reserves has gained market acceptance. With Bitcoin ETFs approved in 2024, institutional allocation demand has been fully unleashed.

However, the Bitcoin treasury playbook is relatively simple — buy and hold — leaving less room for advanced asset engineering. Ethereum’s DAT builds on that and layers in richer “yield generation.”

Ethereum DAT: From “Storage” to “Value-Add”

Ethereum’s advantages are clear — higher volatility and staking capability — making it the top DAT pick after BTC.

Data shows over 4.1 million ETH have been placed in various institutional treasuries, with a market value above $17.6 billion, accounting for 3.39% of ETH’s total supply. BitMine, SharpLink Gaming, and The Ether Machine together hold positions worth over $10 billion, effectively dominating the top end of institutional ETH treasuries.

Why has Ethereum’s DAT moved faster?

1)Volatility creates financing room

ETH’s historical volatility exceeds BTC’s, opening the door for arbitrage and derivatives strategies. ETH treasury companies often collateralize assets to issue convertible notes on better terms, lowering financing costs.

2)Staking generates steady cash flow

Unlike Bitcoin, post-Merge Ethereum (PoS) lets ETH holders earn staking yield. Institutional DAT operators aren’t just hoarding — they can lock in recurring on-chain cash flows, turning ETH into a bond-like asset.

3)Ecosystem depth

DeFi, NFTs, and RWA rely heavily on Ethereum, making ETH not just a reserve asset but also the fuel of a financial ecosystem. This network effect gives ETH DAT outsized strategic value.

In essence, ETH DAT has evolved from “simple reserves” to “financial engineering,” offering listed companies a new capital-markets playbook.

Solana DAT: The Rise of a New Force

1) From follower to breakout

Even as ETH DAT boomed, Solana began catching Wall Street’s eye. Latest figures show 17 entities have established SOL treasuries, totaling 11.739 million SOL — about $2.84 billion — or 2.04% of total supply.

This means Solana has moved from “edge chain” to the third major institutional allocation target, after BTC and ETH.

Forward Industries, Helius Medical Technologies (HSDT), and Upexi have all named Solana a strategic asset. Capital heavyweight Galaxy Digital has doubled down as well, adding $400 million of SOL for Forward Industries. 2) DAT 2.0: The appeal of staking yield

Another highlight of Solana DAT is attractive staking yields. So far, around 585,000 SOL — worth over $100 million — have been staked at an average yield of 6.86%.

Upexi raised holdings from 73,500 SOL to 1.8 million SOL and staked nearly all of it, expecting ~$26 million in annual cash flow. In other words, Solana DAT is shifting from pure “reserve” to active value-add, akin to an interest-bearing asset in TradFi.

3) Wall Street logic: Smaller market cap, bigger elasticity

Compared with BTC and ETH, SOL’s market cap is smaller (~$116 billion, roughly 1/20 of BTC). That means the same dollar inflow can move SOL’s price far more than BTC/ETH.

For example, Forward Industries’ $1.6 billion injection into SOL would be equivalent to ~$33 billion of buying pressure in BTC terms. Given supply-demand dynamics, SOL’s price elasticity is greater — appealing to institutions seeking higher upside.

Solana’s Distinct Appeal

1) High-performance network: TradFi-grade speed and cost

Solana uses a monolithic design — unlike Ethereum’s modular route (splitting execution and data layers via L2s). By integrating functions on a single L1, Solana delivers very high throughput — tens of thousands of TPS — and ultra-low fees (often <$0.01 per transaction).

For Wall Street, this is critical. Institutional settlement is highly sensitive to speed and cost. With recent upgrades, Solana cut transaction confirmation to ~150 ms, approaching Web2-grade UX. For the first time, a blockchain’s settlement layer starts to look compatible with financial back-office systems.

2) Broad use cases: Multiple tracks, parallel momentum

If Bitcoin is a reserve asset and Ethereum is financial Lego, Solana’s edge is multi-vertical applications. It has solid traction across payments, DeFi, NFTs, GameFi, SocialFi, and DePIN (decentralized physical infrastructure). In stablecoins and tokenized assets, Solana is emerging as a mainstream settlement network.

USDC circulation on Solana is climbing fast; some cross-border payment firms already use Solana for clearing. In DePIN, Helium fully migrated to Solana — proof of its capacity for large-scale IoT workloads.

This “horizontal bloom” means institutions aren’t betting on a single narrative, but on a consumer-grade super-platform potential.

3) Early institutional adoption: Huge upside ahead

Currently, institutional SOL ownership is below 1%, far lower than ETH (~7%) and BTC (~16%). That doesn’t imply lack of recognition — rather, it shows massive runway.

With Solana ETPs advancing and more corporates adding SOL to DAT, institutional penetration could rise quickly. Unlike BTC and ETH — already deeply held — Solana is a low-penetration “white canvas.” Each incremental institutional buy can have an outsized impact on price and market cap.

Part of Wall Street’s interest is precisely this market-cap elasticity. At ~$116B, SOL is ~1/20 of BTC and 1/5 of ETH. The marginal price impact of equal-sized inflows is therefore much larger for SOL. In short, Solana enjoys a late-mover advantage with substantial incremental potential in the DAT lane.

Net-net: Financial-grade performance, multi-track demand, and low starting institutional penetration combine to make Solana one of the most commercially compelling blockchains in Wall Street’s eyes.

Conclusion

From Bitcoin to Ethereum, and now to Solana, Digital Asset Treasuries (DAT) are reshaping the institutional crypto map.

- BTC brings the certainty of a reserve asset.

- ETH showcases the value-add of a financial asset.

- SOL represents the high-growth potential of a next-gen L1.

As Forward Industries, Helius, Upexi and others keep adding, and a potential Solana ETF gathers momentum, Wall Street capital is flowing into Solana at unprecedented speed.

This is not just an investment trend — it’s a vote by global capital on how the crypto market structure is evolving. Whether Solana can truly cement its place as Wall Street’s new favorite will depend on its ability to balance hyper-growth with long-term resilience. #JuExchange #ETH #SOL

Lee | Ju.Com

2025-09-22 10:42

Wall Street and DAT’s New Darling: Can Solana Take the Baton from Ethereum?

Disclaimer:Contains third-party content. Not financial advice.

See Terms and Conditions.

- Ethereum (ETH) is trading near $3,445, down 17.5% month-to-month but up a modest 3.5% over the past week.

- This short-term recovery masks a deeper concern — Ethereum’s chart shows two bearish crossovers forming.

- However, Ethereum whales have added nearly $900 million in ETH in just a few days.

The question is: what do they see that most traders don't see?

Negative EMA Crossover Is Near, But Ethereum Whales Keep Buying

- On the daily chart, Ethereum faces a potential short-term change in direction. The 50-day EMA is close to crossing below the 100-day EMA, a bearish signal that typically indicates a decline in price strength.

- (EMAs are large moving Medium that give more weight to recent prices, helping to spot trend changes faster than regular moving Medium .)

- The last time a similar crossover occurred — when the 20-day EMA moved below the 100-day EMA in early November — ETH fell nearly 22% within a week.

- Want more information on Token like this? Subscribe to Editor Harsh Notariya's daily Crypto Newsletter here .

- Now, another warning is emerging as the 20-day EMA approaches the 200-day EMA. If selling pressure increases after the first cross, a second cross could quickly follow, potentially adding to the bearish pressure.

- Despite these signs, whales are unfazed. On- chain data from Santiment shows that large wallets increased their holdings from 101.44 million ETH on November 10 to 101.70 million ETH on November 12 — an increase of about 260,000 ETH, or about $900 million at current prices.

- This suggests that whales XEM these price drops not as a risk, but as an opportunity — perhaps expecting the price to recover once short-term selling pressure eases.

Hidden bullish divergence explains whale confidence

- That optimism may stem from what’s happening on the momentum side. Between June 22 and November 4, ETH prices formed higher Dip , while the RSI, which measures buying and selling strength, formed lower Dip.

- This is a phenomenon called hidden bullish divergence, which often suggests that an uptrend (from June to now) is still holding despite the chart looking weak.

- If the price holds above $3,333, a key support level, ETH could target $3,650, then $3,994. A break above $3,994 would break the short-term bearish structure and open up targets at $4,251 and even $4,762.

- However, if the price drops below $3,050, this will confirm the negative impact of the EMA crossovers and test the whales' confidence. However, for that to happen, Ethereum's price needs to close below $3,333 on the day.

Ethereum's chart is showing a rare confrontation right now — bearish signals are forming, but whales are clearly eyeing the next big move.

#Ethereum#EthereumWhales #Jucom #ETH #cryptocurrency $ETH/USDT $BTC/USDT $JU/USDT

Lee | Ju.Com

2025-11-13 05:33

❗️ Ethereum Whales Pump $900 Million Despite Bearish Crossover Risks — But Why?

Disclaimer:Contains third-party content. Not financial advice.

See Terms and Conditions.

"Brother Machi" made a profit of $45.66 million from his ETH long position, but later returned all of that profit and suffered a loss of $17.72 million.

According to on-chain analyst Yu Jin, on November 18, "Brother Machi" added $256,000 in margin to his long position and opened a new long position with 1,775 ETH, worth $5.3 million. His average opening price was $3,024, and the liquidation price was $2,908.🚨🚨🚨

Over the past six months, "Brother Machi" has made a profit of $45.66 million from his ETH long position. However, the market later reversed, forcing him to return all profits and incur a loss of $17.72 million.⭐️⭐️⭐️

#cryptocurrency #blockchain #Jucom #Finance #ETH $BTC/USDT $ETH/USDT $JU/USDT

Lee | Ju.Com

2025-11-18 09:56

#Crypto_Rumors🌈🌈🌈

Disclaimer:Contains third-party content. Not financial advice.

See Terms and Conditions.

JUST IN: REX-Osprey’s $XRP/USDT ETF (XRPR) just smashed $100M AUM

in under a month — a milestone that signals massive investor appetite for Ripple’s ecosystem assets. ⚡️

Institutions aren’t just watching — they’re diving in headfirst. The next wave of capital may be flowing straight into real-world utility tokens. 🌊

#XRP #ETH #cryptocurrency

Carmelita

2025-10-26 11:54

Disclaimer:Contains third-party content. Not financial advice.

See Terms and Conditions.