JuCoin Official

2025-08-06 07:47

📈 Another milestone unlocked! $JU breaks through $13!!

Disclaimer:Contains third-party content. Not financial advice.

See Terms and Conditions.

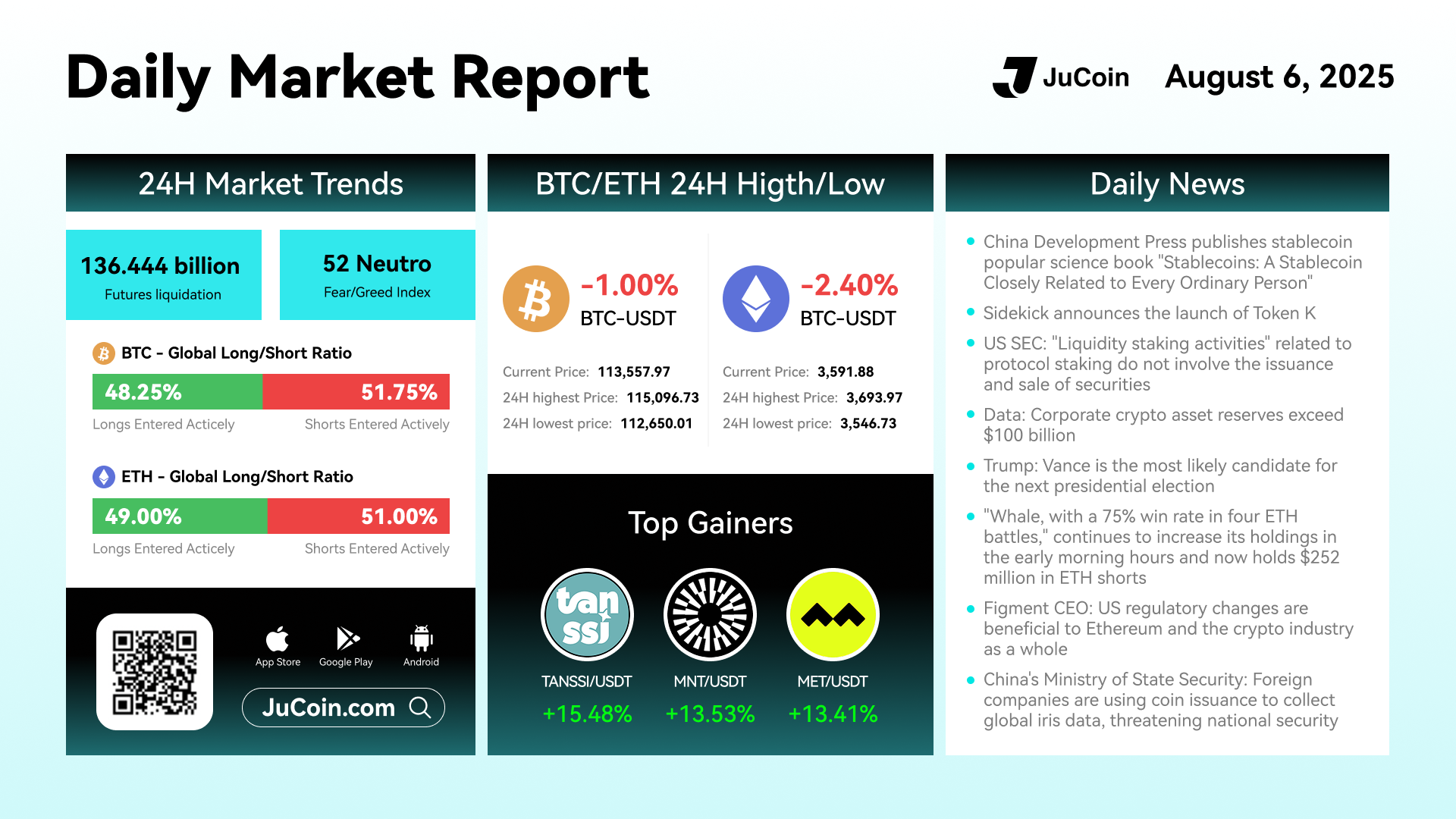

📅 August 6 2025

🎉 Stay updated with the latest crypto market trends!

👉 Trade on:https://bit.ly/3DFYq30

👉 X:https://twitter.com/Jucoinex

👉 APP download: https://www.jucoin.com/en/community-downloads

JuCoin Community

2025-08-06 04:51

#JuCoin Daily Market Report

Disclaimer:Contains third-party content. Not financial advice.

See Terms and Conditions.

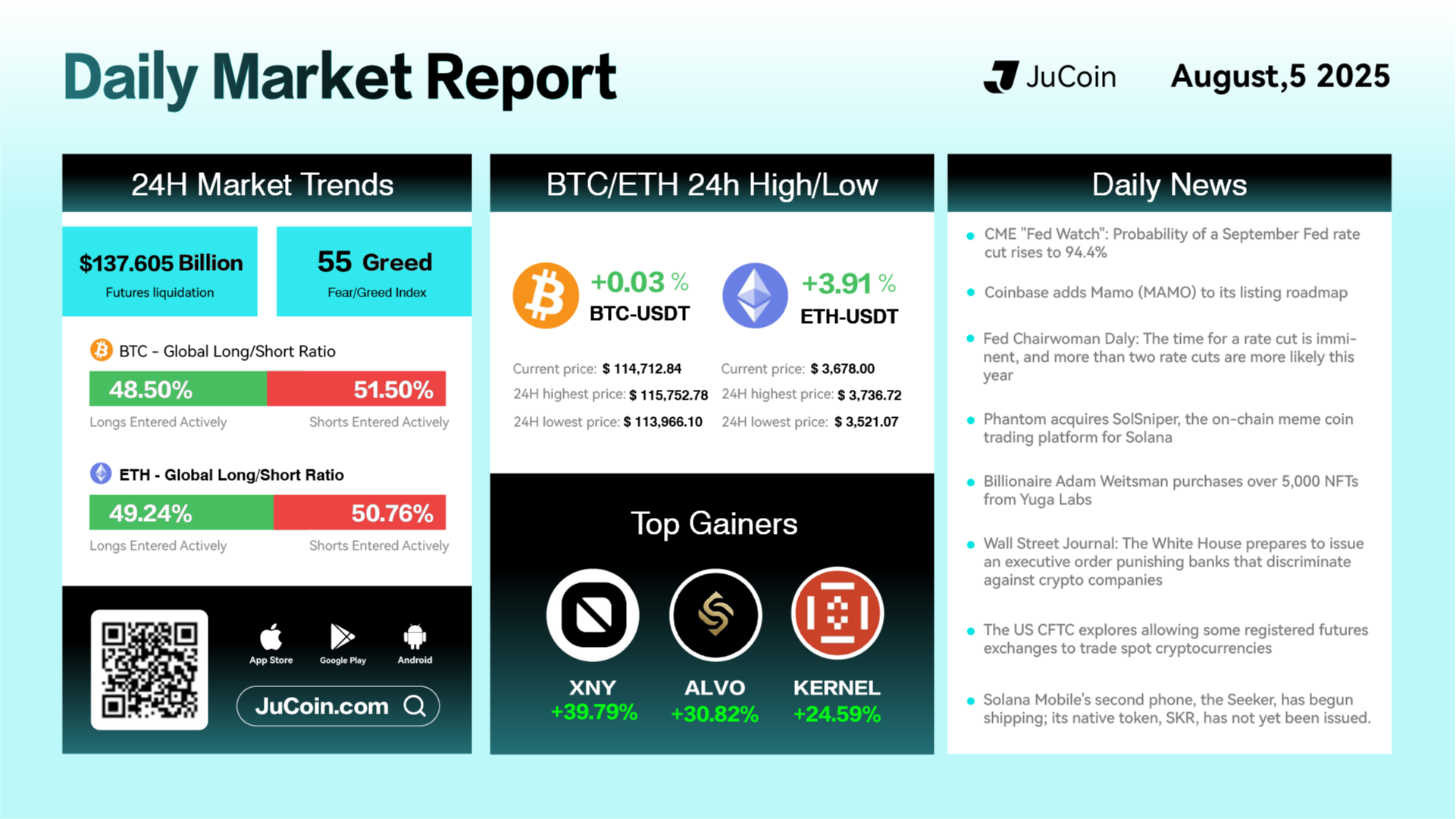

📅 August 5 2025

🎉 Stay updated with the latest crypto market trends!

👉 Trade on:https://bit.ly/3DFYq30

👉 X:https://twitter.com/Jucoinex

👉 APP download: https://www.jucoin.com/en/community-downloads

JuCoin Community

2025-08-05 04:32

🚀 #JuCoin Daily Market Report

Disclaimer:Contains third-party content. Not financial advice.

See Terms and Conditions.

JuTrust Insurance is a Web3.0 open API interface. The Solth Trust protocol has been integrated into JuTrust Insurance. 30% of the funds entered by users into Solth Trust will automatically enter the insurance pool, which is used to underwrite risk policies for the amount entered by users into Sloth Trust. JuTrust will automatically capture user withdrawal records as a basis for statistical claims.

💎Compensation triggering mechanism

🔣The core service of the project is closed, and tokens cannot be withdrawn.

🔣And other force majeure factors determined by the platform.

👉 Read More:https://bit.ly/4foWISj

JuCoin Community

2025-08-04 10:23

Sloth Trust officially joins JuTrust insurance warehouse

Disclaimer:Contains third-party content. Not financial advice.

See Terms and Conditions.

👌JuCoin will list the RA/USDT trading pair on Aug. 4, 2025

🔷Deposit & Withdrawal: 10:00 (UTC) on Aug. 3, 2025

🔷Trading: 15:00 (UTC) on Aug. 4, 2025

👉More:https://bit.ly/4oerW2p

JuCoin Community

2025-08-04 03:43

📢New Listing

Disclaimer:Contains third-party content. Not financial advice.

See Terms and Conditions.

From 16:06 to 16:09 (UTC+8) on August 1, ETHUSDT futures experienced a price spike, resulting in approximately $2.87M in abnormal profits for some users and $7.3M in abnormal losses for others.

💪🏻To fully protect the interests of all platform users, we have decided:

✅Full release of abnormal profits: Users who profited during the incident will not be subject to clawbacks, with a total of approximately 2.87million USDT being distributed.

✅Full compensation for abnormal losses: Users who incurred losses during the incident will be fully compensated by the platform, including those in unrealized loss positions. The total compensation amounts to approximately 7.3 million USDT.

👌JuCoin will bear a total compensation exceeding $10 million USDT for this incident. All compensations will be completed by 24:00 (UTC+8) on August 8.

We will continue to optimize system stability to ensure every user receives the protection they deserve, even in extreme market conditions.

👉More: https://bit.ly/46E2woC

JuCoin Community

2025-08-01 16:58

🚨Statement on August 1, 2025 Futures System Anomaly and Compensation Decision

Disclaimer:Contains third-party content. Not financial advice.

See Terms and Conditions.

The altcoin market is experiencing significant resurgence with institutional backing and regulatory clarity driving unprecedented growth opportunities. Here's what's shaping the current landscape:

💰 Market Dynamics:

-

Post-Bitcoin capital rotation (Bitcoin hit $118K in July 2025)

86% of institutional investors have or plan digital asset exposure

Altcoin Season Index at 50 (early-stage rotation phase)

Enhanced liquidity through potential altcoin ETPs

🎯 Leading Sectors & Narratives:

1️⃣ AI & Blockchain Integration

-

AI-powered altcoins transitioning from speculation to utility

Autonomous agents creating economic value in crypto ecosystems

2️⃣ Real-World Asset (RWA) Tokenization

-

Market surged to $25B in Q2 2025 (245x increase since 2020)

Bridging traditional finance with blockchain technology

Fractional ownership of real estate, commodities, and fine art

3️⃣ DeFi Evolution

-

Focus on Layer 2 solutions and high-performance blockchains

Innovative liquid staking and restaking protocols

More user-friendly and cost-effective transactions

4️⃣ Gaming & Metaverse

-

Sustainable play-to-earn models

Interoperable metaverse experiences

🏛️ Regulatory Catalysts:

-

EU's MiCA regulation providing comprehensive framework

U.S. stablecoin bills (GENIUS Act) enhancing stability

Spot altcoin ETP discussions (Solana, XRP gaining traction)

XRP hitting multi-year highs amid favorable regulations

💡 Key Investment Insights:

-

Diversify into altcoins with strong fundamentals in emerging sectors

Monitor regulatory developments for institutional flow opportunities

Prioritize projects with active communities and continuous innovation

Understand capital rotation patterns from Bitcoin to altcoins

Focus on utility-driven tokens over speculative assets

🔮 Market Outlook: The shift from speculative to utility-driven altcoins is accelerating, with institutional adoption providing stability and legitimacy. Projects solving real-world problems through AI integration, RWA tokenization, and advanced DeFi protocols are positioned for sustained growth.

Read the complete market analysis with detailed sector breakdowns and investment strategies: 👇 https://blog.jucoin.com/explore-the-current-altcoin-market-in-2025/

#Altcoin #Crypto #Blockchain #AI #RWA #DeFi #Institutional #Regulation #Bitcoin #Ethereum #Solana #XRP #JuCoin #Tokenization #Web3 #Investment #2025 #DigitalAssets #MiCA #ETP

JU Blog

2025-07-31 13:37

🚀 Altcoin Market in 2025: Institutional-Driven Growth & Innovation Surge!

Disclaimer:Contains third-party content. Not financial advice.

See Terms and Conditions.

Best Times to Trade During the XT Carnival

The XT Carnival is one of the most anticipated events in the cryptocurrency trading calendar. It attracts thousands of traders, investors, and enthusiasts eager to capitalize on heightened market activity. Understanding when to trade during this event can significantly influence your success, especially given its characteristic high liquidity and volatility. This guide aims to help traders identify the most strategic times for trading during the XT Carnival based on recent insights and market patterns.

What Is the XT Carnival?

The XT Carnival is an annual gathering organized by XT.com, a leading cryptocurrency exchange. It features a series of activities including trading competitions, workshops, seminars, and networking opportunities designed for both novice and experienced traders. The event's core appeal lies in its ability to generate increased market activity—traders are motivated by prizes from competitions and educational content that enhances their skills.

This event typically spans several days with fluctuating schedules each year but consistently draws large participation due to its reputation for high liquidity and volatility. These conditions create both opportunities for profit through quick trades or swing strategies as well as risks that require careful risk management.

Why Timing Matters During the XT Carnival

Timing your trades during such a dynamic period can make a significant difference in outcomes. High liquidity means more buying and selling activity which often leads to rapid price movements—both upward surges and sharp declines. For traders aiming to maximize gains or minimize losses, understanding when these movements are likely occurs is crucial.

Market openings at the start of each day or session tend to be volatile as new information enters markets or participants react collectively after overnight developments. Similarly, periods around scheduled activities like workshops or competition deadlines often see spikes in trading volume because participants adjust their positions based on new insights gained from educational sessions or competitive results.

Key Periods When Trading Is Most Active

Based on recent trends observed during past editions of the XT Carnival—and supported by general market behavior—the following periods are typically characterized by increased activity:

Market Openings: The beginning of each trading day within the event usually witnesses notable price swings as traders digest overnight news or react quickly after initial announcements.

Mid-Day Sessions (Lunch Breaks): Around midday—often coinciding with breaks in scheduled events—trading volume tends to increase as participants reassess their strategies based on early-day developments.

During Trading Competitions: When specific contests are active—such as "Crypto Trading Challenge" winners being announced—the surge in participant engagement leads directly to higher liquidity.

Post-Educational Workshops: After seminars focusing on technical analysis or risk management conclude, many attendees actively implement learned strategies immediately afterward; this creates short-term volatility spikes.

Pre-Event Announcements & Market Updates: Any significant news released just before key segments can trigger rapid price adjustments across various cryptocurrencies involved in those updates.

How Traders Can Maximize Opportunities

To effectively leverage these peak periods:

- Monitor Event Schedules Closely: Keep track of daily agendas including workshop timings, competition phases, and announcement windows.

- Use Real-Time Data & Alerts: Employ tools like live charts with alerts set around expected volatile periods so you can act swiftly when opportunities arise.

- Practice Risk Management: Given high volatility potential—even during prime times—it’s essential always to use stop-loss orders and position sizing appropriate for your risk appetite.

- Focus on Liquid Pairs: During busy periods like competition peaks or session openings, prioritize highly liquid cryptocurrencies such as Bitcoin (BTC), Ethereum (ETH), or top altcoins which facilitate smoother entry/exit points without slippage.

Risks Associated With Peak Trading Times

While these windows offer lucrative opportunities due to increased movement, they also come with heightened risks:

- Sudden Price Swings: Rapid fluctuations may lead inexperienced traders into significant losses if not managed properly.

- Market Manipulation Concerns: High-liquidity events sometimes attract manipulative practices; however, reputable platforms like XT.com implement measures against such activities.

- Emotional Trading: Increased excitement might lead some traders into impulsive decisions rather than disciplined strategies.

Understanding these risks underscores why preparation—including education about technical analysis—is vital before engaging heavily during peak times at events like the XT Carnival.

Final Thoughts: Strategic Planning Enhances Success

Knowing when best times occur isn’t enough; successful trading also depends on preparation beforehand — including analyzing historical data from previous Carnivals—and maintaining discipline throughout volatile sessions. By aligning your trading schedule with key activity windows identified above while practicing sound risk management principles you stand better chances at capitalizing on this vibrant event’s full potential without exposing yourself unnecessarily to downside risks.

In summary:

- Focus on opening hours

- Watch mid-day shifts

- Participate actively during competitions

- Stay alert post-workshopsThese strategic timings combined with proper planning will help you navigate one of crypto’s most exciting seasons effectively while safeguarding your investments amidst unpredictable swings typical of high-volatility environments like the XT Carnival.

Lo

2025-06-09 08:03

What are the best times to trade during the XT Carnival?

Best Times to Trade During the XT Carnival

The XT Carnival is one of the most anticipated events in the cryptocurrency trading calendar. It attracts thousands of traders, investors, and enthusiasts eager to capitalize on heightened market activity. Understanding when to trade during this event can significantly influence your success, especially given its characteristic high liquidity and volatility. This guide aims to help traders identify the most strategic times for trading during the XT Carnival based on recent insights and market patterns.

What Is the XT Carnival?

The XT Carnival is an annual gathering organized by XT.com, a leading cryptocurrency exchange. It features a series of activities including trading competitions, workshops, seminars, and networking opportunities designed for both novice and experienced traders. The event's core appeal lies in its ability to generate increased market activity—traders are motivated by prizes from competitions and educational content that enhances their skills.

This event typically spans several days with fluctuating schedules each year but consistently draws large participation due to its reputation for high liquidity and volatility. These conditions create both opportunities for profit through quick trades or swing strategies as well as risks that require careful risk management.

Why Timing Matters During the XT Carnival

Timing your trades during such a dynamic period can make a significant difference in outcomes. High liquidity means more buying and selling activity which often leads to rapid price movements—both upward surges and sharp declines. For traders aiming to maximize gains or minimize losses, understanding when these movements are likely occurs is crucial.

Market openings at the start of each day or session tend to be volatile as new information enters markets or participants react collectively after overnight developments. Similarly, periods around scheduled activities like workshops or competition deadlines often see spikes in trading volume because participants adjust their positions based on new insights gained from educational sessions or competitive results.

Key Periods When Trading Is Most Active

Based on recent trends observed during past editions of the XT Carnival—and supported by general market behavior—the following periods are typically characterized by increased activity:

Market Openings: The beginning of each trading day within the event usually witnesses notable price swings as traders digest overnight news or react quickly after initial announcements.

Mid-Day Sessions (Lunch Breaks): Around midday—often coinciding with breaks in scheduled events—trading volume tends to increase as participants reassess their strategies based on early-day developments.

During Trading Competitions: When specific contests are active—such as "Crypto Trading Challenge" winners being announced—the surge in participant engagement leads directly to higher liquidity.

Post-Educational Workshops: After seminars focusing on technical analysis or risk management conclude, many attendees actively implement learned strategies immediately afterward; this creates short-term volatility spikes.

Pre-Event Announcements & Market Updates: Any significant news released just before key segments can trigger rapid price adjustments across various cryptocurrencies involved in those updates.

How Traders Can Maximize Opportunities

To effectively leverage these peak periods:

- Monitor Event Schedules Closely: Keep track of daily agendas including workshop timings, competition phases, and announcement windows.

- Use Real-Time Data & Alerts: Employ tools like live charts with alerts set around expected volatile periods so you can act swiftly when opportunities arise.

- Practice Risk Management: Given high volatility potential—even during prime times—it’s essential always to use stop-loss orders and position sizing appropriate for your risk appetite.

- Focus on Liquid Pairs: During busy periods like competition peaks or session openings, prioritize highly liquid cryptocurrencies such as Bitcoin (BTC), Ethereum (ETH), or top altcoins which facilitate smoother entry/exit points without slippage.

Risks Associated With Peak Trading Times

While these windows offer lucrative opportunities due to increased movement, they also come with heightened risks:

- Sudden Price Swings: Rapid fluctuations may lead inexperienced traders into significant losses if not managed properly.

- Market Manipulation Concerns: High-liquidity events sometimes attract manipulative practices; however, reputable platforms like XT.com implement measures against such activities.

- Emotional Trading: Increased excitement might lead some traders into impulsive decisions rather than disciplined strategies.

Understanding these risks underscores why preparation—including education about technical analysis—is vital before engaging heavily during peak times at events like the XT Carnival.

Final Thoughts: Strategic Planning Enhances Success

Knowing when best times occur isn’t enough; successful trading also depends on preparation beforehand — including analyzing historical data from previous Carnivals—and maintaining discipline throughout volatile sessions. By aligning your trading schedule with key activity windows identified above while practicing sound risk management principles you stand better chances at capitalizing on this vibrant event’s full potential without exposing yourself unnecessarily to downside risks.

In summary:

- Focus on opening hours

- Watch mid-day shifts

- Participate actively during competitions

- Stay alert post-workshopsThese strategic timings combined with proper planning will help you navigate one of crypto’s most exciting seasons effectively while safeguarding your investments amidst unpredictable swings typical of high-volatility environments like the XT Carnival.

Disclaimer:Contains third-party content. Not financial advice.

See Terms and Conditions.

How Can Investors Evaluate Cryptocurrencies Other Than Bitcoin?

Understanding the landscape of cryptocurrencies beyond Bitcoin is essential for investors seeking diversification and growth opportunities. With thousands of digital assets available, evaluating their potential requires a strategic approach grounded in key factors such as market metrics, technological innovation, regulatory context, and market dynamics. This guide aims to provide clarity on how to assess these digital assets effectively.

Assessing Market Capitalization and Liquidity

Market capitalization remains one of the most straightforward indicators of a cryptocurrency’s size and stability. It reflects the total value of all circulating coins or tokens and can signal investor confidence. Larger market caps often correlate with higher liquidity, meaning assets can be bought or sold quickly without causing significant price fluctuations. For example, Ethereum (ETH), Binance Coin (BNB), and Solana (SOL) have experienced notable increases in market cap recently, making them more attractive options for investors looking for established projects with growth potential.

Liquidity is equally important because it affects trading flexibility. High liquidity reduces risks associated with large price swings during transactions and allows investors to enter or exit positions smoothly. The expansion of stablecoins like Tether (USDT) has contributed significantly to liquidity pools within crypto markets—offering a perceived safe haven amid volatility—and attracting both retail and institutional traders.

Evaluating Adoption Rates

Adoption rate measures how widely a cryptocurrency is being used by individuals, businesses, financial institutions, or governments. A high adoption rate indicates that the asset has practical utility beyond speculation—such as facilitating cross-border payments or powering decentralized applications—which enhances its long-term viability.

Recent developments show increasing corporate interest; for instance, Meta's exploration into integrating stablecoins into its platforms could dramatically boost adoption rates by enabling seamless international transactions for content creators worldwide. Such moves not only validate the technology but also expand user bases rapidly.

Understanding Regulatory Environments

The legal framework surrounding cryptocurrencies varies significantly across jurisdictions—and this variability influences investment decisions profoundly. Favorable regulations tend to attract more institutional participation by providing clarity on compliance requirements while reducing risks associated with legal uncertainties.

For example, BlackRock’s recent investment in Circle Internet—the issuer behind USDC stablecoin—signals growing institutional confidence supported by clearer regulatory pathways in certain regions like the United States. Conversely, ambiguous or restrictive policies can hinder growth prospects and lead to increased volatility due to sudden regulatory crackdowns or bans.

Technological Innovation: The Backbone of Growth

Technological advancements are crucial drivers shaping the future trajectory of cryptocurrencies other than Bitcoin. Innovations such as improved scalability solutions—like those seen with Solana’s high-throughput blockchain—or interoperability features exemplified by Polkadot enable different networks to communicate seamlessly.

These technological improvements enhance security protocols while expanding usability—for developers creating decentralized apps (dApps) or enterprises adopting blockchain solutions—making these assets more appealing from an investor perspective who values innovation-driven growth potential.

Recent Developments Impacting Market Dynamics

Partnerships between crypto projects and mainstream companies are increasingly common; they serve as validation points that can accelerate adoption rates further down the line.

- For instance: X partnered with Polymarket introduces real-time prediction markets that foster user engagement.

- Stablecoin markets have surged from $20 billion in 2020 to over $246 billion today according to Deutsche Bank research—a testament to their growing importance within crypto ecosystems.

- Institutional investments continue rising; BlackRock’s backing of USDC signals mainstream acceptance.

- Blockchain innovations like Solana's scalability improvements attract developers seeking efficient platforms capable of handling complex applications at scale.

These recent trends highlight an evolving ecosystem where strategic partnerships and technological progress play pivotal roles in shaping future opportunities but also introduce new challenges requiring careful analysis by investors aiming for sustainable gains.

Risks That Could Affect Cryptocurrency Valuations

While promising prospects exist outside Bitcoin’s dominance, several risks warrant attention:

- Regulatory Risks: Uncertain legal environments may lead to sudden restrictions impacting asset prices negatively.

- Market Volatility: Cryptocurrencies are known for sharp price swings driven by sentiment shifts or macroeconomic factors.

- Security Concerns: Hacks targeting exchanges or wallets undermine trust; recent breaches have caused significant losses across various projects.

- Competitive Landscape: Rapid technological advancements mean new entrants could disrupt existing leaders’ positions quickly if they offer superior features or better security measures.

Investors must weigh these risks carefully against potential rewards when diversifying into alternative cryptocurrencies.

Identifying Opportunities Through Due Diligence

To make informed decisions about investing outside Bitcoin:

- Analyze project fundamentals—including whitepapers detailing technology use cases

- Monitor development activity on repositories like GitHub

- Review community engagement levels across social media channels

- Stay updated on regulatory news affecting specific jurisdictions5.. Evaluate partnership announcements indicating industry validation

Combining technical analysis with fundamental insights ensures a balanced approach aligned with best practices recommended by financial experts specializing in digital assets.

Staying Ahead With Continuous Learning

The cryptocurrency space evolves rapidly; therefore,investors should commit ongoing education through reputable sources such as industry reports,regulatory updates,and expert analyses from trusted voices within blockchain communities.This proactive stance helps mitigate risks associated with misinformation while identifying emerging trends early enough for strategic positioning.

Final Thoughts on Evaluating Non-Bitcoin Cryptocurrencies

Assessing alternative cryptocurrencies involves examining multiple dimensions—from market metrics like capitalization and liquidity—to innovative aspects such as technology upgrades and real-world adoption initiatives—all within an evolving regulatory landscape that influences overall stability and growth prospects.

By maintaining diligent research practices combined with awareness of current developments—including partnerships fostering mainstream acceptance—and understanding inherent risks—investors can better navigate this dynamic environment toward making informed investment choices aligned with their risk tolerance levels.

Lo

2025-06-09 05:09

How can investors evaluate cryptocurrencies other than Bitcoin?

How Can Investors Evaluate Cryptocurrencies Other Than Bitcoin?

Understanding the landscape of cryptocurrencies beyond Bitcoin is essential for investors seeking diversification and growth opportunities. With thousands of digital assets available, evaluating their potential requires a strategic approach grounded in key factors such as market metrics, technological innovation, regulatory context, and market dynamics. This guide aims to provide clarity on how to assess these digital assets effectively.

Assessing Market Capitalization and Liquidity

Market capitalization remains one of the most straightforward indicators of a cryptocurrency’s size and stability. It reflects the total value of all circulating coins or tokens and can signal investor confidence. Larger market caps often correlate with higher liquidity, meaning assets can be bought or sold quickly without causing significant price fluctuations. For example, Ethereum (ETH), Binance Coin (BNB), and Solana (SOL) have experienced notable increases in market cap recently, making them more attractive options for investors looking for established projects with growth potential.

Liquidity is equally important because it affects trading flexibility. High liquidity reduces risks associated with large price swings during transactions and allows investors to enter or exit positions smoothly. The expansion of stablecoins like Tether (USDT) has contributed significantly to liquidity pools within crypto markets—offering a perceived safe haven amid volatility—and attracting both retail and institutional traders.

Evaluating Adoption Rates

Adoption rate measures how widely a cryptocurrency is being used by individuals, businesses, financial institutions, or governments. A high adoption rate indicates that the asset has practical utility beyond speculation—such as facilitating cross-border payments or powering decentralized applications—which enhances its long-term viability.

Recent developments show increasing corporate interest; for instance, Meta's exploration into integrating stablecoins into its platforms could dramatically boost adoption rates by enabling seamless international transactions for content creators worldwide. Such moves not only validate the technology but also expand user bases rapidly.

Understanding Regulatory Environments

The legal framework surrounding cryptocurrencies varies significantly across jurisdictions—and this variability influences investment decisions profoundly. Favorable regulations tend to attract more institutional participation by providing clarity on compliance requirements while reducing risks associated with legal uncertainties.

For example, BlackRock’s recent investment in Circle Internet—the issuer behind USDC stablecoin—signals growing institutional confidence supported by clearer regulatory pathways in certain regions like the United States. Conversely, ambiguous or restrictive policies can hinder growth prospects and lead to increased volatility due to sudden regulatory crackdowns or bans.

Technological Innovation: The Backbone of Growth

Technological advancements are crucial drivers shaping the future trajectory of cryptocurrencies other than Bitcoin. Innovations such as improved scalability solutions—like those seen with Solana’s high-throughput blockchain—or interoperability features exemplified by Polkadot enable different networks to communicate seamlessly.

These technological improvements enhance security protocols while expanding usability—for developers creating decentralized apps (dApps) or enterprises adopting blockchain solutions—making these assets more appealing from an investor perspective who values innovation-driven growth potential.

Recent Developments Impacting Market Dynamics

Partnerships between crypto projects and mainstream companies are increasingly common; they serve as validation points that can accelerate adoption rates further down the line.

- For instance: X partnered with Polymarket introduces real-time prediction markets that foster user engagement.

- Stablecoin markets have surged from $20 billion in 2020 to over $246 billion today according to Deutsche Bank research—a testament to their growing importance within crypto ecosystems.

- Institutional investments continue rising; BlackRock’s backing of USDC signals mainstream acceptance.

- Blockchain innovations like Solana's scalability improvements attract developers seeking efficient platforms capable of handling complex applications at scale.

These recent trends highlight an evolving ecosystem where strategic partnerships and technological progress play pivotal roles in shaping future opportunities but also introduce new challenges requiring careful analysis by investors aiming for sustainable gains.

Risks That Could Affect Cryptocurrency Valuations

While promising prospects exist outside Bitcoin’s dominance, several risks warrant attention:

- Regulatory Risks: Uncertain legal environments may lead to sudden restrictions impacting asset prices negatively.

- Market Volatility: Cryptocurrencies are known for sharp price swings driven by sentiment shifts or macroeconomic factors.

- Security Concerns: Hacks targeting exchanges or wallets undermine trust; recent breaches have caused significant losses across various projects.

- Competitive Landscape: Rapid technological advancements mean new entrants could disrupt existing leaders’ positions quickly if they offer superior features or better security measures.

Investors must weigh these risks carefully against potential rewards when diversifying into alternative cryptocurrencies.

Identifying Opportunities Through Due Diligence

To make informed decisions about investing outside Bitcoin:

- Analyze project fundamentals—including whitepapers detailing technology use cases

- Monitor development activity on repositories like GitHub

- Review community engagement levels across social media channels

- Stay updated on regulatory news affecting specific jurisdictions5.. Evaluate partnership announcements indicating industry validation

Combining technical analysis with fundamental insights ensures a balanced approach aligned with best practices recommended by financial experts specializing in digital assets.

Staying Ahead With Continuous Learning

The cryptocurrency space evolves rapidly; therefore,investors should commit ongoing education through reputable sources such as industry reports,regulatory updates,and expert analyses from trusted voices within blockchain communities.This proactive stance helps mitigate risks associated with misinformation while identifying emerging trends early enough for strategic positioning.

Final Thoughts on Evaluating Non-Bitcoin Cryptocurrencies

Assessing alternative cryptocurrencies involves examining multiple dimensions—from market metrics like capitalization and liquidity—to innovative aspects such as technology upgrades and real-world adoption initiatives—all within an evolving regulatory landscape that influences overall stability and growth prospects.

By maintaining diligent research practices combined with awareness of current developments—including partnerships fostering mainstream acceptance—and understanding inherent risks—investors can better navigate this dynamic environment toward making informed investment choices aligned with their risk tolerance levels.

Disclaimer:Contains third-party content. Not financial advice.

See Terms and Conditions.

What Are the Benefits of Using USDC?

USDC, or USD Coin, has become one of the most prominent stablecoins in the cryptocurrency ecosystem. Its primary appeal lies in its ability to combine blockchain technology's efficiency with the stability of traditional fiat currencies like the US dollar. For users ranging from individual investors to large financial institutions, understanding the benefits of USDC is crucial for making informed decisions about its role within digital finance.

Stability and Reliability in Digital Transactions

One of USDC’s core advantages is its stability. Unlike volatile cryptocurrencies such as Bitcoin or Ethereum, USDC maintains a 1:1 peg with the US dollar. This means that each token is backed by a corresponding dollar held in reserve, providing users with confidence that their holdings will not experience sudden fluctuations. This stability makes USDC an attractive medium for transactions where predictability and security are essential—such as remittances, payroll payments, or trading pairs on crypto exchanges.

The transparency surrounding USDC’s supply further enhances trustworthiness. The issuing entity regularly publishes attestations confirming that every issued coin is fully backed by reserves. Such transparency aligns with regulatory standards and reassures both retail and institutional users about its integrity.

Cost-Effective Cross-Border Payments

Traditional cross-border transactions often involve high fees and lengthy settlement times due to banking intermediaries and currency conversion processes. In contrast, using USDC on blockchain networks significantly reduces these costs while speeding up transaction times.

Blockchain technology enables near-instantaneous transfers across borders without relying on conventional banking infrastructure. For businesses engaged in international trade or remittance services, this can translate into substantial savings—lower transaction fees and faster settlement periods—making global commerce more efficient.

Accessibility for Retail Investors and Institutions

USDC’s design promotes inclusivity within financial markets by offering a stable digital asset accessible to both retail investors and large institutions alike. Its peg to the dollar provides a familiar reference point for those new to cryptocurrencies who might be wary of volatility risks associated with other tokens.

Major financial players such as Coinbase, Circle (the issuer), BlackRock, Fidelity Investments, and JPMorgan have integrated or expressed interest in stablecoins like USDC as part of their broader digital asset strategies. This institutional backing lends credibility while expanding usability across various platforms—from decentralized finance (DeFi) applications to payment processors—further increasing accessibility for everyday users seeking reliable crypto options.

Regulatory Compliance Ensures Long-Term Viability

Regulatory compliance remains a critical factor influencing cryptocurrency adoption worldwide—and this is where USDC stands out among stablecoins. Designed explicitly to meet legal standards set forth by regulators like U.S authorities—including anti-money laundering (AML) policies—it offers reassurance that it operates within established legal frameworks.

This compliance facilitates smoother integration into traditional financial systems while reducing risks associated with regulatory crackdowns or bans common among less regulated tokens. As governments worldwide develop clearer guidelines around stablecoins’ use cases—including issuance procedures—the long-term viability of assets like USDC becomes more assured for both issuers and users alike.

Multi-Chain Support Enhances Flexibility

Initially launched on Ethereum—a leading blockchain platform—USDC has expanded onto other blockchains such as Solana and Algorand through multi-chain support initiatives. This development allows users greater flexibility when choosing networks based on factors like transaction speed, cost-efficiency, or compatibility with specific applications.

Multi-chain support also improves scalability; as demand grows globally—with millions adopting stablecoins—the ability to operate seamlessly across different platforms ensures continued usability without bottlenecks caused by network congestion or high fees typical during peak periods on single chains.

Use Cases Driving Adoption Across Sectors

The versatility offered by USDC extends beyond simple transfers:

- Decentralized Finance (DeFi): Users leverage USDC for lending protocols — earning interest—or borrowing funds against collateral.

- Trading: Many exchanges list USD pairs involving USDC due to its stability.

- Remittances: Migrants send money home efficiently using stablecoin transfers.

- Business Payments: Companies utilize it for payrolls or vendor settlements without exposing themselves excessively to market volatility.

These diverse use cases contribute significantly toward mainstream acceptance—a trend reinforced by growing institutional interest aiming at integrating digital dollars into existing financial workflows securely under regulatory oversight.

Risks & Challenges Facing Stablecoin Adoption

While benefits are compelling—and many stakeholders see potential—the landscape isn’t without hurdles:

Some concerns revolve around regulatory uncertainty; governments are still developing comprehensive frameworks governing stablecoin issuance and usage globally—which could impact future operations if regulations tighten unexpectedly.Scalability issues may also arise if network congestion increases dramatically during surges in demand—potentially raising transaction costs temporarily.Market risks linked indirectly through systemic events could influence even pegged assets if broader cryptocurrency markets experience downturns affecting liquidity levels.

Final Thoughts: Why Choosing Stablecoins Like USDC Matters

For anyone involved in digital finance today—from individual traders seeking safer assets during volatile periods—to enterprises looking at efficient cross-border solutions—USDC offers tangible advantages rooted in transparency, stability,and compliance standards aligned with evolving regulations worldwide.

As technological advancements continue—with multi-chain integrations—and adoption expands across sectors including DeFi platforms,big tech firms,and traditional banks—the role of stablecoins like USD Coin will likely grow stronger over time.As always,the key lies in staying informed about ongoing developments,potential risks,and how best these tools can serve your specific needs within an increasingly interconnected global economy.

JCUSER-WVMdslBw

2025-05-29 08:55

What are the benefits of using USDC?

What Are the Benefits of Using USDC?

USDC, or USD Coin, has become one of the most prominent stablecoins in the cryptocurrency ecosystem. Its primary appeal lies in its ability to combine blockchain technology's efficiency with the stability of traditional fiat currencies like the US dollar. For users ranging from individual investors to large financial institutions, understanding the benefits of USDC is crucial for making informed decisions about its role within digital finance.

Stability and Reliability in Digital Transactions

One of USDC’s core advantages is its stability. Unlike volatile cryptocurrencies such as Bitcoin or Ethereum, USDC maintains a 1:1 peg with the US dollar. This means that each token is backed by a corresponding dollar held in reserve, providing users with confidence that their holdings will not experience sudden fluctuations. This stability makes USDC an attractive medium for transactions where predictability and security are essential—such as remittances, payroll payments, or trading pairs on crypto exchanges.

The transparency surrounding USDC’s supply further enhances trustworthiness. The issuing entity regularly publishes attestations confirming that every issued coin is fully backed by reserves. Such transparency aligns with regulatory standards and reassures both retail and institutional users about its integrity.

Cost-Effective Cross-Border Payments

Traditional cross-border transactions often involve high fees and lengthy settlement times due to banking intermediaries and currency conversion processes. In contrast, using USDC on blockchain networks significantly reduces these costs while speeding up transaction times.

Blockchain technology enables near-instantaneous transfers across borders without relying on conventional banking infrastructure. For businesses engaged in international trade or remittance services, this can translate into substantial savings—lower transaction fees and faster settlement periods—making global commerce more efficient.

Accessibility for Retail Investors and Institutions

USDC’s design promotes inclusivity within financial markets by offering a stable digital asset accessible to both retail investors and large institutions alike. Its peg to the dollar provides a familiar reference point for those new to cryptocurrencies who might be wary of volatility risks associated with other tokens.

Major financial players such as Coinbase, Circle (the issuer), BlackRock, Fidelity Investments, and JPMorgan have integrated or expressed interest in stablecoins like USDC as part of their broader digital asset strategies. This institutional backing lends credibility while expanding usability across various platforms—from decentralized finance (DeFi) applications to payment processors—further increasing accessibility for everyday users seeking reliable crypto options.

Regulatory Compliance Ensures Long-Term Viability

Regulatory compliance remains a critical factor influencing cryptocurrency adoption worldwide—and this is where USDC stands out among stablecoins. Designed explicitly to meet legal standards set forth by regulators like U.S authorities—including anti-money laundering (AML) policies—it offers reassurance that it operates within established legal frameworks.

This compliance facilitates smoother integration into traditional financial systems while reducing risks associated with regulatory crackdowns or bans common among less regulated tokens. As governments worldwide develop clearer guidelines around stablecoins’ use cases—including issuance procedures—the long-term viability of assets like USDC becomes more assured for both issuers and users alike.

Multi-Chain Support Enhances Flexibility

Initially launched on Ethereum—a leading blockchain platform—USDC has expanded onto other blockchains such as Solana and Algorand through multi-chain support initiatives. This development allows users greater flexibility when choosing networks based on factors like transaction speed, cost-efficiency, or compatibility with specific applications.

Multi-chain support also improves scalability; as demand grows globally—with millions adopting stablecoins—the ability to operate seamlessly across different platforms ensures continued usability without bottlenecks caused by network congestion or high fees typical during peak periods on single chains.

Use Cases Driving Adoption Across Sectors

The versatility offered by USDC extends beyond simple transfers:

- Decentralized Finance (DeFi): Users leverage USDC for lending protocols — earning interest—or borrowing funds against collateral.

- Trading: Many exchanges list USD pairs involving USDC due to its stability.

- Remittances: Migrants send money home efficiently using stablecoin transfers.

- Business Payments: Companies utilize it for payrolls or vendor settlements without exposing themselves excessively to market volatility.

These diverse use cases contribute significantly toward mainstream acceptance—a trend reinforced by growing institutional interest aiming at integrating digital dollars into existing financial workflows securely under regulatory oversight.

Risks & Challenges Facing Stablecoin Adoption

While benefits are compelling—and many stakeholders see potential—the landscape isn’t without hurdles:

Some concerns revolve around regulatory uncertainty; governments are still developing comprehensive frameworks governing stablecoin issuance and usage globally—which could impact future operations if regulations tighten unexpectedly.Scalability issues may also arise if network congestion increases dramatically during surges in demand—potentially raising transaction costs temporarily.Market risks linked indirectly through systemic events could influence even pegged assets if broader cryptocurrency markets experience downturns affecting liquidity levels.

Final Thoughts: Why Choosing Stablecoins Like USDC Matters

For anyone involved in digital finance today—from individual traders seeking safer assets during volatile periods—to enterprises looking at efficient cross-border solutions—USDC offers tangible advantages rooted in transparency, stability,and compliance standards aligned with evolving regulations worldwide.

As technological advancements continue—with multi-chain integrations—and adoption expands across sectors including DeFi platforms,big tech firms,and traditional banks—the role of stablecoins like USD Coin will likely grow stronger over time.As always,the key lies in staying informed about ongoing developments,potential risks,and how best these tools can serve your specific needs within an increasingly interconnected global economy.

Disclaimer:Contains third-party content. Not financial advice.

See Terms and Conditions.

Understanding the Risks of Investing in Dogecoin

Investing in cryptocurrencies has become increasingly popular over recent years, with Dogecoin (DOGE) standing out as one of the most talked-about digital assets. Originally created as a joke, Dogecoin has gained substantial market value and a dedicated community. However, potential investors should be aware that investing in DOGE involves significant risks that can impact their financial outcomes.

What Is Dogecoin and How Did It Evolve?

Dogecoin was launched in 2013 by Jackson Palmer and Billy Markus as a parody of the cryptocurrency hype surrounding Bitcoin. Its mascot, the Shiba Inu dog from the "Doge" meme, quickly became iconic within internet culture. Despite its humorous origins, Dogecoin transitioned into a legitimate digital currency with active use cases such as tipping content creators online and charitable donations.

Over time, DOGE's popularity surged due to social media influence and endorsements from high-profile figures like Elon Musk. This rapid growth attracted many retail investors seeking quick profits but also introduced volatility that can pose risks for those unaware of market dynamics.

Cryptocurrency Market Volatility: A Major Concern

One of the primary risks associated with investing in Dogecoin is its extreme price volatility. Cryptocurrencies are inherently volatile assets; however, DOGE's price swings tend to be more pronounced compared to traditional investments or even other cryptocurrencies. Prices can skyrocket on positive news or social media hype but may plummet just as quickly during downturns or negative sentiment shifts.

This volatility makes it challenging for investors to predict future values accurately or develop stable investment strategies. For long-term wealth accumulation, such unpredictability requires careful risk management and an understanding that losses could occur rapidly.

Lack of Regulation Increases Exposure to Fraud

Unlike stocks traded on regulated exchanges governed by strict oversight bodies like the SEC (Securities and Exchange Commission), cryptocurrencies—including Dogecoin—operate largely outside formal regulatory frameworks. This lack of regulation creates opportunities for scams, pump-and-dump schemes, market manipulation tactics like wash trading, and fraudulent initial coin offerings (ICOs).

Investors must exercise caution when dealing with unregulated markets by verifying sources before purchasing DOGE tokens or engaging with new platforms claiming to offer trading services related to this cryptocurrency.

Security Risks: Hacks and Theft Threats

Security remains a critical concern when holding any digital asset. Cryptocurrency exchanges have historically been targets for hacking incidents resulting in significant financial losses for users who fail to implement proper security measures such as two-factor authentication (2FA) or cold storage wallets.

Dogecoin holdings stored on vulnerable exchanges are susceptible if those platforms experience breaches or operational failures. Investors should consider using reputable wallets designed specifically for secure storage rather than leaving funds on exchange accounts prone to cyberattacks.

Market Sentiment Drives Price Fluctuations

The value of DOGE is heavily influenced by market sentiment fueled through social media trends, celebrity endorsements, news coverage—and sometimes even memes! Positive developments like favorable regulatory news or institutional interest can cause sudden surges; conversely, negative reports about security issues or regulatory crackdowns often lead to sharp declines.

This emotional component adds another layer of unpredictability since investor psychology plays a significant role in short-term price movements rather than fundamental economic factors alone.

Regulatory Environment Changes Impacting Crypto Markets

Regulatory shifts at national levels significantly affect cryptocurrency prices globally—including Dogecoin’s valuation prospects. Recent restrictions imposed by authorities such as the Department of Government Efficiency (DOGE) have demonstrated how government policies can restrict certain activities related to digital currencies—potentially limiting access or increasing compliance costs for traders and holders alike.

Furthermore, ongoing debates around crypto taxation policies worldwide could influence investor confidence negatively if regulations become more restrictive over time.

Recent Developments That Could Influence Future Risks

In recent months leading up to 2025-05-27*, discussions about approving ETFs (Exchange-Traded Funds) focused on DOGE have gained traction among industry analysts who estimate there’s roughly a 63%–75% chance these financial products will receive approval[3]. While ETF approval could boost mainstream adoption—and potentially increase demand—the process also introduces new risks related to increased institutional involvement which might lead toward greater market manipulation concerns if not properly regulated*.

Additionally,* Hong Kong’s economy experienced growth driven partly by trade opportunities during specific periods[2], which might indirectly influence broader investment trends including cryptocurrencies like DOGE*. Such macroeconomic factors add complexity when assessing long-term risk profiles.

Potential Fallout Scenarios Investors Should Consider

Investors need awareness about possible adverse scenarios:

- Market Crash: A sudden downturn across global markets could drag down all cryptocurrencies including Dogecoin sharply.

- Regulatory Crackdowns: Governments tightening rules around crypto trading may restrict access further—reducing liquidity—and impacting prices adversely.

- Technological Failures: Security breaches at exchanges hosting DOGE could result in loss-of-funds incidents.

Being prepared involves understanding these potential pitfalls alongside ongoing developments affecting crypto markets overall.

Navigating Investment Decisions Safely

Given these inherent risks—volatility extremes , lack of regulation , security vulnerabilities , sentiment-driven pricing —investors should approach doge investments cautiously:

- Conduct thorough research before buying

- Use secure wallets

- Diversify holdings across different assets

- Stay updated on legal changes affecting crypto markets

- Avoid investing more than you’re willing—or able—to lose

By doing so within an informed framework rooted in transparency and due diligence—which aligns with principles underpinning credible financial advice—you enhance your ability not only to capitalize on potential gains but also mitigate downside exposure.

Understanding these key risk factors helps ensure smarter decision-making when considering whether adding Dogecoin into your investment portfolio makes sense given your individual risk tolerance.

Note: Dates mentioned refer primarily up-to-date events relevant until October 2023.

JCUSER-F1IIaxXA

2025-05-29 05:42

What are the risks of investing in Dogecoin?

Understanding the Risks of Investing in Dogecoin

Investing in cryptocurrencies has become increasingly popular over recent years, with Dogecoin (DOGE) standing out as one of the most talked-about digital assets. Originally created as a joke, Dogecoin has gained substantial market value and a dedicated community. However, potential investors should be aware that investing in DOGE involves significant risks that can impact their financial outcomes.

What Is Dogecoin and How Did It Evolve?

Dogecoin was launched in 2013 by Jackson Palmer and Billy Markus as a parody of the cryptocurrency hype surrounding Bitcoin. Its mascot, the Shiba Inu dog from the "Doge" meme, quickly became iconic within internet culture. Despite its humorous origins, Dogecoin transitioned into a legitimate digital currency with active use cases such as tipping content creators online and charitable donations.

Over time, DOGE's popularity surged due to social media influence and endorsements from high-profile figures like Elon Musk. This rapid growth attracted many retail investors seeking quick profits but also introduced volatility that can pose risks for those unaware of market dynamics.

Cryptocurrency Market Volatility: A Major Concern

One of the primary risks associated with investing in Dogecoin is its extreme price volatility. Cryptocurrencies are inherently volatile assets; however, DOGE's price swings tend to be more pronounced compared to traditional investments or even other cryptocurrencies. Prices can skyrocket on positive news or social media hype but may plummet just as quickly during downturns or negative sentiment shifts.

This volatility makes it challenging for investors to predict future values accurately or develop stable investment strategies. For long-term wealth accumulation, such unpredictability requires careful risk management and an understanding that losses could occur rapidly.

Lack of Regulation Increases Exposure to Fraud

Unlike stocks traded on regulated exchanges governed by strict oversight bodies like the SEC (Securities and Exchange Commission), cryptocurrencies—including Dogecoin—operate largely outside formal regulatory frameworks. This lack of regulation creates opportunities for scams, pump-and-dump schemes, market manipulation tactics like wash trading, and fraudulent initial coin offerings (ICOs).

Investors must exercise caution when dealing with unregulated markets by verifying sources before purchasing DOGE tokens or engaging with new platforms claiming to offer trading services related to this cryptocurrency.

Security Risks: Hacks and Theft Threats

Security remains a critical concern when holding any digital asset. Cryptocurrency exchanges have historically been targets for hacking incidents resulting in significant financial losses for users who fail to implement proper security measures such as two-factor authentication (2FA) or cold storage wallets.

Dogecoin holdings stored on vulnerable exchanges are susceptible if those platforms experience breaches or operational failures. Investors should consider using reputable wallets designed specifically for secure storage rather than leaving funds on exchange accounts prone to cyberattacks.

Market Sentiment Drives Price Fluctuations

The value of DOGE is heavily influenced by market sentiment fueled through social media trends, celebrity endorsements, news coverage—and sometimes even memes! Positive developments like favorable regulatory news or institutional interest can cause sudden surges; conversely, negative reports about security issues or regulatory crackdowns often lead to sharp declines.

This emotional component adds another layer of unpredictability since investor psychology plays a significant role in short-term price movements rather than fundamental economic factors alone.

Regulatory Environment Changes Impacting Crypto Markets

Regulatory shifts at national levels significantly affect cryptocurrency prices globally—including Dogecoin’s valuation prospects. Recent restrictions imposed by authorities such as the Department of Government Efficiency (DOGE) have demonstrated how government policies can restrict certain activities related to digital currencies—potentially limiting access or increasing compliance costs for traders and holders alike.

Furthermore, ongoing debates around crypto taxation policies worldwide could influence investor confidence negatively if regulations become more restrictive over time.

Recent Developments That Could Influence Future Risks

In recent months leading up to 2025-05-27*, discussions about approving ETFs (Exchange-Traded Funds) focused on DOGE have gained traction among industry analysts who estimate there’s roughly a 63%–75% chance these financial products will receive approval[3]. While ETF approval could boost mainstream adoption—and potentially increase demand—the process also introduces new risks related to increased institutional involvement which might lead toward greater market manipulation concerns if not properly regulated*.

Additionally,* Hong Kong’s economy experienced growth driven partly by trade opportunities during specific periods[2], which might indirectly influence broader investment trends including cryptocurrencies like DOGE*. Such macroeconomic factors add complexity when assessing long-term risk profiles.

Potential Fallout Scenarios Investors Should Consider

Investors need awareness about possible adverse scenarios:

- Market Crash: A sudden downturn across global markets could drag down all cryptocurrencies including Dogecoin sharply.

- Regulatory Crackdowns: Governments tightening rules around crypto trading may restrict access further—reducing liquidity—and impacting prices adversely.

- Technological Failures: Security breaches at exchanges hosting DOGE could result in loss-of-funds incidents.

Being prepared involves understanding these potential pitfalls alongside ongoing developments affecting crypto markets overall.

Navigating Investment Decisions Safely

Given these inherent risks—volatility extremes , lack of regulation , security vulnerabilities , sentiment-driven pricing —investors should approach doge investments cautiously:

- Conduct thorough research before buying

- Use secure wallets

- Diversify holdings across different assets

- Stay updated on legal changes affecting crypto markets

- Avoid investing more than you’re willing—or able—to lose

By doing so within an informed framework rooted in transparency and due diligence—which aligns with principles underpinning credible financial advice—you enhance your ability not only to capitalize on potential gains but also mitigate downside exposure.

Understanding these key risk factors helps ensure smarter decision-making when considering whether adding Dogecoin into your investment portfolio makes sense given your individual risk tolerance.

Note: Dates mentioned refer primarily up-to-date events relevant until October 2023.

Disclaimer:Contains third-party content. Not financial advice.

See Terms and Conditions.

What Is the Current Market Price of Chainlink?

Understanding the current market price of Chainlink (LINK) is essential for investors, developers, and enthusiasts tracking the evolving landscape of blockchain technology. As of May 29, 2025, LINK is valued at approximately $6.50 USD per token. This figure reflects recent market activity and provides insight into how Chainlink is performing amidst broader cryptocurrency trends.

The stability in LINK’s price over recent months indicates a relatively steady demand and confidence among traders and users. While fluctuations are common in volatile markets like cryptocurrencies, this stability suggests that Chainlink maintains a solid position within the decentralized oracle network ecosystem. It’s important to note that prices can vary slightly across different exchanges due to liquidity differences or regional trading volumes.

Factors Influencing Chainlink's Market Price

Several elements influence LINK’s current valuation:

- Market Sentiment: Broader trends in the crypto space often impact individual tokens like LINK. Positive news about blockchain adoption or DeFi growth can boost prices.

- Integration & Adoption: Recent integrations with major platforms such as Ethereum, Binance Smart Chain, and Polkadot have bolstered confidence in its utility.

- Regulatory Environment: Ongoing regulatory developments worldwide can create volatility; stricter regulations may dampen enthusiasm while clearer guidelines could foster growth.

- Use Cases & Developments: Expansion into sectors like gaming and NFTs enhances demand for reliable data feeds provided by Chainlink.

Why Monitoring Price Movements Matters

For investors considering entry points or existing holders evaluating their portfolios, understanding current pricing helps inform strategic decisions. The $6.50 mark positions LINK as a mid-range asset—less volatile than some smaller-cap tokens but still susceptible to macroeconomic shifts affecting cryptocurrencies globally.

Moreover, tracking these movements offers insights into how external factors—such as technological upgrades or regulatory news—impact market perception and valuation.

How Does Market Price Reflect Chainlink's Role?

Chainlink’s value isn’t solely determined by its token price but also by its utility within the blockchain ecosystem. As a decentralized oracle network providing real-world data to smart contracts on platforms like Ethereum or Binance Smart Chain, its importance grows with increased adoption across sectors such as DeFi (Decentralized Finance), NFTs (Non-Fungible Tokens), and gaming.

A stable yet rising price generally indicates strong trust from developers integrating Chainlink's services into their applications. Conversely, significant drops might signal concerns about security vulnerabilities or regulatory pressures impacting overall confidence.

The Impact of Adoption on Token Value

The more widespread use cases for Chainlink—such as verifying NFT ownerships or powering DeFi lending protocols—the higher the demand for LINK tokens needed to incentivize node operators who supply accurate data feeds. This relationship underscores why monitoring both technical developments and market sentiment is crucial when assessing future potential.

Future Outlook for Link Token Pricing

While current valuations provide a snapshot of where things stand today, future projections depend heavily on several dynamic factors:

- Continued integration with leading blockchains

- Regulatory clarity around crypto assets

- Technological advancements enhancing network security

- Growth in sectors relying on real-world data inputs

Given these variables, stakeholders should remain vigilant about macroeconomic conditions influencing investor behavior across global markets.

Risks That Could Affect Future Prices

Potential risks include:

- Regulatory crackdowns that restrict oracle services

- Security breaches compromising node integrity

- Competition from emerging oracle solutions offering similar functionalities

These elements could lead to short-term volatility but also present opportunities if they catalyze innovation within the space.

Summary: Tracking Link Token Amidst Evolving Blockchain Trends

In summary, as of late May 2025, Link’s approximate value at $6.50 USD per token reflects its ongoing relevance within an expanding blockchain ecosystem reliant on secure external data sources. Its integration into prominent networks underscores its vital role in enabling complex decentralized applications across finance, gaming, NFTs—and beyond.

Investors should consider not only current prices but also underlying factors driving demand—including technological progressions and regulatory landscapes—to make informed decisions aligned with long-term trends rather than short-term fluctuations.

Keywords: Chainlink price today | LINK token value | Blockchain oracle network | Decentralized finance | Crypto market analysis 2025 | Cryptocurrency investment tips

JCUSER-WVMdslBw

2025-05-29 04:30

What is the current market price of Chainlink?

What Is the Current Market Price of Chainlink?

Understanding the current market price of Chainlink (LINK) is essential for investors, developers, and enthusiasts tracking the evolving landscape of blockchain technology. As of May 29, 2025, LINK is valued at approximately $6.50 USD per token. This figure reflects recent market activity and provides insight into how Chainlink is performing amidst broader cryptocurrency trends.

The stability in LINK’s price over recent months indicates a relatively steady demand and confidence among traders and users. While fluctuations are common in volatile markets like cryptocurrencies, this stability suggests that Chainlink maintains a solid position within the decentralized oracle network ecosystem. It’s important to note that prices can vary slightly across different exchanges due to liquidity differences or regional trading volumes.

Factors Influencing Chainlink's Market Price

Several elements influence LINK’s current valuation:

- Market Sentiment: Broader trends in the crypto space often impact individual tokens like LINK. Positive news about blockchain adoption or DeFi growth can boost prices.

- Integration & Adoption: Recent integrations with major platforms such as Ethereum, Binance Smart Chain, and Polkadot have bolstered confidence in its utility.

- Regulatory Environment: Ongoing regulatory developments worldwide can create volatility; stricter regulations may dampen enthusiasm while clearer guidelines could foster growth.

- Use Cases & Developments: Expansion into sectors like gaming and NFTs enhances demand for reliable data feeds provided by Chainlink.

Why Monitoring Price Movements Matters

For investors considering entry points or existing holders evaluating their portfolios, understanding current pricing helps inform strategic decisions. The $6.50 mark positions LINK as a mid-range asset—less volatile than some smaller-cap tokens but still susceptible to macroeconomic shifts affecting cryptocurrencies globally.

Moreover, tracking these movements offers insights into how external factors—such as technological upgrades or regulatory news—impact market perception and valuation.

How Does Market Price Reflect Chainlink's Role?

Chainlink’s value isn’t solely determined by its token price but also by its utility within the blockchain ecosystem. As a decentralized oracle network providing real-world data to smart contracts on platforms like Ethereum or Binance Smart Chain, its importance grows with increased adoption across sectors such as DeFi (Decentralized Finance), NFTs (Non-Fungible Tokens), and gaming.

A stable yet rising price generally indicates strong trust from developers integrating Chainlink's services into their applications. Conversely, significant drops might signal concerns about security vulnerabilities or regulatory pressures impacting overall confidence.

The Impact of Adoption on Token Value

The more widespread use cases for Chainlink—such as verifying NFT ownerships or powering DeFi lending protocols—the higher the demand for LINK tokens needed to incentivize node operators who supply accurate data feeds. This relationship underscores why monitoring both technical developments and market sentiment is crucial when assessing future potential.

Future Outlook for Link Token Pricing

While current valuations provide a snapshot of where things stand today, future projections depend heavily on several dynamic factors:

- Continued integration with leading blockchains

- Regulatory clarity around crypto assets

- Technological advancements enhancing network security

- Growth in sectors relying on real-world data inputs

Given these variables, stakeholders should remain vigilant about macroeconomic conditions influencing investor behavior across global markets.

Risks That Could Affect Future Prices

Potential risks include:

- Regulatory crackdowns that restrict oracle services

- Security breaches compromising node integrity

- Competition from emerging oracle solutions offering similar functionalities

These elements could lead to short-term volatility but also present opportunities if they catalyze innovation within the space.

Summary: Tracking Link Token Amidst Evolving Blockchain Trends

In summary, as of late May 2025, Link’s approximate value at $6.50 USD per token reflects its ongoing relevance within an expanding blockchain ecosystem reliant on secure external data sources. Its integration into prominent networks underscores its vital role in enabling complex decentralized applications across finance, gaming, NFTs—and beyond.

Investors should consider not only current prices but also underlying factors driving demand—including technological progressions and regulatory landscapes—to make informed decisions aligned with long-term trends rather than short-term fluctuations.

Keywords: Chainlink price today | LINK token value | Blockchain oracle network | Decentralized finance | Crypto market analysis 2025 | Cryptocurrency investment tips

Disclaimer:Contains third-party content. Not financial advice.

See Terms and Conditions.

Common Services and Platforms in the DeFi Ecosystem

The decentralized finance (DeFi) ecosystem has revolutionized traditional financial services by leveraging blockchain technology to create open, transparent, and permissionless platforms. As DeFi continues to grow rapidly, understanding its core services and key platforms is essential for users, investors, and developers alike. This article explores the most common offerings within DeFi, providing a comprehensive overview of how these components work together to shape the future of finance.

What Are DeFi Services?

DeFi services encompass a broad range of financial activities that operate without centralized intermediaries like banks or brokerages. Instead, smart contracts—self-executing code stored on blockchains—automate transactions and enforce rules transparently. These services aim to democratize access to financial tools by making them accessible globally and removing barriers such as geographic restrictions or credit checks.

The primary categories include lending and borrowing platforms, decentralized exchanges (DEXs), yield farming protocols, stablecoins, and prediction markets. Each serves a specific purpose but often integrates with others within the ecosystem to provide seamless user experiences.

Lending and Borrowing Platforms

Lending protocols are among the earliest innovations in DeFi that mirror traditional banking functions but operate in a decentralized manner. They enable users to lend their crypto assets out for interest or borrow against collateral without involving banks or other intermediaries.

Aave is one of the most prominent examples; it allows users to lend various cryptocurrencies while earning interest or borrow assets at variable rates based on market conditions. Its flexible features include flash loans—unsecured loans executed within a single transaction—which have opened new possibilities for arbitrageurs and developers.

Similarly, Compound offers an algorithmic money market where supply rates fluctuate depending on supply-demand dynamics. Users can earn interest by supplying assets or take out loans using their crypto holdings as collateral.

MakerDAO, distinct from pure lending platforms, provides stability through its governance model that issues DAI—a decentralized stablecoin pegged 1:1 with USD. Users can lock collateral into Maker vaults to generate DAI tokens used across various DeFi applications.

Decentralized Exchanges (DEXs)

Decentralized exchanges facilitate peer-to-peer trading directly from user wallets without relying on centralized order books or custodianship of funds. They use automated market makers (AMMs), which rely on liquidity pools instead of traditional order matching systems.

Uniswap, arguably the most popular DEX globally, exemplifies this model with its simple interface allowing anyone to swap tokens instantly via liquidity pools funded by other users who earn fees proportional to their contribution’s size.

Other notable DEXs include SushiSwap, which originated as a fork of Uniswap but added community-driven features like staking rewards for liquidity providers; it has gained significant traction due partly due to its governance token SUSHI.

Curve Finance specializes in stablecoin trading with low slippage thanks to optimized algorithms tailored for assets pegged closely together—ideal for traders seeking minimal price impact when swapping USDC for USDT or similar pairs.

Yield Farming & Liquidity Provision

Yield farming involves providing liquidity—depositing tokens into protocols—to earn returns often higher than traditional savings accounts but accompanied by increased risk levels such as impermanent loss or smart contract vulnerabilities.

Platforms like Yearn.finance aggregate multiple yield opportunities across different protocols automatically optimizing yields based on current conditions. Users deposit tokens into Yearn vaults that deploy funds into various strategies aiming at maximizing returns while managing risks effectively.

SushiSwap also offers yield farming options through its liquidity pools where participants stake pairs like ETH/USDT earning transaction fees plus additional incentives via SUSHI tokens—a process incentivizing active participation in maintaining healthy markets within the ecosystem.

Stablecoins: The Cornerstone Assets

Stablecoins are digital assets designed explicitly for stability—they maintain peg values close enough that they serve as reliable mediums of exchange within DeFi environments rather than volatile cryptocurrencies like Bitcoin (BTC).

- DAI, created by MakerDAO’s protocol using overcollateralized crypto assets such as ETH; it maintains decentralization while offering stability.

- USDC, issued jointly by Circle Financial and Coinbase; widely adopted due to regulatory compliance.

- Tether (USDT) remains one of the most traded stablecoins despite ongoing debates about transparency because of its extensive adoption across exchanges worldwide.

These coins underpin many DeFi activities—from trading pairs on DEXs—and serve as safe havens during volatile periods when traders seek refuge from price swings elsewhere in crypto markets.

Prediction Markets & Oracles

Prediction markets allow participants betting on future events’ outcomes—for example election results—or even sports scores—all conducted securely via blockchain-based smart contracts ensuring transparency around odds-setting processes.

Platforms like Augur enable users not only bet but also create custom markets covering diverse topics ranging from politics' outcomes till economic indicators’ movements—all settled automatically once event results are verified externally through oracle feeds provided primarily by Chainlink's network infrastructure.

Oracles play an essential role here—they bridge real-world data with blockchain environments ensuring accurate information feeds necessary for fair settlement processes in prediction markets.

Recent Trends Shaping Core Platforms

Over recent years, regulatory scrutiny has intensified globally—with agencies like SEC scrutinizing certain projects suspected of unregistered securities issuance—and this has prompted many platforms toward increased transparency standards including audits and compliance measures aimed at safeguarding investor interests while maintaining decentralization principles effectively balancing innovation versus regulation adherence.

Security remains paramount amid frequent high-profile hacks exposing vulnerabilities inherent in complex smart contracts architectures leading developers investing heavily into security audits alongside bug bounty programs designed explicitly toward identifying potential flaws before exploitation occurs.