Popular Posts

We're thrilled to announce that JUDAO 3.0, a decentralized autonomous protocol built on Polygon & AI tech, is now officially part of the JuCoin ecosystem! This collaboration initiated by NordCore Labs will focus on DAO node operations and on-chain incentive mechanisms.

🔗 JUDAO 3.0 has completed JU computing power procurement

⚙️ Will participate in JuChain ecosystem node operations

🤝 Gradually integrating into on-chain governance

JuCoin will continue providing technical support to co-build an open Web3 ecosystem! Stay tuned for on-chain updates.

JuCoin Community

2025-07-31 06:25

🚀 JUDAO 3.0 Joins JuCoin Ecosystem!

Disclaimer:Contains third-party content. Not financial advice.

See Terms and Conditions.

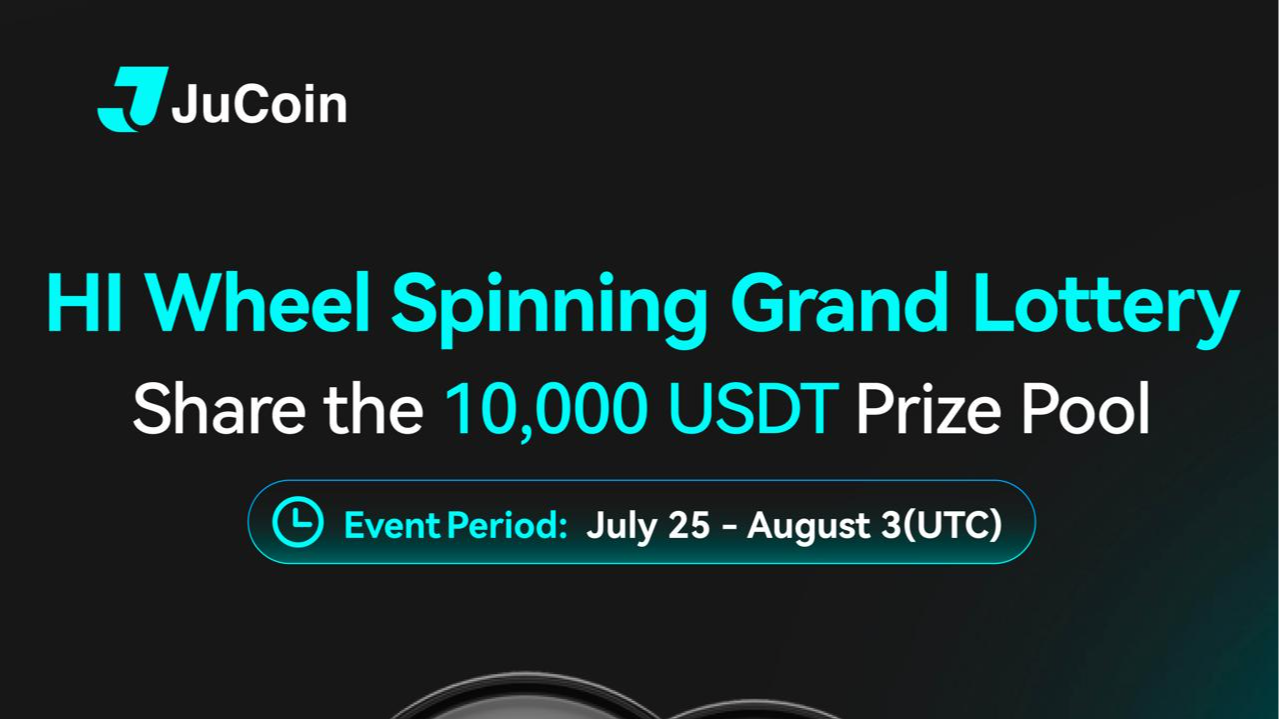

Time: 2025/7/25 13:00 - 2025/8/3 15:59 (UTC)

🔷Completing regular tasks, daily tasks, and step-by-step tasks can earn you a chance to win a USDT airdrop and share a prize pool of 10,000 USDT.

JuCoin Community

2025-07-31 06:22

HI Wheel Draw: Share the 10,000 USDT prize pool!

Disclaimer:Contains third-party content. Not financial advice.

See Terms and Conditions.

How Does the Rebranding of EOS to Vaulta Affect Its Market Perception and Value?

The recent rebranding of EOS to Vaulta marks a significant shift in the cryptocurrency landscape, sparking widespread discussion among investors, developers, and industry analysts. This strategic move aims to reshape how the project is perceived in terms of security, innovation, and market relevance. Understanding its implications requires examining both the background of EOS and what Vaulta represents moving forward.

Background of EOS: From Launch to Challenges

EOS was launched in 2017 by blockchain pioneers Dan Larimer and Brendan Blumer. It quickly gained attention for its high-performance decentralized operating system designed for scalable smart contracts and dApps (decentralized applications). At its peak, EOS was considered one of the leading platforms in blockchain technology due to its innovative consensus mechanism—Delegated Proof-of-Stake (DPoS)—and developer-friendly environment.

However, despite early success, EOS faced persistent governance issues such as centralization concerns and disputes over decision-making processes. Security vulnerabilities also emerged over time, raising questions about platform stability. These challenges affected community trust and investor confidence—factors crucial for long-term sustainability.

Despite these hurdles, EOS maintained a dedicated user base that continued contributing to its ecosystem's growth. Over time, efforts were made to improve protocol security and governance structures; however, perceptions around past controversies lingered within broader market narratives.

The Rationale Behind Rebranding: From EOS to Vaulta

In late 2024, the project announced it would rebrand from EOS to Vaulta—a move signaling a fresh start aimed at overcoming previous limitations. The primary motivation appears rooted in distancing itself from past governance scandals while emphasizing new strategic priorities centered on decentralized finance (DeFi).

Vaulta’s branding underscores a renewed focus on security enhancements—an essential aspect given recent DeFi exploits across various platforms—and aims at positioning itself as a trustworthy player within this rapidly expanding sector. By aligning with DeFi trends such as lending protocols or stablecoins integration, Vaulta seeks not only technological upgrades but also improved market perception among investors seeking reliable financial services on blockchain.

This rebranding can be viewed as an effort by leadership to redefine identity amidst fierce competition among DeFi projects like Aave or Compound that are capturing investor interest through transparency and robust security measures.

Market Context: Why Rebranding Matters Now

The cryptocurrency industry has experienced exponential growth in DeFi applications over recent years. As users increasingly look toward decentralized financial solutions for borrowing/lending or asset management without intermediaries—the sector has become highly competitive yet fragmented.

In this environment:

- Projects that successfully reposition themselves with clear value propositions tend to attract more investment.

- Transparency around technical improvements enhances credibility.

- Community engagement fosters trust during transitional phases like rebranding.

Rebranding efforts like Vaulta’s are therefore critical—they serve both marketing purposes by signaling change—and practical ones by implementing technical upgrades aligned with current industry standards.

Impact on Market Perception

Market perception following such a major change depends heavily on community response and tangible progress made post-rebrand:

- Community Engagement: Active communication through updates or meetings helps build trust; positive feedback can boost confidence.

- Technical Improvements: Upgrades focusing on smart contract efficiency alongside enhanced security protocols demonstrate commitment toward reliability—a key factor influencing investor sentiment.

- Partnerships & Collaborations: Strategic alliances within DeFi ecosystems reinforce credibility; they suggest validation from established players which can positively influence perception.

However, skepticism remains prevalent among some segments who question whether rebranding alone addresses core issues like governance transparency or whether it is merely superficial branding effort aimed at attracting new investors without substantial changes underneath.

Short-Term Market Effects: Token Price Fluctuations

Following any major announcement—including rebrands—cryptocurrency tokens often experience volatility driven by speculative trading behaviors:

- Some investors interpret the move optimistically expecting future growth opportunities.

- Others may react cautiously due to uncertainties about actual implementation success or lingering doubts about past controversies affecting long-term viability.

Since specific data points are limited regarding immediate price movements post-rebrand for Vaulta/EOS specifically—but generally speaking—such transitions tend initially toward increased volatility before settling into new valuation levels based on subsequent developments.

Factors Influencing Short-Term Price Movements:

- Investor sentiment shifts

- Technical upgrade announcements

- Partnership news

- Broader market conditions during transition periods

Risks & Challenges Ahead

While rebranding offers potential benefits—including improved brand image—it also introduces risks that could impact future performance:

Regulatory Scrutiny

Regulators worldwide are increasingly attentive towards crypto projects involved in financial activities like DeFi services; any perceived attempt at evasion or lack of compliance could invite legal challenges impacting operations negatively.

Community Trust & Adoption

Maintaining community support is vital; if stakeholders perceive insufficient progress or mismanagement during transition phases—as seen historically with other projects—they may withdraw support leading to decreased adoption rates which directly affect token value stability.

Competitive Landscape

Vaulta faces stiff competition from well-established DeFi platforms offering similar features but with proven track records for transparency/security—which means differentiation through innovation becomes critical.

Technical Complexity During Transition

Implementing significant upgrades while ensuring network stability poses inherent risks; bugs or vulnerabilities introduced inadvertently could undermine user confidence further if not managed carefully.

Strategic Recommendations Moving Forward

For vaulta’s sustained success—and ultimately improving market perception—the following strategies should be prioritized:

Transparent Communication

Regular updates regarding development milestones help reassure stakeholders about ongoing progress.Delivering Tangible Results

Focus on deploying secure smart contracts coupled with real-world partnerships demonstrating ecosystem expansion.Engaging Community

Active forums where users can voice concerns foster loyalty amid change processes.Compliance Readiness

Proactively addressing regulatory requirements minimizes legal risks down the line.

Final Thoughts: Navigating Change Effectively

Rebranding from EOS to Vaulta signifies an ambitious attempt at revitalizing a legacy project amid evolving industry demands—in particular emphasizing decentralization-focused finance solutions backed by stronger security measures.. While initial reactions show mixed sentiments influenced largely by speculation rather than concrete outcomes yet—success will depend heavily upon how well technical improvements translate into real-world utility combined with transparent stakeholder engagement..

As the crypto space continues shifting rapidly towards more sophisticated financial instruments built atop secure blockchains—with increasing regulatory oversight—the ability of projects like Vaulta/EOS's successor—to adapt swiftly will determine their long-term relevance—and ultimately their impact on market perception and valuation.

JCUSER-F1IIaxXA

2025-06-09 20:19

How does the rebranding of EOS to Vaulta affect its market perception and value?

How Does the Rebranding of EOS to Vaulta Affect Its Market Perception and Value?

The recent rebranding of EOS to Vaulta marks a significant shift in the cryptocurrency landscape, sparking widespread discussion among investors, developers, and industry analysts. This strategic move aims to reshape how the project is perceived in terms of security, innovation, and market relevance. Understanding its implications requires examining both the background of EOS and what Vaulta represents moving forward.

Background of EOS: From Launch to Challenges

EOS was launched in 2017 by blockchain pioneers Dan Larimer and Brendan Blumer. It quickly gained attention for its high-performance decentralized operating system designed for scalable smart contracts and dApps (decentralized applications). At its peak, EOS was considered one of the leading platforms in blockchain technology due to its innovative consensus mechanism—Delegated Proof-of-Stake (DPoS)—and developer-friendly environment.

However, despite early success, EOS faced persistent governance issues such as centralization concerns and disputes over decision-making processes. Security vulnerabilities also emerged over time, raising questions about platform stability. These challenges affected community trust and investor confidence—factors crucial for long-term sustainability.

Despite these hurdles, EOS maintained a dedicated user base that continued contributing to its ecosystem's growth. Over time, efforts were made to improve protocol security and governance structures; however, perceptions around past controversies lingered within broader market narratives.

The Rationale Behind Rebranding: From EOS to Vaulta

In late 2024, the project announced it would rebrand from EOS to Vaulta—a move signaling a fresh start aimed at overcoming previous limitations. The primary motivation appears rooted in distancing itself from past governance scandals while emphasizing new strategic priorities centered on decentralized finance (DeFi).

Vaulta’s branding underscores a renewed focus on security enhancements—an essential aspect given recent DeFi exploits across various platforms—and aims at positioning itself as a trustworthy player within this rapidly expanding sector. By aligning with DeFi trends such as lending protocols or stablecoins integration, Vaulta seeks not only technological upgrades but also improved market perception among investors seeking reliable financial services on blockchain.

This rebranding can be viewed as an effort by leadership to redefine identity amidst fierce competition among DeFi projects like Aave or Compound that are capturing investor interest through transparency and robust security measures.

Market Context: Why Rebranding Matters Now

The cryptocurrency industry has experienced exponential growth in DeFi applications over recent years. As users increasingly look toward decentralized financial solutions for borrowing/lending or asset management without intermediaries—the sector has become highly competitive yet fragmented.

In this environment:

- Projects that successfully reposition themselves with clear value propositions tend to attract more investment.

- Transparency around technical improvements enhances credibility.

- Community engagement fosters trust during transitional phases like rebranding.

Rebranding efforts like Vaulta’s are therefore critical—they serve both marketing purposes by signaling change—and practical ones by implementing technical upgrades aligned with current industry standards.

Impact on Market Perception

Market perception following such a major change depends heavily on community response and tangible progress made post-rebrand:

- Community Engagement: Active communication through updates or meetings helps build trust; positive feedback can boost confidence.

- Technical Improvements: Upgrades focusing on smart contract efficiency alongside enhanced security protocols demonstrate commitment toward reliability—a key factor influencing investor sentiment.

- Partnerships & Collaborations: Strategic alliances within DeFi ecosystems reinforce credibility; they suggest validation from established players which can positively influence perception.

However, skepticism remains prevalent among some segments who question whether rebranding alone addresses core issues like governance transparency or whether it is merely superficial branding effort aimed at attracting new investors without substantial changes underneath.

Short-Term Market Effects: Token Price Fluctuations

Following any major announcement—including rebrands—cryptocurrency tokens often experience volatility driven by speculative trading behaviors:

- Some investors interpret the move optimistically expecting future growth opportunities.

- Others may react cautiously due to uncertainties about actual implementation success or lingering doubts about past controversies affecting long-term viability.

Since specific data points are limited regarding immediate price movements post-rebrand for Vaulta/EOS specifically—but generally speaking—such transitions tend initially toward increased volatility before settling into new valuation levels based on subsequent developments.

Factors Influencing Short-Term Price Movements:

- Investor sentiment shifts

- Technical upgrade announcements

- Partnership news

- Broader market conditions during transition periods

Risks & Challenges Ahead

While rebranding offers potential benefits—including improved brand image—it also introduces risks that could impact future performance:

Regulatory Scrutiny

Regulators worldwide are increasingly attentive towards crypto projects involved in financial activities like DeFi services; any perceived attempt at evasion or lack of compliance could invite legal challenges impacting operations negatively.

Community Trust & Adoption

Maintaining community support is vital; if stakeholders perceive insufficient progress or mismanagement during transition phases—as seen historically with other projects—they may withdraw support leading to decreased adoption rates which directly affect token value stability.

Competitive Landscape

Vaulta faces stiff competition from well-established DeFi platforms offering similar features but with proven track records for transparency/security—which means differentiation through innovation becomes critical.

Technical Complexity During Transition

Implementing significant upgrades while ensuring network stability poses inherent risks; bugs or vulnerabilities introduced inadvertently could undermine user confidence further if not managed carefully.

Strategic Recommendations Moving Forward

For vaulta’s sustained success—and ultimately improving market perception—the following strategies should be prioritized:

Transparent Communication

Regular updates regarding development milestones help reassure stakeholders about ongoing progress.Delivering Tangible Results

Focus on deploying secure smart contracts coupled with real-world partnerships demonstrating ecosystem expansion.Engaging Community

Active forums where users can voice concerns foster loyalty amid change processes.Compliance Readiness

Proactively addressing regulatory requirements minimizes legal risks down the line.

Final Thoughts: Navigating Change Effectively

Rebranding from EOS to Vaulta signifies an ambitious attempt at revitalizing a legacy project amid evolving industry demands—in particular emphasizing decentralization-focused finance solutions backed by stronger security measures.. While initial reactions show mixed sentiments influenced largely by speculation rather than concrete outcomes yet—success will depend heavily upon how well technical improvements translate into real-world utility combined with transparent stakeholder engagement..

As the crypto space continues shifting rapidly towards more sophisticated financial instruments built atop secure blockchains—with increasing regulatory oversight—the ability of projects like Vaulta/EOS's successor—to adapt swiftly will determine their long-term relevance—and ultimately their impact on market perception and valuation.

Disclaimer:Contains third-party content. Not financial advice.

See Terms and Conditions.

Recent Bitcoin Rally and Its Effect on Bearish Market Positions

Understanding the Impact of Bitcoin’s Price Surge on Short-Selling Strategies

The recent rally in Bitcoin (BTC) has captured significant attention within the cryptocurrency community and financial markets at large. On June 8, 2025, Bitcoin surged to a new high of $105,460, representing a 2.36% increase from the previous day. This sharp upward movement has not only influenced market sentiment but also reshaped investor behavior—particularly among those holding bearish bets or short positions.

How Price Movements Influence Market Sentiment

Bitcoin’s rapid price appreciation often triggers shifts in investor outlooks. Historically, such rallies tend to reduce bearish sentiment as traders become more optimistic about future gains. The current rally exemplifies this trend: many investors who previously anticipated a decline are now reconsidering their positions. As a result, there has been a notable decrease in bearish bets—investors are closing short positions or converting them into long ones to capitalize on the bullish momentum.

Futures Contracts Indicate Continued Optimism

Despite the rally's immediate effects on spot trading and investor sentiment, futures markets reveal an even more bullish outlook among certain segments of traders. Futures contracts with higher premiums suggest that some investors still believe in potential further increases in Bitcoin’s price down the line. These derivatives serve as indicators of market expectations for future volatility and growth; elevated premiums imply confidence that prices could rise beyond current levels.

The Role of ETFs During Market Fluctuations

Exchange-traded funds (ETFs), which provide exposure to cryptocurrencies without direct ownership, have shown nearly flat performance during this period. This stability indicates mixed sentiments: while some investors remain optimistic about short-term gains driven by recent rallies, others exhibit caution regarding long-term stability amid ongoing market uncertainties. ETFs’ muted response underscores that not all market participants are uniformly convinced about sustained upward momentum.

Investor Behavior Shifts Amid Price Surges

The surge in Bitcoin's value has prompted significant behavioral changes among traders and institutional investors alike:

- Closing Short Positions: Traders who bet against BTC are increasingly liquidating their shorts.

- Increasing Long Positions: Many are shifting strategies toward buying or holding long positions to benefit from continued growth.

- Adjusting Risk Tolerance: Investors appear more willing to accept higher risk levels given positive recent trends.

This collective shift reflects an overarching move toward optimism but also highlights increased vulnerability if prices reverse suddenly.

Broader Cryptocurrency Market Trends Supporting Bullish Sentiment

Bitcoin does not operate in isolation; its movements often influence broader crypto markets:

- Growing interest from institutional investors

- Increased retail participation

- Rising adoption rates across various sectors

These factors contribute to overall bullish trends within cryptocurrencies and help explain why bearish bets have diminished during this rally phase.

Potential Risks Associated With Rapid Market Changes

While rising prices can generate profit opportunities, they also carry inherent risks:

- Market Volatility: Rapid surges can lead to sharp corrections if investor enthusiasm wanes unexpectedly.

- Overleveraging: Elevated futures premiums may encourage risky leverage strategies that amplify losses during downturns.

- Market Manipulation Concerns: Sudden price spikes sometimes attract manipulative practices which can distort true market fundamentals.

Investors should remain cautious and employ risk management techniques when navigating such volatile environments.

Historical Context: Cycles of Bullish Rallies and Corrections

Cryptocurrency markets have historically experienced cycles characterized by rapid rallies followed by corrections:

- Past bull runs were often preceded by accumulation phases where bearish bets declined sharply.

- Corrections typically follow after speculative excesses or macroeconomic shifts.

Understanding these patterns helps contextualize current developments—highlighting that while optimism is justified now, prudence remains essential due to past volatility cycles.

Expert Forecasts on Future Trends

Financial analysts closely monitor these developments for signs of sustainability:

- Some experts predict continued upward momentum if institutional interest persists

- Others warn against overexposure amid potential correction risks

Overall consensus emphasizes balancing optimism with caution—recognizing that while recent gains boost confidence temporarily, underlying fundamentals must support sustained growth for lasting market health.

Monitoring Investor Strategies Moving Forward

As Bitcoin continues its upward trajectory post-rally:

- Investors should stay informed about macroeconomic factors influencing crypto markets

- Diversification remains key amidst fluctuating sentiment

- Regularly reviewing open positions helps manage exposure effectively

Adapting strategies based on evolving data ensures better resilience against sudden reversals typical of volatile cryptocurrency environments.

Tracking Broader Economic Indicators Affecting Crypto Markets

Beyond internal crypto dynamics, external economic variables play crucial roles:

- Currency exchange rates (e.g., SGD/CHF)

- Regulatory developments worldwide

- Macroeconomic policies impacting liquidity

For example, fluctuations like those seen recently between SGD/CHF reflect ongoing global financial activity influencing investment flows into cryptocurrencies like BTC.

How Recent Rally Shapes Long-Term Investment Outlook

The swift shift from bearishness toward optimism following BTC’s rally signifies changing perceptions among both retail and institutional players alike. While this environment offers promising opportunities for profit-taking or portfolio diversification,

it is vital for investors—and especially newcomers—to approach with due diligence,

considering both technical signals (such as moving averages) and fundamental factors (like network adoption). Maintaining awareness of historical patterns helps mitigate risks associated with sudden corrections after rapid surges.

Staying Informed Is Key During Volatile Periods

Given how quickly sentiment can change—as evidenced by past cycles—it is essential for stakeholders at all levels:

- To follow credible news sources covering regulatory updates,

- To analyze technical charts regularly,

- To understand macroeconomic influences shaping crypto valuations,

This comprehensive approach enables better decision-making amid unpredictable swings characteristic of cryptocurrency markets.

In summary,

the recent Bitcoin rally has significantly altered trader positioning—from widespread bearish bets towards increased bullishness—reflecting heightened confidence driven by rising prices and positive market signals. However,investors must remain vigilant regarding potential volatility spikes,continuously adapt their strategies based on evolving data,and maintain a balanced perspective rooted in historical context when navigating these dynamic digital asset landscapes

JCUSER-WVMdslBw

2025-06-09 20:03

How did the recent BTC rally impact bearish bets in the market?

Recent Bitcoin Rally and Its Effect on Bearish Market Positions

Understanding the Impact of Bitcoin’s Price Surge on Short-Selling Strategies

The recent rally in Bitcoin (BTC) has captured significant attention within the cryptocurrency community and financial markets at large. On June 8, 2025, Bitcoin surged to a new high of $105,460, representing a 2.36% increase from the previous day. This sharp upward movement has not only influenced market sentiment but also reshaped investor behavior—particularly among those holding bearish bets or short positions.

How Price Movements Influence Market Sentiment

Bitcoin’s rapid price appreciation often triggers shifts in investor outlooks. Historically, such rallies tend to reduce bearish sentiment as traders become more optimistic about future gains. The current rally exemplifies this trend: many investors who previously anticipated a decline are now reconsidering their positions. As a result, there has been a notable decrease in bearish bets—investors are closing short positions or converting them into long ones to capitalize on the bullish momentum.

Futures Contracts Indicate Continued Optimism

Despite the rally's immediate effects on spot trading and investor sentiment, futures markets reveal an even more bullish outlook among certain segments of traders. Futures contracts with higher premiums suggest that some investors still believe in potential further increases in Bitcoin’s price down the line. These derivatives serve as indicators of market expectations for future volatility and growth; elevated premiums imply confidence that prices could rise beyond current levels.

The Role of ETFs During Market Fluctuations

Exchange-traded funds (ETFs), which provide exposure to cryptocurrencies without direct ownership, have shown nearly flat performance during this period. This stability indicates mixed sentiments: while some investors remain optimistic about short-term gains driven by recent rallies, others exhibit caution regarding long-term stability amid ongoing market uncertainties. ETFs’ muted response underscores that not all market participants are uniformly convinced about sustained upward momentum.

Investor Behavior Shifts Amid Price Surges

The surge in Bitcoin's value has prompted significant behavioral changes among traders and institutional investors alike:

- Closing Short Positions: Traders who bet against BTC are increasingly liquidating their shorts.

- Increasing Long Positions: Many are shifting strategies toward buying or holding long positions to benefit from continued growth.

- Adjusting Risk Tolerance: Investors appear more willing to accept higher risk levels given positive recent trends.

This collective shift reflects an overarching move toward optimism but also highlights increased vulnerability if prices reverse suddenly.

Broader Cryptocurrency Market Trends Supporting Bullish Sentiment

Bitcoin does not operate in isolation; its movements often influence broader crypto markets:

- Growing interest from institutional investors

- Increased retail participation

- Rising adoption rates across various sectors

These factors contribute to overall bullish trends within cryptocurrencies and help explain why bearish bets have diminished during this rally phase.

Potential Risks Associated With Rapid Market Changes

While rising prices can generate profit opportunities, they also carry inherent risks:

- Market Volatility: Rapid surges can lead to sharp corrections if investor enthusiasm wanes unexpectedly.

- Overleveraging: Elevated futures premiums may encourage risky leverage strategies that amplify losses during downturns.

- Market Manipulation Concerns: Sudden price spikes sometimes attract manipulative practices which can distort true market fundamentals.

Investors should remain cautious and employ risk management techniques when navigating such volatile environments.

Historical Context: Cycles of Bullish Rallies and Corrections

Cryptocurrency markets have historically experienced cycles characterized by rapid rallies followed by corrections:

- Past bull runs were often preceded by accumulation phases where bearish bets declined sharply.

- Corrections typically follow after speculative excesses or macroeconomic shifts.

Understanding these patterns helps contextualize current developments—highlighting that while optimism is justified now, prudence remains essential due to past volatility cycles.

Expert Forecasts on Future Trends

Financial analysts closely monitor these developments for signs of sustainability:

- Some experts predict continued upward momentum if institutional interest persists

- Others warn against overexposure amid potential correction risks

Overall consensus emphasizes balancing optimism with caution—recognizing that while recent gains boost confidence temporarily, underlying fundamentals must support sustained growth for lasting market health.

Monitoring Investor Strategies Moving Forward

As Bitcoin continues its upward trajectory post-rally:

- Investors should stay informed about macroeconomic factors influencing crypto markets

- Diversification remains key amidst fluctuating sentiment

- Regularly reviewing open positions helps manage exposure effectively

Adapting strategies based on evolving data ensures better resilience against sudden reversals typical of volatile cryptocurrency environments.

Tracking Broader Economic Indicators Affecting Crypto Markets

Beyond internal crypto dynamics, external economic variables play crucial roles:

- Currency exchange rates (e.g., SGD/CHF)

- Regulatory developments worldwide

- Macroeconomic policies impacting liquidity

For example, fluctuations like those seen recently between SGD/CHF reflect ongoing global financial activity influencing investment flows into cryptocurrencies like BTC.

How Recent Rally Shapes Long-Term Investment Outlook

The swift shift from bearishness toward optimism following BTC’s rally signifies changing perceptions among both retail and institutional players alike. While this environment offers promising opportunities for profit-taking or portfolio diversification,

it is vital for investors—and especially newcomers—to approach with due diligence,

considering both technical signals (such as moving averages) and fundamental factors (like network adoption). Maintaining awareness of historical patterns helps mitigate risks associated with sudden corrections after rapid surges.

Staying Informed Is Key During Volatile Periods

Given how quickly sentiment can change—as evidenced by past cycles—it is essential for stakeholders at all levels:

- To follow credible news sources covering regulatory updates,

- To analyze technical charts regularly,

- To understand macroeconomic influences shaping crypto valuations,

This comprehensive approach enables better decision-making amid unpredictable swings characteristic of cryptocurrency markets.

In summary,

the recent Bitcoin rally has significantly altered trader positioning—from widespread bearish bets towards increased bullishness—reflecting heightened confidence driven by rising prices and positive market signals. However,investors must remain vigilant regarding potential volatility spikes,continuously adapt their strategies based on evolving data,and maintain a balanced perspective rooted in historical context when navigating these dynamic digital asset landscapes

Disclaimer:Contains third-party content. Not financial advice.

See Terms and Conditions.

How Gas Fees Impact the Growth of Decentralized Applications

Decentralized applications (dApps) are transforming the way we interact with digital services by leveraging blockchain technology. They promise increased security, transparency, and user control. However, a significant barrier to their widespread adoption is the cost associated with executing transactions—gas fees. Understanding how these fees influence dApp development and user engagement is crucial for developers, investors, and users alike.

What Are Gas Fees in Blockchain Networks?

Gas fees are transaction costs paid by users to process operations on blockchain platforms like Ethereum. These fees compensate miners or validators for validating transactions and maintaining network security. The term "gas" quantifies the computational effort required to execute specific actions within a smart contract or transaction.

On networks such as Ethereum, gas prices fluctuate based on network demand; during periods of high activity, gas prices spike sharply. This dynamic pricing model ensures that miners prioritize higher-paying transactions but can also lead to unpredictable costs for users.

Why Do Gas Fees Matter for Decentralized Applications?

Gas fees directly impact multiple facets of dApp ecosystems:

User Experience: High transaction costs can make simple interactions prohibitively expensive. For example, in gaming or social media dApps where frequent transactions are common, elevated gas prices discourage regular use.

Scalability Challenges: As more users join a network like Ethereum during peak times, congestion increases leading to even higher gas fees—a phenomenon known as the "fee spike." This creates a feedback loop where rising costs deter new users while existing ones reduce activity.

Development Constraints: Developers face hurdles when designing cost-effective dApps due to unpredictable fee fluctuations. They often need to optimize code or delay features until network conditions improve—delays that can hinder innovation.

Economic Inequality: Elevated gas charges disproportionately affect lower-income participants who may find it difficult or impossible to afford frequent transactions—limiting inclusivity within decentralized ecosystems.

Recent Solutions Addressing High Gas Fees

The blockchain community has been actively working on solutions aimed at reducing transaction costs:

Transitioning to Ethereum 2.0

Ethereum's upgrade plan involves moving from proof-of-work (PoW) consensus mechanism toward proof-of-stake (PoS), coupled with sharding techniques designed to increase throughput and reduce congestion. Launched initially via the Beacon Chain in December 2020, Eth2 aims at lowering gas fees significantly while improving scalability.

Layer 2 Scaling Solutions

Layer 2 solutions process most transactions off-chain before settling them onto the main chain periodically:

Optimism & Arbitrum: Use rollups that bundle multiple transactions into one batch processed off-chain but secured by Ethereum’s mainnet.

Polygon (formerly Matic): Provides sidechains optimized for fast and low-cost transfers suitable for gaming and social media apps.

These innovations have already demonstrated substantial reductions in transaction costs while maintaining decentralization standards.

Alternative Blockchain Platforms

Platforms like Binance Smart Chain (BSC) and Solana offer lower-cost alternatives compared to Ethereum without sacrificing performance significantly. Their growing popularity has led some developers away from Ethereum’s costly environment toward these more affordable options.

Potential Risks of Rising Gas Fees

If current trends continue unchecked, several adverse outcomes could emerge:

User Migration: Users seeking cheaper alternatives might shift their activities elsewhere—potentially weakening Ethereum’s dominance in decentralized finance (DeFi) and NFT markets.

Developer Exodus: Costly development environments may push creators toward blockchains with lower operational expenses—reducing innovation within certain ecosystems.

Economic Barriers & Inequality: Persistently high fees could deepen economic divides by excluding less wealthy participants from engaging fully with decentralized services.

Innovation Stagnation

High unpredictability around fee levels discourages experimentation among developers who fear incurring unsustainable costs when deploying new features or protocols.

The Future Outlook for Gas Fees & dApp Growth

Addressing high gas fees remains critical if decentralized applications are expected to reach mainstream adoption levels. Ongoing upgrades like Eth2 combined with layer 2 scaling solutions show promise but require time before they become universally effective at reducing costs substantially.

Furthermore, alternative blockchains gaining traction suggest a diversification trend that could reshape how developers approach building scalable dApps—not solely relying on Ethereum's infrastructure anymore but embracing multi-chain strategies tailored for specific use cases such as gaming or enterprise solutions.

Stakeholders must also monitor regulatory developments which might influence fee structures indirectly through policies affecting cryptocurrency exchanges or blockchain governance frameworks globally.

By understanding these dynamics—the causes behind rising gas prices and ongoing technological responses—it becomes clearer why managing transaction costs is vital not just for individual projects but also for fostering sustainable growth across decentralized applications overall.

Key Takeaways:

- High gas fees hinder user engagement by making simple interactions costly.

- Scalability issues caused by congestion lead directly to increased transaction expenses.

- Innovations like Eth2 upgrades and layer 2 solutions aim at mitigating these challenges over time.

- Alternative blockchains provide cost-effective options that could shift market share away from Ethereum if high fees persist long-term.

Staying informed about evolving solutions will be essential as stakeholders work together towards creating more accessible—and ultimately more successful—decentralized application ecosystems worldwide.

Lo

2025-06-09 06:37

How do gas fees affect the growth of decentralized applications?

How Gas Fees Impact the Growth of Decentralized Applications

Decentralized applications (dApps) are transforming the way we interact with digital services by leveraging blockchain technology. They promise increased security, transparency, and user control. However, a significant barrier to their widespread adoption is the cost associated with executing transactions—gas fees. Understanding how these fees influence dApp development and user engagement is crucial for developers, investors, and users alike.

What Are Gas Fees in Blockchain Networks?

Gas fees are transaction costs paid by users to process operations on blockchain platforms like Ethereum. These fees compensate miners or validators for validating transactions and maintaining network security. The term "gas" quantifies the computational effort required to execute specific actions within a smart contract or transaction.

On networks such as Ethereum, gas prices fluctuate based on network demand; during periods of high activity, gas prices spike sharply. This dynamic pricing model ensures that miners prioritize higher-paying transactions but can also lead to unpredictable costs for users.

Why Do Gas Fees Matter for Decentralized Applications?

Gas fees directly impact multiple facets of dApp ecosystems:

User Experience: High transaction costs can make simple interactions prohibitively expensive. For example, in gaming or social media dApps where frequent transactions are common, elevated gas prices discourage regular use.

Scalability Challenges: As more users join a network like Ethereum during peak times, congestion increases leading to even higher gas fees—a phenomenon known as the "fee spike." This creates a feedback loop where rising costs deter new users while existing ones reduce activity.

Development Constraints: Developers face hurdles when designing cost-effective dApps due to unpredictable fee fluctuations. They often need to optimize code or delay features until network conditions improve—delays that can hinder innovation.

Economic Inequality: Elevated gas charges disproportionately affect lower-income participants who may find it difficult or impossible to afford frequent transactions—limiting inclusivity within decentralized ecosystems.

Recent Solutions Addressing High Gas Fees

The blockchain community has been actively working on solutions aimed at reducing transaction costs:

Transitioning to Ethereum 2.0

Ethereum's upgrade plan involves moving from proof-of-work (PoW) consensus mechanism toward proof-of-stake (PoS), coupled with sharding techniques designed to increase throughput and reduce congestion. Launched initially via the Beacon Chain in December 2020, Eth2 aims at lowering gas fees significantly while improving scalability.

Layer 2 Scaling Solutions

Layer 2 solutions process most transactions off-chain before settling them onto the main chain periodically:

Optimism & Arbitrum: Use rollups that bundle multiple transactions into one batch processed off-chain but secured by Ethereum’s mainnet.

Polygon (formerly Matic): Provides sidechains optimized for fast and low-cost transfers suitable for gaming and social media apps.

These innovations have already demonstrated substantial reductions in transaction costs while maintaining decentralization standards.

Alternative Blockchain Platforms

Platforms like Binance Smart Chain (BSC) and Solana offer lower-cost alternatives compared to Ethereum without sacrificing performance significantly. Their growing popularity has led some developers away from Ethereum’s costly environment toward these more affordable options.

Potential Risks of Rising Gas Fees

If current trends continue unchecked, several adverse outcomes could emerge:

User Migration: Users seeking cheaper alternatives might shift their activities elsewhere—potentially weakening Ethereum’s dominance in decentralized finance (DeFi) and NFT markets.

Developer Exodus: Costly development environments may push creators toward blockchains with lower operational expenses—reducing innovation within certain ecosystems.

Economic Barriers & Inequality: Persistently high fees could deepen economic divides by excluding less wealthy participants from engaging fully with decentralized services.

Innovation Stagnation

High unpredictability around fee levels discourages experimentation among developers who fear incurring unsustainable costs when deploying new features or protocols.

The Future Outlook for Gas Fees & dApp Growth

Addressing high gas fees remains critical if decentralized applications are expected to reach mainstream adoption levels. Ongoing upgrades like Eth2 combined with layer 2 scaling solutions show promise but require time before they become universally effective at reducing costs substantially.

Furthermore, alternative blockchains gaining traction suggest a diversification trend that could reshape how developers approach building scalable dApps—not solely relying on Ethereum's infrastructure anymore but embracing multi-chain strategies tailored for specific use cases such as gaming or enterprise solutions.

Stakeholders must also monitor regulatory developments which might influence fee structures indirectly through policies affecting cryptocurrency exchanges or blockchain governance frameworks globally.

By understanding these dynamics—the causes behind rising gas prices and ongoing technological responses—it becomes clearer why managing transaction costs is vital not just for individual projects but also for fostering sustainable growth across decentralized applications overall.

Key Takeaways:

- High gas fees hinder user engagement by making simple interactions costly.

- Scalability issues caused by congestion lead directly to increased transaction expenses.

- Innovations like Eth2 upgrades and layer 2 solutions aim at mitigating these challenges over time.

- Alternative blockchains provide cost-effective options that could shift market share away from Ethereum if high fees persist long-term.

Staying informed about evolving solutions will be essential as stakeholders work together towards creating more accessible—and ultimately more successful—decentralized application ecosystems worldwide.

Disclaimer:Contains third-party content. Not financial advice.

See Terms and Conditions.

What Is the BlackRock IBIT Spot Bitcoin ETF?

The BlackRock IBIT Spot Bitcoin ETF is a financial product designed to give investors exposure to Bitcoin without the need to directly purchase or hold the cryptocurrency itself. As an exchange-traded fund (ETF), it operates within traditional financial markets, allowing investors to buy and sell shares on stock exchanges just like stocks. This ETF is actively managed, meaning professional fund managers oversee its holdings and strategies to closely track Bitcoin’s price movements.

Unlike some other investment vehicles that rely on futures contracts or derivatives, the IBIT Spot Bitcoin ETF aims to mirror the actual spot price of Bitcoin. This means it holds assets that are directly linked to the current market value of Bitcoin, providing a more straightforward way for investors to participate in cryptocurrency price fluctuations through familiar investment channels.

How Does It Work?

The core mechanism behind this ETF involves holding a basket of assets—most likely including actual Bitcoins or derivatives closely tied to their value—that reflect real-time changes in Bitcoin’s market price. The fund's management team continuously adjusts its holdings based on market conditions, ensuring that its share price remains aligned with Bitcoin's spot rate.

Investors can purchase shares of this ETF via their brokerage accounts without needing specialized knowledge about digital wallets or private keys associated with cryptocurrencies. This accessibility makes it an attractive option for both institutional and retail investors seeking exposure while avoiding direct crypto ownership complexities.

Why Is It Significant?

The introduction of BlackRock’s IBIT Spot Bitcoin ETF marks a pivotal moment in mainstream finance because it bridges traditional investment methods with digital assets. Managed by one of the world’s largest asset managers—BlackRock—the product signals growing confidence among institutional players regarding cryptocurrencies as legitimate investments.

This development also responds directly to increasing investor demand for diversified portfolios that include digital assets. By offering a regulated and transparent vehicle for investing in Bitcoin, BlackRock helps reduce barriers such as security concerns and regulatory uncertainties often associated with direct crypto investments.

Key Features at a Glance

- Launch Date: February 14, 2023

- Management: Managed by BlackRock Investment Institute

- Trading Platform: Listed on NYSE under ticker symbol IBIT

- Investment Approach: Tracks bitcoin's spot price through direct holdings or derivatives

- Accessibility: No minimum investment requirements typically apply

Impact on Financial Markets

Since its launch, the BlackRock IBIT Spot Bitcoin ETF has garnered significant attention from both individual and institutional investors. Its presence has increased trading volumes in related markets such as bitcoin futures contracts and other cryptocurrency-related securities. The product has also contributed positively toward legitimizing cryptocurrencies within traditional finance sectors by demonstrating regulatory acceptance and institutional backing.

Moreover, this ETF facilitates easier access for those who may be hesitant about managing private keys or navigating complex crypto exchanges but still want exposure to bitcoin’s potential upside—and risk profile—in their portfolios.

Challenges & Future Outlook

Despite its promising prospects, there are inherent challenges tied to cryptocurrency investments—primarily volatility. The prices of digital currencies like bitcoin can fluctuate sharply due to factors including regulatory developments, technological changes, macroeconomic trends, or shifts in investor sentiment.

Regulatory scrutiny remains an ongoing concern; authorities worldwide continue evaluating how best to oversee these new financial products while protecting investors from potential risks such as market manipulation or fraud. As regulators become more comfortable approving similar products over time, we may see further innovations like additional ETFs tracking different cryptocurrencies or related indices.

Looking ahead, if successful—and if broader acceptance continues—the BlackRock IBIT Spot Bitcoin ETF could pave the way for more mainstream adoption of crypto-based investment solutions across global markets. Increased participation from large institutions might lead not only toward greater liquidity but also toward stabilization efforts within volatile digital asset markets.

Why Investors Are Turning Toward Cryptocurrency ETFs

Investors increasingly seek alternative ways into emerging asset classes like cryptocurrencies due to several compelling reasons:

- Simplified access via regulated platforms

- Reduced security risks compared with holding private keys

- Greater transparency through established custodians

- Portfolio diversification benefits

Cryptocurrency ETFs serve as an essential bridge between innovative blockchain technology and conventional finance systems—making them appealing options amid evolving investor preferences.

Regulatory Environment Surrounding Cryptocurrency ETFs

The approval process for cryptocurrency-based ETFs varies significantly across jurisdictions but generally involves rigorous review by securities regulators such as the U.S Securities and Exchange Commission (SEC). While some proposals have faced delays due primarilyto concerns over market manipulationand lackof sufficient oversight,the recent approvalof productslikeBlackrock'sIBITindicatesa gradual shifttowardacceptanceandregulatory clarityinthisspace.This trend suggeststhat future offeringsmay benefitfrom clearer guidelinesand increased confidenceamonginvestorsandissuers alike.

Final Thoughts: The Long-Term Potential

As mainstream financial institutions continue embracing cryptocurrencies through products like blackrock ibit spot bitcoin etf,the landscape is poisedfor further growthand innovation.Investors who adopt these vehicles gain opportunitiesfor diversificationwhile benefitingfromthe credibilityofferedby established firms.Blackrock's move signals thatcryptocurrenciesare becoming integral componentswithin diversified portfolios,and ongoing developments could reshape how individualsand institutions approach digital asset investments moving forward.

kai

2025-06-07 17:11

What is the BlackRock IBIT Spot Bitcoin ETF?

What Is the BlackRock IBIT Spot Bitcoin ETF?

The BlackRock IBIT Spot Bitcoin ETF is a financial product designed to give investors exposure to Bitcoin without the need to directly purchase or hold the cryptocurrency itself. As an exchange-traded fund (ETF), it operates within traditional financial markets, allowing investors to buy and sell shares on stock exchanges just like stocks. This ETF is actively managed, meaning professional fund managers oversee its holdings and strategies to closely track Bitcoin’s price movements.

Unlike some other investment vehicles that rely on futures contracts or derivatives, the IBIT Spot Bitcoin ETF aims to mirror the actual spot price of Bitcoin. This means it holds assets that are directly linked to the current market value of Bitcoin, providing a more straightforward way for investors to participate in cryptocurrency price fluctuations through familiar investment channels.

How Does It Work?

The core mechanism behind this ETF involves holding a basket of assets—most likely including actual Bitcoins or derivatives closely tied to their value—that reflect real-time changes in Bitcoin’s market price. The fund's management team continuously adjusts its holdings based on market conditions, ensuring that its share price remains aligned with Bitcoin's spot rate.

Investors can purchase shares of this ETF via their brokerage accounts without needing specialized knowledge about digital wallets or private keys associated with cryptocurrencies. This accessibility makes it an attractive option for both institutional and retail investors seeking exposure while avoiding direct crypto ownership complexities.

Why Is It Significant?

The introduction of BlackRock’s IBIT Spot Bitcoin ETF marks a pivotal moment in mainstream finance because it bridges traditional investment methods with digital assets. Managed by one of the world’s largest asset managers—BlackRock—the product signals growing confidence among institutional players regarding cryptocurrencies as legitimate investments.

This development also responds directly to increasing investor demand for diversified portfolios that include digital assets. By offering a regulated and transparent vehicle for investing in Bitcoin, BlackRock helps reduce barriers such as security concerns and regulatory uncertainties often associated with direct crypto investments.

Key Features at a Glance

- Launch Date: February 14, 2023

- Management: Managed by BlackRock Investment Institute

- Trading Platform: Listed on NYSE under ticker symbol IBIT

- Investment Approach: Tracks bitcoin's spot price through direct holdings or derivatives

- Accessibility: No minimum investment requirements typically apply

Impact on Financial Markets

Since its launch, the BlackRock IBIT Spot Bitcoin ETF has garnered significant attention from both individual and institutional investors. Its presence has increased trading volumes in related markets such as bitcoin futures contracts and other cryptocurrency-related securities. The product has also contributed positively toward legitimizing cryptocurrencies within traditional finance sectors by demonstrating regulatory acceptance and institutional backing.

Moreover, this ETF facilitates easier access for those who may be hesitant about managing private keys or navigating complex crypto exchanges but still want exposure to bitcoin’s potential upside—and risk profile—in their portfolios.

Challenges & Future Outlook

Despite its promising prospects, there are inherent challenges tied to cryptocurrency investments—primarily volatility. The prices of digital currencies like bitcoin can fluctuate sharply due to factors including regulatory developments, technological changes, macroeconomic trends, or shifts in investor sentiment.

Regulatory scrutiny remains an ongoing concern; authorities worldwide continue evaluating how best to oversee these new financial products while protecting investors from potential risks such as market manipulation or fraud. As regulators become more comfortable approving similar products over time, we may see further innovations like additional ETFs tracking different cryptocurrencies or related indices.

Looking ahead, if successful—and if broader acceptance continues—the BlackRock IBIT Spot Bitcoin ETF could pave the way for more mainstream adoption of crypto-based investment solutions across global markets. Increased participation from large institutions might lead not only toward greater liquidity but also toward stabilization efforts within volatile digital asset markets.

Why Investors Are Turning Toward Cryptocurrency ETFs

Investors increasingly seek alternative ways into emerging asset classes like cryptocurrencies due to several compelling reasons:

- Simplified access via regulated platforms

- Reduced security risks compared with holding private keys

- Greater transparency through established custodians

- Portfolio diversification benefits

Cryptocurrency ETFs serve as an essential bridge between innovative blockchain technology and conventional finance systems—making them appealing options amid evolving investor preferences.

Regulatory Environment Surrounding Cryptocurrency ETFs

The approval process for cryptocurrency-based ETFs varies significantly across jurisdictions but generally involves rigorous review by securities regulators such as the U.S Securities and Exchange Commission (SEC). While some proposals have faced delays due primarilyto concerns over market manipulationand lackof sufficient oversight,the recent approvalof productslikeBlackrock'sIBITindicatesa gradual shifttowardacceptanceandregulatory clarityinthisspace.This trend suggeststhat future offeringsmay benefitfrom clearer guidelinesand increased confidenceamonginvestorsandissuers alike.

Final Thoughts: The Long-Term Potential

As mainstream financial institutions continue embracing cryptocurrencies through products like blackrock ibit spot bitcoin etf,the landscape is poisedfor further growthand innovation.Investors who adopt these vehicles gain opportunitiesfor diversificationwhile benefitingfromthe credibilityofferedby established firms.Blackrock's move signals thatcryptocurrenciesare becoming integral componentswithin diversified portfolios,and ongoing developments could reshape how individualsand institutions approach digital asset investments moving forward.

Disclaimer:Contains third-party content. Not financial advice.

See Terms and Conditions.

How Does Merging Impact the Market Price of Bitcoin and Bitcoin Gold?

Understanding how merging cryptocurrencies influences their market prices is essential for investors, developers, and enthusiasts alike. As the crypto space evolves, discussions around potential mergers—particularly between Bitcoin (BTC) and Bitcoin Gold (BTG)—have gained traction. This article explores the technical, market, and regulatory factors that shape these impacts.

What Is a Cryptocurrency Merge?

A merge in the context of cryptocurrencies refers to combining two separate blockchain projects into a single entity or protocol. Unlike simple token swaps or forks, a true merge aims to unify underlying technologies, communities, and ecosystems. This process can be executed through various mechanisms such as hard forks (creating new chains), soft forks (upgrading existing chains), or consensus-driven integrations.

The goal behind such merges often includes improving scalability, security features, or fostering interoperability between different blockchain networks. However, merging two distinct cryptocurrencies like Bitcoin and Bitcoin Gold presents unique challenges due to their differing technical foundations.

Differences Between Bitcoin and Bitcoin Gold

Bitcoin (BTC) was launched in 2009 as the pioneer cryptocurrency using the SHA-256 proof-of-work algorithm. Its decentralized nature has made it a store of value over time with widespread adoption.

Bitcoin Gold (BTG), introduced in 2017 as an alternative fork of BTC, uses the Equihash algorithm designed to promote decentralization by enabling mining with GPUs rather than specialized ASIC hardware. These fundamental differences in consensus algorithms have led to divergent community interests and market behaviors for each coin.

Because they operate on separate technological principles—SHA-256 versus Equihash—the process of merging them involves complex compatibility considerations that impact both technical stability and investor confidence.

Recent Market Trends for Bitcoin & Bitcoin Gold

As of mid-2025:

Bitcoin has experienced significant growth with approximately a 25% increase since January 2025 alone—a reflection of broader bullish trends across traditional markets.

Bitcoin Gold, however, remains relatively less volatile but sensitive to developments related to potential mergers or upgrades within its ecosystem.

Any announcement regarding a merger could trigger immediate reactions from traders who speculate on price swings driven by news flow rather than fundamentals alone.

Potential Effects on Market Prices

Short-Term Volatility

The anticipation or confirmation of a merger often leads to increased trading volume due to speculative activity. Investors may buy into expectations that unification will enhance network utility or value proposition—driving prices upward temporarily. Conversely, uncertainty about integration risks can cause sharp declines if investors fear technical failures or community rejection.

Long-Term Price Impacts

If successfully executed without major issues:

The merged entity could benefit from combined user bases.

Enhanced interoperability might attract institutional interest seeking diversified exposure.

However, failure during implementation—such as code incompatibilities or security vulnerabilities—could erode trust leading to prolonged price declines for both assets.

Community Sentiment & Investor Confidence

Community support plays an influential role; strong backing from core developers and stakeholders tends toward positive price momentum. Conversely, opposition from either community can lead to fragmentation fears impacting investor sentiment negatively across both coins' markets.

Technical Challenges Affecting Prices

Merging two blockchains with different consensus mechanisms requires meticulous planning:

- Code Compatibility: Ensuring seamless integration without bugs is crucial; incompatibilities may introduce vulnerabilities.

- Security Concerns: Any perceived weakness during transition phases can prompt sell-offs.

- Network Stability: Maintaining uninterrupted operation during migration minimizes disruptions affecting trader confidence.

Failure at any stage could result in significant losses for investors holding either currency post-merger attempt.

Regulatory Environment's Role in Price Dynamics

Regulatory bodies like the U.S Securities & Exchange Commission are increasingly scrutinizing cryptocurrency projects involving complex mergers due to concerns over securities classification and investor protection measures[4]. Delays caused by regulatory reviews can dampen enthusiasm among traders expecting quick benefits from consolidation efforts—and potentially lead markets into periods of stagnation until clarity emerges.

Furthermore:

Regulatory approval processes influence project timelines.

Uncertainty surrounding legal compliance impacts investor risk appetite.

Thus regulatory developments are integral factors influencing how merging activities translate into market movements over time.

Institutional Investment & Merging Impact

Recent institutional moves highlight growing mainstream acceptance:

GameStop’s purchase of $500 million worth of bitcoins signals increasing interest among hedge funds[2].

Such investments tend toward long-term holding strategies but also react sharply when major project updates occur—including potential mergers—which could sway prices significantly depending on perceived outcomes[5].

Additionally:

Financial Products Like ETFs

Gold-backed ETFs demonstrate sustained demand for gold-related assets[3], hinting at possible parallels where similar financial instruments linked directly with merged cryptocurrencies might emerge—potentially stabilizing prices through diversified investment channels.

Key Factors Influencing Future Market Outcomes

Investors should monitor several critical elements:

- Technical Readiness: Successful code integration reduces risks associated with bugs/security flaws.

- Community Support: Broad backing ensures smoother transitions; opposition may cause fragmentation.

- Regulatory Approvals: Clear guidelines facilitate smoother execution timelines.

- Market Sentiment: Positive news boosts confidence; delays/risks induce caution.5.. Institutional Interest: Large-scale investments tend to stabilize prices but also amplify volatility around key announcements.

By understanding these dynamics comprehensively—from technology hurdles through regulatory landscapes—market participants can better anticipate how future merges might influence cryptocurrency valuations.

How Investors Can Prepare for Potential Mergers

Given these complexities,

investors should adopt cautious strategies including:

- Diversifying holdings across multiple assets

- Staying informed about development milestones

- Monitoring official communications from project teams

- Considering long-term perspectives rather than short-term speculation

Informed decision-making grounded in thorough analysis helps mitigate risks associated with high-impact events like cryptocurrency merges.

Final Thoughts

The prospect of merging Bitcoin with other cryptocurrencies like Bitcoin Gold presents exciting opportunities alongside notable challenges — technically speaking—and within broader market contexts influenced by regulation and sentiment shifts[4][5]. While successful execution could unlock new value streams via enhanced interoperability or institutional participation,

failures pose substantial risks that require careful assessment before engaging heavily based on merger rumors alone.

Staying updated on technological progressions along with macroeconomic trends remains vital for navigating this evolving landscape effectively.

References

1. [Market Data June 2025]

2. [GameStop’s Crypto Investment May 2025]

3. [Gold ETF Performance May 2025]

4. [SEC Regulatory Updates May 2025]

5. [Antalpha’s Hedging Strategy May 2025]

JCUSER-WVMdslBw

2025-06-05 07:21

How does merging impact the market price of Bitcoin and Bitcoin Gold?

How Does Merging Impact the Market Price of Bitcoin and Bitcoin Gold?

Understanding how merging cryptocurrencies influences their market prices is essential for investors, developers, and enthusiasts alike. As the crypto space evolves, discussions around potential mergers—particularly between Bitcoin (BTC) and Bitcoin Gold (BTG)—have gained traction. This article explores the technical, market, and regulatory factors that shape these impacts.

What Is a Cryptocurrency Merge?

A merge in the context of cryptocurrencies refers to combining two separate blockchain projects into a single entity or protocol. Unlike simple token swaps or forks, a true merge aims to unify underlying technologies, communities, and ecosystems. This process can be executed through various mechanisms such as hard forks (creating new chains), soft forks (upgrading existing chains), or consensus-driven integrations.

The goal behind such merges often includes improving scalability, security features, or fostering interoperability between different blockchain networks. However, merging two distinct cryptocurrencies like Bitcoin and Bitcoin Gold presents unique challenges due to their differing technical foundations.

Differences Between Bitcoin and Bitcoin Gold

Bitcoin (BTC) was launched in 2009 as the pioneer cryptocurrency using the SHA-256 proof-of-work algorithm. Its decentralized nature has made it a store of value over time with widespread adoption.

Bitcoin Gold (BTG), introduced in 2017 as an alternative fork of BTC, uses the Equihash algorithm designed to promote decentralization by enabling mining with GPUs rather than specialized ASIC hardware. These fundamental differences in consensus algorithms have led to divergent community interests and market behaviors for each coin.

Because they operate on separate technological principles—SHA-256 versus Equihash—the process of merging them involves complex compatibility considerations that impact both technical stability and investor confidence.

Recent Market Trends for Bitcoin & Bitcoin Gold

As of mid-2025:

Bitcoin has experienced significant growth with approximately a 25% increase since January 2025 alone—a reflection of broader bullish trends across traditional markets.

Bitcoin Gold, however, remains relatively less volatile but sensitive to developments related to potential mergers or upgrades within its ecosystem.

Any announcement regarding a merger could trigger immediate reactions from traders who speculate on price swings driven by news flow rather than fundamentals alone.

Potential Effects on Market Prices

Short-Term Volatility

The anticipation or confirmation of a merger often leads to increased trading volume due to speculative activity. Investors may buy into expectations that unification will enhance network utility or value proposition—driving prices upward temporarily. Conversely, uncertainty about integration risks can cause sharp declines if investors fear technical failures or community rejection.

Long-Term Price Impacts

If successfully executed without major issues:

The merged entity could benefit from combined user bases.

Enhanced interoperability might attract institutional interest seeking diversified exposure.

However, failure during implementation—such as code incompatibilities or security vulnerabilities—could erode trust leading to prolonged price declines for both assets.

Community Sentiment & Investor Confidence

Community support plays an influential role; strong backing from core developers and stakeholders tends toward positive price momentum. Conversely, opposition from either community can lead to fragmentation fears impacting investor sentiment negatively across both coins' markets.

Technical Challenges Affecting Prices

Merging two blockchains with different consensus mechanisms requires meticulous planning:

- Code Compatibility: Ensuring seamless integration without bugs is crucial; incompatibilities may introduce vulnerabilities.

- Security Concerns: Any perceived weakness during transition phases can prompt sell-offs.

- Network Stability: Maintaining uninterrupted operation during migration minimizes disruptions affecting trader confidence.

Failure at any stage could result in significant losses for investors holding either currency post-merger attempt.

Regulatory Environment's Role in Price Dynamics

Regulatory bodies like the U.S Securities & Exchange Commission are increasingly scrutinizing cryptocurrency projects involving complex mergers due to concerns over securities classification and investor protection measures[4]. Delays caused by regulatory reviews can dampen enthusiasm among traders expecting quick benefits from consolidation efforts—and potentially lead markets into periods of stagnation until clarity emerges.

Furthermore:

Regulatory approval processes influence project timelines.

Uncertainty surrounding legal compliance impacts investor risk appetite.

Thus regulatory developments are integral factors influencing how merging activities translate into market movements over time.

Institutional Investment & Merging Impact

Recent institutional moves highlight growing mainstream acceptance:

GameStop’s purchase of $500 million worth of bitcoins signals increasing interest among hedge funds[2].

Such investments tend toward long-term holding strategies but also react sharply when major project updates occur—including potential mergers—which could sway prices significantly depending on perceived outcomes[5].

Additionally:

Financial Products Like ETFs

Gold-backed ETFs demonstrate sustained demand for gold-related assets[3], hinting at possible parallels where similar financial instruments linked directly with merged cryptocurrencies might emerge—potentially stabilizing prices through diversified investment channels.

Key Factors Influencing Future Market Outcomes

Investors should monitor several critical elements:

- Technical Readiness: Successful code integration reduces risks associated with bugs/security flaws.

- Community Support: Broad backing ensures smoother transitions; opposition may cause fragmentation.

- Regulatory Approvals: Clear guidelines facilitate smoother execution timelines.

- Market Sentiment: Positive news boosts confidence; delays/risks induce caution.5.. Institutional Interest: Large-scale investments tend to stabilize prices but also amplify volatility around key announcements.

By understanding these dynamics comprehensively—from technology hurdles through regulatory landscapes—market participants can better anticipate how future merges might influence cryptocurrency valuations.

How Investors Can Prepare for Potential Mergers

Given these complexities,

investors should adopt cautious strategies including:

- Diversifying holdings across multiple assets

- Staying informed about development milestones

- Monitoring official communications from project teams

- Considering long-term perspectives rather than short-term speculation

Informed decision-making grounded in thorough analysis helps mitigate risks associated with high-impact events like cryptocurrency merges.

Final Thoughts

The prospect of merging Bitcoin with other cryptocurrencies like Bitcoin Gold presents exciting opportunities alongside notable challenges — technically speaking—and within broader market contexts influenced by regulation and sentiment shifts[4][5]. While successful execution could unlock new value streams via enhanced interoperability or institutional participation,

failures pose substantial risks that require careful assessment before engaging heavily based on merger rumors alone.

Staying updated on technological progressions along with macroeconomic trends remains vital for navigating this evolving landscape effectively.

References

1. [Market Data June 2025]

2. [GameStop’s Crypto Investment May 2025]

3. [Gold ETF Performance May 2025]

4. [SEC Regulatory Updates May 2025]

5. [Antalpha’s Hedging Strategy May 2025]

Disclaimer:Contains third-party content. Not financial advice.

See Terms and Conditions.

How to Protect Your Assets During a Merger or Acquisition

When companies merge or acquire each other, it can create significant shifts in the financial landscape. These changes often lead to increased market volatility, regulatory adjustments, and fluctuations in asset values. For investors and asset holders, understanding how to safeguard their investments during these periods is essential. This guide provides practical steps and strategies to help you protect your assets effectively during mergers and acquisitions (M&A).

Understanding the Impact of Mergers on Asset Values

Mergers can influence various asset classes differently. While some sectors may experience growth due to strategic synergies, others might face declines because of uncertainty or regulatory hurdles. For example, recent high-profile M&A activities like the Capital One-Discover merger in April 2025 have shown positive market reactions, boosting share prices[1]. Conversely, currency markets such as the South African Rand and Thai Baht tend to exhibit modest volatility amid mixed economic signals during such times.

It's crucial for investors to recognize that these market dynamics are often temporary but can significantly impact portfolio performance if not managed properly.

Key Strategies for Asset Protection During M&A Events

To navigate the uncertainties associated with mergers effectively, consider implementing these core strategies:

Diversify Your Investment Portfolio

Diversification remains one of the most reliable methods for mitigating risk during volatile periods. By spreading investments across different sectors—such as equities, bonds, real estate, commodities—and geographic regions you reduce exposure to any single market downturn or sector-specific risks.

For instance:

- Invest in both domestic and international markets.

- Include a mix of traditional assets like stocks and bonds alongside alternative investments like cryptocurrencies.

This approach ensures that adverse movements in one area do not disproportionately affect your overall portfolio.

Conduct Regular Risk Assessments

Market conditions change rapidly around merger events; therefore, continuous risk evaluation is vital. Review your investment holdings periodically—especially when significant corporate activities occur—and adjust your allocations based on evolving risks.

Key considerations include:

- The financial health of involved entities.

- Regulatory developments affecting specific industries.

- Potential impacts on currency exchange rates if international assets are involved.

Maintain Adequate Liquidity

Liquidity management involves keeping enough cash or liquid assets accessible so you can respond swiftly if markets move unfavorably. During mergers: