2026: Making Every Choice Trustworthy

— An End-of-Year Letter to Global Users from Sammi, Founder & CEO of Ju.com

Dear Ju.com users, partners, and peers across the industry,

Wishing you all a Happy New Year in advance!

As we stand at the close of 2025 and look back on a year marked by volatility and change, I want to begin by thanking every user who chose Ju.com and placed their trust in us. It is your confidence that has given us the opportunity to stay true to our principles and move forward steadily in an industry full of both challenges and opportunities.

For Ju.com, 2025 was a year of renewal—and, more importantly, a year of delivering on our promises. Beyond completing a brand upgrade, we focused on turning the words “user first” into concrete, verifiable actions.

User Protection: Not a Slogan, but a Verifiable Commitment

In January, on the first day of the JU platform token launch, we faced a difficult decision. Subscription demand far exceeded expectations, and we could have easily secured short-term revenue—but doing so would have meant some users bearing losses. My team and I made a decisive choice: we distributed free token airdrops to all participants and issued full refunds.

That decision established Ju.com’s core principle: user protection takes priority over platform revenue.

During the sharp market downturn in October, we launched a network-wide 1.9 billion hashrate subsidy program to provide meaningful support for derivatives traders who needed a fresh start. We believe that a trading platform should grow alongside its users’ success—not profit from their inevitable losses.

From full refunds during the IEO to hashrate subsidies, this comprehensive user protection framework demonstrates a simple truth: in crypto, user protection and commercial success are not contradictory. The real question is whether you are truly willing to put users first.

Ecosystem Building: From a Trading Platform to Full-Stack Infrastructure

This year, we completed a major strategic shift—evolving from a single trading platform into a comprehensive ecosystem.

The launch of JuChain marked a critical step in this journey. In December, we announced the establishment of a $100 million JuChain Venture Fund. This is more than a capital commitment—it is a long-term promise to the developer community. Through sustained funding, technical support, and real-world integration, we aim to help more projects move from “being possible” to “scaling meaningfully.”

On the product innovation front, the launch of 01959.HK represents our exploration into bridging traditional finance with on-chain innovation. By connecting real stock custody with on-chain liquidity incentive mechanisms, we enable traditional assets to participate in blockchain-native incentive models. Our goal is to better reward long-term contributors while making real stock ownership more accessible, seamless, and user-friendly.

Updates to JuPay are also accelerating. We are working to connect trading, asset management, and everyday use into one smooth, coherent flow—so that Ju.com feels less like a pure trading tool and more like part of daily life.

Brand Renewal: The Transformation from JuCoin to Ju.com

Our brand renewal journey in the Maldives this September was deeply meaningful for both me and the entire team. In our in-depth discussions with KOLs and partners, the most consistent feedback we heard was clear: the experience needs to be smoother, and the service needs to be more solid.

This is also the context behind our message of “Rewrite the Impossible”—and a reminder to ourselves: break down hard problems, refine details patiently, and get things done with steady execution.

The shift from JuCoin to Ju.com is not just a name change; it is a clarification of our positioning. We want Ju.com to be the starting point for global users entering the digital asset world—where processes feel intuitive, experiences resemble everyday applications, and users take one less step of friction and gain more certainty.

Global Engagement: Advancing International Expansion with Pragmatism

In 2025, we attended TOKEN2049 twice—Dubai in the first half of the year, and Singapore in the second. Both events highlighted a clear shift toward pragmatism in the industry. Conversations are no longer just about concepts and visions, but about whether products truly work and whether they can retain long-term users.

Through these opportunities, we clearly communicated Ju.com’s product direction and core philosophy, and put our details on display for the industry to examine. Long-term users come from long-term experiences—this is something we will continue to stand by.

I often say that as Ju.com grows globally, our sense of responsibility must grow with it. After a major fire in Tai Po, Hong Kong, in November, we promptly donated HKD 2 million through accredited charitable channels to support relief and reconstruction efforts. A platform that can step up for society at critical moments is fulfilling a basic obligation.

JU Platform Token: Continued Buybacks and Burns

Since the JU platform token launched earlier this year, we have consistently used platform revenue to advance our buyback and burn mechanism. This is about taking responsibility in a long-term way, and allowing ecosystem participants to see that we are serious about honoring our commitments.

The true value of a platform lies not in what it promises, but in what it delivers.

2026: Moving Forward, Side by Side

Looking back on 2025, we have delivered verifiable results across user protection, ecosystem development, product innovation, brand renewal, and social responsibility. But I know this is only the beginning.

In the year ahead, we will:

- Continue to deepen the ecosystem and integrate more real-world use cases

- Further solidify the Point.Click.Trade. experience

- Continuously optimize trading experience and service stability

- Ensure every promise is reflected in verifiable details

At its core, the crypto industry is about rebuilding trust through technological innovation. But technology is only a tool. Real trust is built through reliable delivery, day after day, and through decisions that consistently put users first.

This is my commitment to every Ju.com user—and my expectation of our team.

May 2026 bring you greater stability and more confidence in your choices. Ju.com wishes you a smooth and successful year ahead. Let us continue moving forward, side by side.

Sammi Li Founder & CEO, Ju.com December 31, 2025

#cryptocurrency #blockchain #Jucom

JU Blog

2025-12-31 10:00

2026: Making Every Choice Trustworthy

Disclaimer:Contains third-party content. Not financial advice.

See Terms and Conditions.

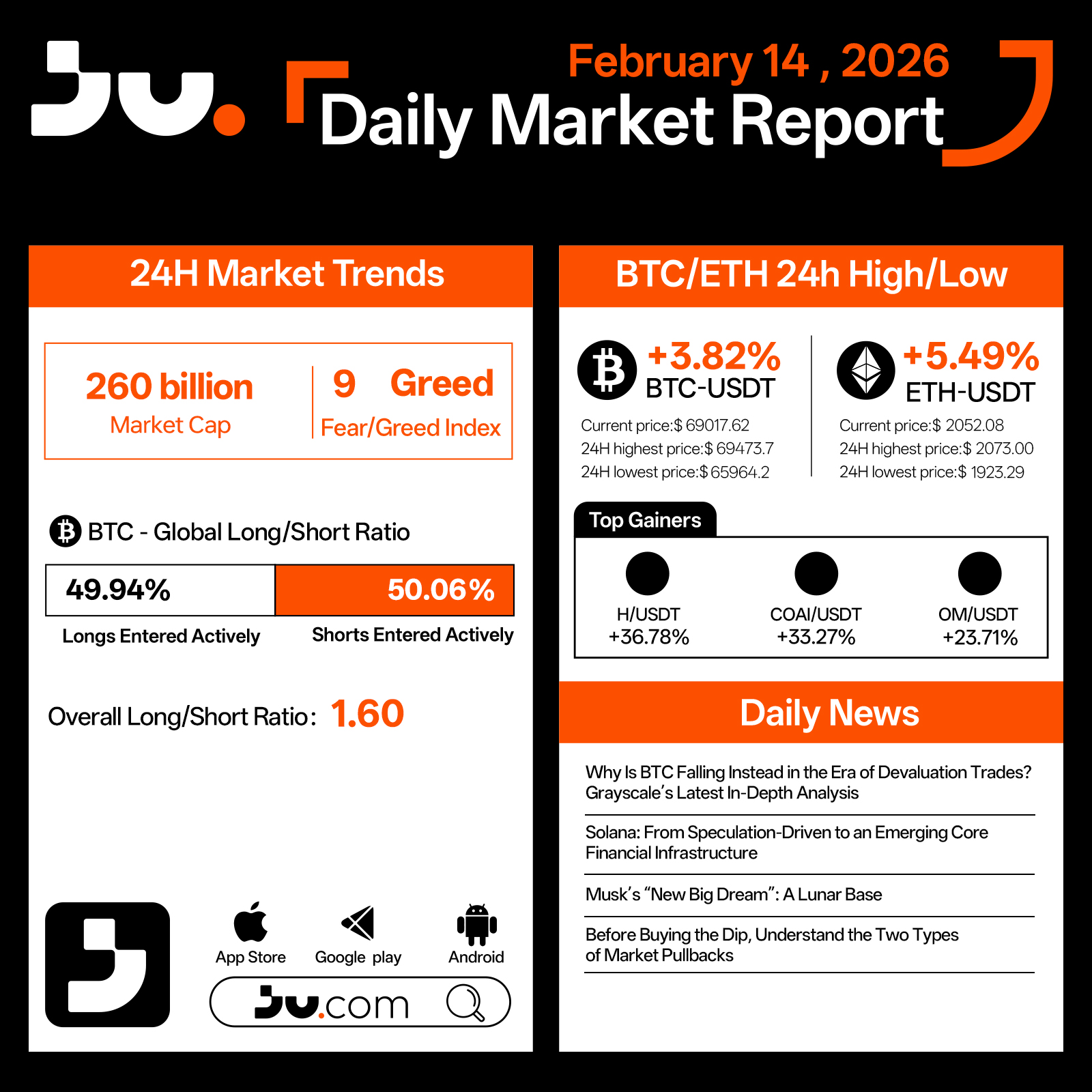

On February 14, the crypto market staged a notable rebound following consecutive sessions of decline, with total market capitalization rising to $260 billion. Although the Fear & Greed Index remains at 9, firmly within extreme fear territory, price action suggests that immediate selling pressure has eased, allowing for short-term recovery momentum.

Bitcoin gained 3.82% to $69,017.62, trading between $65,964.2 and $69,473.7 during the session. Long positions account for 49.94%, while shorts stand at 50.06%, with the aggregate long–short ratio declining to 1.60, reflecting a contraction in leveraged exposure. The rebound appears driven by short covering and tactical dip buying rather than a confirmed structural reversal.

Ethereum outperformed, rising 5.49% to $2,052.08, after dipping to $1,923.29 intraday. As a higher-beta asset, ETH demonstrated stronger recovery elasticity, highlighting renewed risk appetite at lower price levels, though broader market structure remains in a rebuilding phase.

Among leading gainers, H, COAI, and OM posted significant advances, largely attributable to oversold bounces and speculative positioning rather than a broad-based improvement in fundamentals.

Narrative focus centered on Grayscale’s analysis of why Bitcoin has not fully aligned with the “devaluation trade” thesis, emphasizing that macro liquidity dynamics continue to influence crypto pricing. Discussions around Solana’s transition from speculation-driven momentum to a potential core financial infrastructure further underscore evolving sector narratives. Analysts also cautioned investors to distinguish between different types of market pullbacks before engaging in dip-buying strategies.

Overall, February 14 reflects a technical rebound rather than a confirmed trend reversal. While short-term sentiment has improved marginally, extreme fear readings indicate that confidence remains fragile. In the absence of clearer liquidity or policy catalysts, volatility and consolidation are likely to persist in the near term.

#cryptocurrency #blockchain #JU #Jucom

Bitcoin bags are getting blown out today, as the price of BTC falls to nearly $80,000 and marks a new seven-month low.

- The continued downward pressure on its price has pushed Bitcoin into a so-called death cross—when the average price of an asset over the short term falls below the average price over the long term. It’s a technical pattern that typically signals extended bearish momentum. For traders who study charts, it confirms what permabulls don’t want to hear: It’s over—at least for now.

- It’s happening as the crypto market as a whole shrinks to $2.91 trillion, shedding nearly $60 billion in the past 24 hours alone. Almost every single coin in the top 100 by market cap is bleeding red.

- The Fear and Greed Index, which measures market sentiment on a scale from 0 to 100, has cratered to 14 points—just four points above the year's low of 10 back in February. When this index drops below 20, it signals "extreme fear," and right now, traders are absolutely terrified.

- But it's not just crypto drama driving the market selloff. The macro picture is turning nasty. Just weeks ago, markets were pricing in a 97% chance the Federal Reserve would cut interest rates in December. Now? Those odds have collapsed to somewhere between 22% and 43%, depending on which metric you check.

- Fed officials are openly divided, with many signaling they'd prefer to keep rates unchanged through year-end. For risk assets like crypto that thrive on easy money, this is poison.

- On Myriad, a prediction market developed by Decrypt’s parent company Dastan, traders are now overwhelmingly convinced that Bitcoin will not mark a new all-time high this year, placing odds at almost 90% that BTC will not top the $126K mark that it hit on October 6.

- The bearish vibes are so strong, Myriad traders also currently place 40% odds that Bitcoin falls as low as $69K. So how low will it go? Here’s what the charts say.

- Bitcoin opened today at $86,691 and immediately sold off, hitting an intraday low of $80,620 before bouncing slightly to its current price at $85,187. That's a 1.61% drop on the day after being almost 5% down over the last 24 hours. More importantly, for traders, it further confirms the death cross pattern that's been progressively forming since its all-time high in early October. The death cross pattern was first confirmed on Wednesday as Bitcoin slid to around $88,000—now it’s fallen deeper.

- Here's what's happening on the charts: Exponential Moving Averages, or EMAs, help traders identify trend direction by tracking the average price of an asset over the short, medium, and long term. When the short-term 50-day EMA falls below the longer-term 200-day EMA, it means bears are in control and the longer-term bull market structure has been broken.

- For Bitcoin, the 50-day EMA has now decisively crossed below the 200-day EMA. In short, this tells traders market momentum has shifted from bullish to bearish. The gap between both EMAs increases the more the price of BTC trades below those targets—and the bigger the gap, the stronger the trend.

- The price of Bitcoin is now trading well below both EMAs, which creates a situation where each bounce attempt faces immediate resistance, increasing the gap between the two EMAs, making the bearish trend even stronger. Bulls trying to push higher will need to first reclaim the 50-day EMA, then tackle the 200-day—a double wall of resistance that's historically tough to crack in one go.

- As for other technical indicators, the Average Directional Index, or ADX, sits at 41, which is considered "strong." ADX measures trend strength regardless of direction, with readings above 25 indicating a clear trend is in place. At 41, this tells us we’re not seeing just a minor correction, but a potentially extended move lower.

- The Relative Strength Index, or RSI, has plunged to 23.18, placing Bitcoin deep in oversold territory. RSI measures momentum on a scale from 0 to 100, with readings below 30 signaling oversold conditions where assets are potentially undervalued. However, "oversold" doesn't mean the selling has to stop—in strong downtrends, RSI can remain in oversold territory for extended periods as prices continue grinding lower. But, yes, this also provides hopium for momentum traders as it signals that the worst of it may be over. (The worst being an accelerated crash, not necessarily a steady drop.)

- The Squeeze Momentum Indicator is flashing "bearish impulse," meaning selling pressure is intensifying rather than easing. Meanwhile, the Volume Profile Visible Range (VPVP) shows the price of Bitcoin trading "below" key volume nodes, suggesting there's not much buying interest at current levels.

- So, everything is bearish, clearly. But where's the next support? How low can the price of BTC go? The chart reveals several key horizontal levels to watch.

- The immediate danger zone is $80,697, which briefly held today but looked shaky. If that breaks, the next major support sits at $74,555, followed by $65,727, and potentially all the way down to $53,059 if panic really sets in during a crypto winter. Those price levels have previous consolidation zones where significant trading volume accumulated, making them natural landing spots for oversold bounces.

- For resistances, traders will watch for BTC’s price breaking past $90,000 again and look at $100,000 as the major psychological target.

- Ethereum opened at $2,830.7 and dropped as low as $2,621 intraday before stabilizing around $2,798—a 1.16% loss on the day. While not as dramatic as Bitcoin's selloff, ETH's technical picture is equally concerning.

- Unlike Bitcoin, Ethereum hasn't fully confirmed its death cross yet—the 50-day EMA is still technically above the 200-day, giving it a "long" signal on an indicator that is obviously hours away from changing to bearish. The gap is razor-thin and closing fast. More importantly, ETH’s price is trading well below both EMAs, rendering that technical distinction somewhat meaningless. The bearish momentum is clearly established.

- A good way to see the natural support zones is using the Fibonacci retracements: a set of natural clusters that appear during a trend, showing supports and resistances in a specific timeframe—not because of price, but because of natural proportions.

- Right now, ETH is testing the 0.618 Fibonacci level at approximately $2,755. If this level breaks, the next Fibonacci support doesn't appear until $2,180, which would represent a massive 22% drop from current prices, and would resolve a price market on Myriad betting on ETH’s moon or doom.

- The ADX for Ethereum is even stronger than Bitcoin's at 46, indicating the downtrend is rock-solid. Meanwhile, RSI sits at 28.46—not quite as oversold as Bitcoin but definitely in stressed territory. The Squeeze Momentum Indicator shows "bearish impulse" here too, confirming sellers are in control.

- XRP is showing relative strength compared to its larger peers, down just 0.50% to close at $1.98 after opening at $1.99 and hitting an intraday low of $1.81796. Don't let that modest percentage fool you though—the technical damage is real.

- Like Bitcoin, the Ripple-linked XRP has confirmed a full death cross with its 50-day EMA now below the 200-day. The price of XRP is trading beneath both EMAs, and with an ADX of 32, the downtrend has enough strength to continue. While 32 isn't as extreme as Bitcoin's 41 or Ethereum's 46, it's still well above the 25 threshold that confirms a trend is in place rather than just random chop.

- The RSI at 32.86 shows XRP is approaching oversold territory but hasn't quite reached the extreme stress levels of Bitcoin and Ethereum. This could mean two things: either XRP has more downside before finding equilibrium, or it's showing genuine relative strength that could make it a safer harbor if the broader market continues tanking.

- XRP had such a crazy year that its price action shows only two major horizontal support levels that should concern XRP holders—and that would be very painful for hodlers, considering the movement from the all-time high to those targets.

- The next major support zone sits at $1.589, which represents a potential 20% drop from current levels. If that breaks, there's very little support until $0.66, a catastrophic 67% plunge from current prices and almost 80% from all-time high zone that would take XRP back to early 2024 levels.

The Squeeze Momentum Indicator is showing "bearish impulse," and like the other coins, the volume profile indicates XRP’s price is trading below key volume levels, meaning there's not much buying interest stepping in to defend current prices.

#Bitcoin #BitcoinDeathCross #Jucom #cryptocurrency #blockchain $BTC/USDT $JU/USDT $ETH/USDT

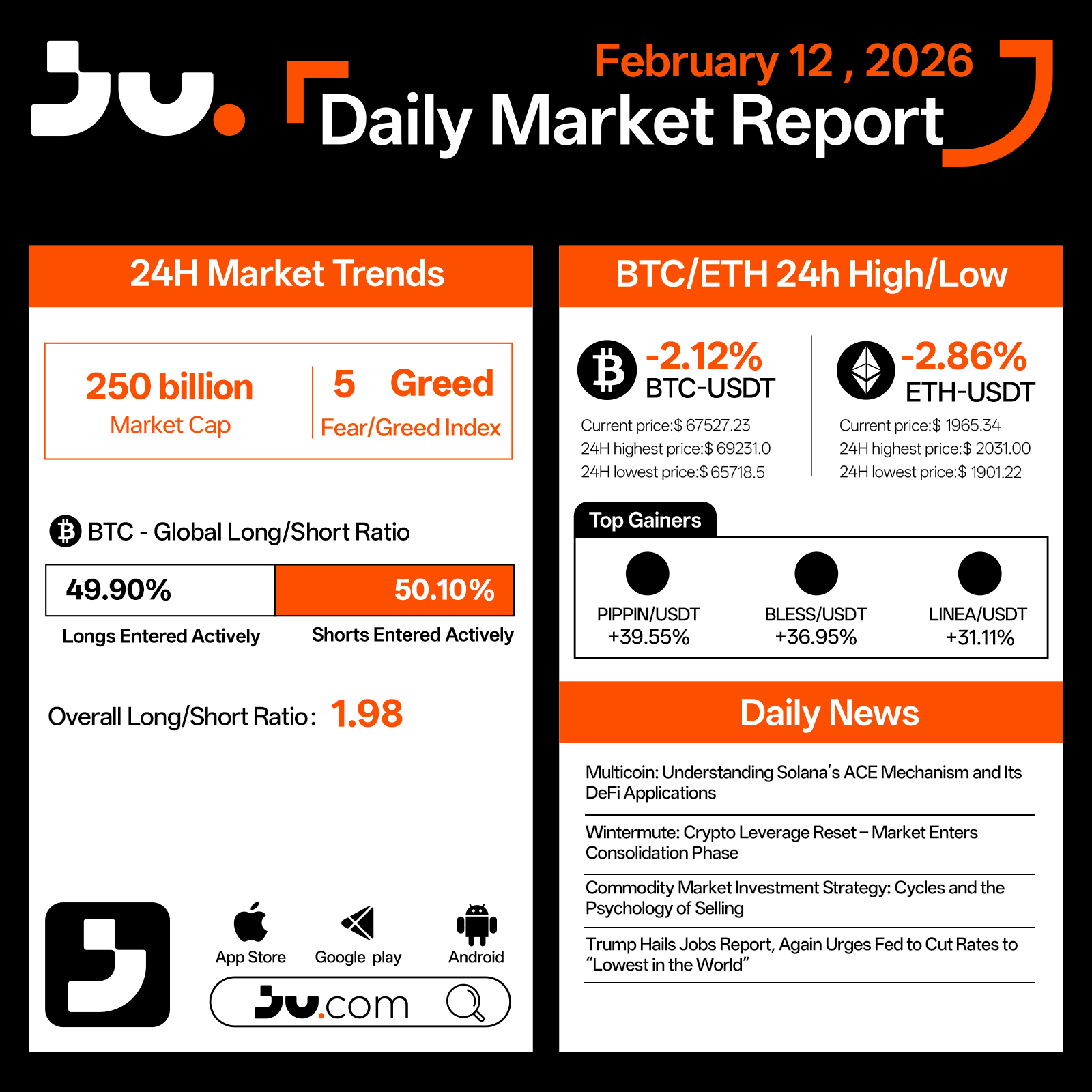

On February 12, the crypto market extended its decline, with total market capitalization falling to $250 billion. The Fear & Greed Index plunged to 5, marking one of the lowest readings of the current cycle and signaling extreme market anxiety. Liquidity remains tight, and post-leverage liquidation dynamics continue to shape price action.

Bitcoin dropped 2.12% to $67,527.23, trading between $65,718.5 and $69,231.0 during the session. Long positions account for 49.90%, while shorts stand at 50.10%, with an aggregate long–short ratio of 1.98, indicating near-balanced positioning despite continued downward pressure. The breakdown below key psychological levels has reinforced cautious sentiment, and volatility remains elevated.

Ethereum declined 2.86% to $1,965.34, with an intraday low of $1,901.22. As a higher-beta asset, ETH continues to exhibit greater downside sensitivity compared to BTC, reflecting ongoing risk reduction across the broader market.

Among top performers, PIPPIN, BLESS, and LINEA recorded strong gains, largely driven by tactical flows and sector rotation rather than a broad-based recovery in sentiment.

From a narrative perspective, Multicoin’s analysis of Solana’s ACE mechanism and its DeFi applications highlights continued innovation within high-performance blockchain ecosystems. Wintermute suggests that following a broad leverage reset, the market may enter a consolidation phase. Discussions surrounding commodity cycles and selling psychology further underscore prevailing macro uncertainty. Meanwhile, renewed political pressure for aggressive rate cuts adds another layer of complexity to risk asset pricing.

Overall, February 12 reflects a market in extreme fear territory. While such readings can historically coincide with late-stage capitulation, the absence of a clear liquidity or policy pivot suggests that consolidation at lower levels may persist before a more sustainable recovery emerges.

#cryptocurrency #blockchain #technical analysis #JU #Jucom

The price of Cardano (ADA) was down on Friday after the blockchain suffered an unexpected chain split, which was caused by a malformed delegation transaction that triggered a software flaw. That created problems for Cardano users, and prompted a public apology from the user who claimed that they caused it.

- Intersect, the Cardano ecosystem’s governance organization, said in an incident report that the divergence began when the malformed transaction passed validation on newer node versions, but nodes running older software rejected it.

- “This exploited a bug in an underlying software library that was not trapped by validation code,” Intersect wrote. “The execution of this transaction caused a divergence in the blockchain, effectively splitting the network into two distinct chains: one containing the ‘poisoned’ transaction and a ‘healthy’ chain without it.”

- Earlier that day, Cardano co-founder Charles Hoskinson posted on X that it was a “premeditated attack from a disgruntled [stake pool operator]” who was “actively looking at ways to harm the brand and reputation of [Cardano developer Input/Output Global].”

- According to Hoskinson, all Cardano users were impacted. The price of Cardano’s token ADA was down more than 6% recently, following the incident.

- According to the incident report, the mismatch caused operators to build blocks on different branches of the chain until patched node software was deployed. Developers and service providers coordinated an emergency response, and operators were urged to upgrade to rejoin the main chain.

- Intersect said the wallet responsible for the malformed transaction has been identified, while Hoskinson said it will take weeks to clean up the mess.

- “Forensic analysis suggests links to a participant from the Incentivized Testnet (ITN) era,” Intersect wrote. “As this incident constitutes a potential cyberattack on a digital network, relevant authorities, including the Federal Bureau of Investigation, are being engaged to investigate.”

- Hours after the incident, an X user posting under the name Homer J. said they were responsible for submitting the transaction that triggered the split.

- “Sorry Cardano folks, it was me who endangered the network with my careless action yesterday evening,” they wrote, describing the attempt as a personal challenge to reproduce the “bad transaction” and said he relied on AI-generated instructions while blocking traffic on their server.

- “I've felt awful as soon as I realized the scale of what I've caused. I know there's nothing I can do to make up for all the pain and stress I've caused over the past X hours,” they added. “Difficult to quantify the negligence on my behalf. I am sorry, I truly am. I didn't have evil intentions.”

- Homer wrote that he did not sell or short ADA, did not coordinate with anyone else, and did not act for financial gain. “I'm ashamed of my carelessness and take full responsibility for it and whatever consequences will follow,” he said.

- According to Intersect, no user funds were lost, and most retail wallets were unaffected because they were running node components that handled the malformed transaction safely.

- Hoskinson, the outspoken co-founder of Cardano, claimed in a video message that the network “didn’t go down,” though users did encounter issues before the problem was fixed.

“It is important to note that the network did not stall. Block production continued on both chains throughout the incident, and at least some identical transactions appeared on both chains,” Intersect wrote. “However, to ensure the integrity of the ledger, exchanges and third-party providers largely paused deposits and withdrawals as a precautionary measure.”

#Cardano #CardanoNetwork #Jucom #cryptocurrency #blockchain $ADA/USDT $JU/USDT $BTC/USDT

A UK operation against Russian sanctions evasion has resulted in 128 arrests and the seizure of $32.6 million in cryptocurrency and cash.

The UK's National Crime Agency (NCA) has revealed that a UK-led operation to crack down on Russian sanctions evasion has resulted in the arrest of 128 people and the seizure of $32.6 million in cryptocurrency and cash.🚨🚨🚨

The operation, dubbed "Operation Destabilize," was first announced in 2024. As of December last year, it had resulted in 84 arrests and the seizure of $25.5 million.💡💡💡

However, the latest NCA data shows that the operation has also resulted in the arrest of a further 45 people suspected of money laundering and the seizure of more than $6.6 million in cash.⭐️⭐️⭐️

#InternationalNews #cryptocurrency #blockchain #Jucom #finance $BTC/USDT $ETH/USDT $JU/USDT

It’s been just over a month since Bitcoin hit an All-Time-High of $126,272.76 on October 6 , but things have gone from bad to worse since then. Now, that peak seems like a distant memory.

- Bitcoin fell more than 9% in the week ending November 14 , and was trading below $92,000 on Monday. The sharp decline — partly due to whales selling — has pushed BTC below several key technical levels.

- Last week, Bitcoin entered a “bear market,” meaning it fell 20% or more from its recent peak. Over the weekend, BTC also appeared in a “death cross” technical pattern — when the 50-day moving Medium crossed below the 200-day Medium . Not only that, Bitcoin officially wiped out all of its gains for 2025 .

- All these signals indicate that negative sentiment is surrounding Bitcoin. But does that mean “crypto winter” is coming?

- “ I don’t think we’re in a crypto winter. I think we’re seeing Bitcoin mature ,” Louis LaValle, CEO of Frontier Investments, told MarketWatch.

- He argues that this is not a typical recession model where people give up, prices crash 70–80%, liquidation disappears, and interest evaporates. Instead, Bitcoin is going through a market structure shift , not a traditional bear cycle.

Beware of margin call risk

- Kevin Kelly — portfolio manager at Amplify ETFs — said that in the past, Bitcoin has often fallen in price without institutional involvement.

- But this bear cycle is quite different because BTC is now a “mature asset,” with more liquidation and more institutional acceptance, such as JP Morgan reportedly accepting Bitcoin as collateral .

- Data from CryptoQuant shows that investors who are selling BTC are still profitable , meaning there are no signs of capitulation or margin calls. However, retail investors are not buying the Dip , while whales are buying at low prices.

- CryptoQuant's Julio Moreno said that the amount of BTC held in US ETFs has dropped sharply from 441,000 BTC on October 10 to just 271,000 BTC, reflecting weak demand from the US. At the same time, the " Medium order" in the spot market also shows that retail has not returned.

Technical perspective

- While on-chain data hasn't shown anything too serious, weak demand hasn't been enough to stop the sell-off.

- Analyst Luke Lango said the recent death cross is a worrying sign. He noted that over the past 13 years, every time Bitcoin broke the 50-week moving Medium during a bull run, the market crashed in the following 1-2 years.

- BTC is now down about 27% from its recent peak — still within “normal range,” as the Medium Bitcoin bear market decline is about 30.8% (based on data going back to 2014). In 2022, there have been two declines of more than 45%.

- Kelly said that tightening global liquidation , the Fed's delay in cutting interest rates, and the TGA's withdrawal of liquidation from the system have made BTC much more vulnerable.

- He assessed the current situation as a combination of weak liquidation , continuous sell-offs, and declining sentiment , rather than a single shock.

“The Zone of Extreme Fear”

- The market has entered “extreme fear territory” after Bitcoin failed to hold the psychological $100,000 mark, according to Kelly.

- But investors have not lost interest. After the hot growth period since the January 2023 Dip , a “digestion wave” is normal.

- History also shows that when the market falls into “extreme fear zones,” it is a good opportunity to cash in — especially for long-term investors who Medium over time.

Macro still favors Bitcoin

- Frank Holmes — co-founder of HIVE Digital Technologies — says the macro backdrop is becoming more positive for both Bitcoin and gold.

- “ Excessive government spending and constant money printing create long-term support for scarce and decentralized assets ,” he observed.

Holmes also emphasized that even if new user growth slows in the short term, structural trends such as rising debt, monetary expansion, and geopolitical Shard still favor Bitcoin in the long term.

#Bitcoin #CryptoMarket #Jucom #cryptocurrency #blockchain $BTC/USDT $ETH/USDT $JU/USDT